This article will help you generate a married filing joint versus married filing separately comparison worksheet, and split an existing MFJ return into two MFS returns.

To create a MFJ vs MFS comparison worksheet:

- Go to the Input Return tab.

- Select General from the left menu.

- Select Client Information.

- From the Filing Status dropdown, select 2=Married filing joint.

- Select the box MFJ vs MFS Comparison.

- Using the primary input screens for income and deductions, indicate items that are Taxpayer, Spouse, or Joint.

- Community property rules should be applied based on the taxpayer's resident state. To do this:

- Go to General > Misc. Info/Direct Deposit.

- Make an entry in Apply community property rules: 1=no, 2=yes.

To split a joint return (new for 2022):

We recommend you check the MFJ vs MFS Comparison worksheet on the Check Return tab for accuracy before splitting.

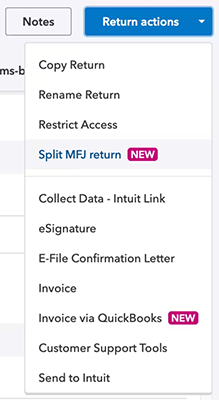

- Press Return actions.

- Select Split MFJ return.

- If you don't see this option, make sure you're in a tax year 2022 return where the filing status is set to 2 = Married filing jointly.

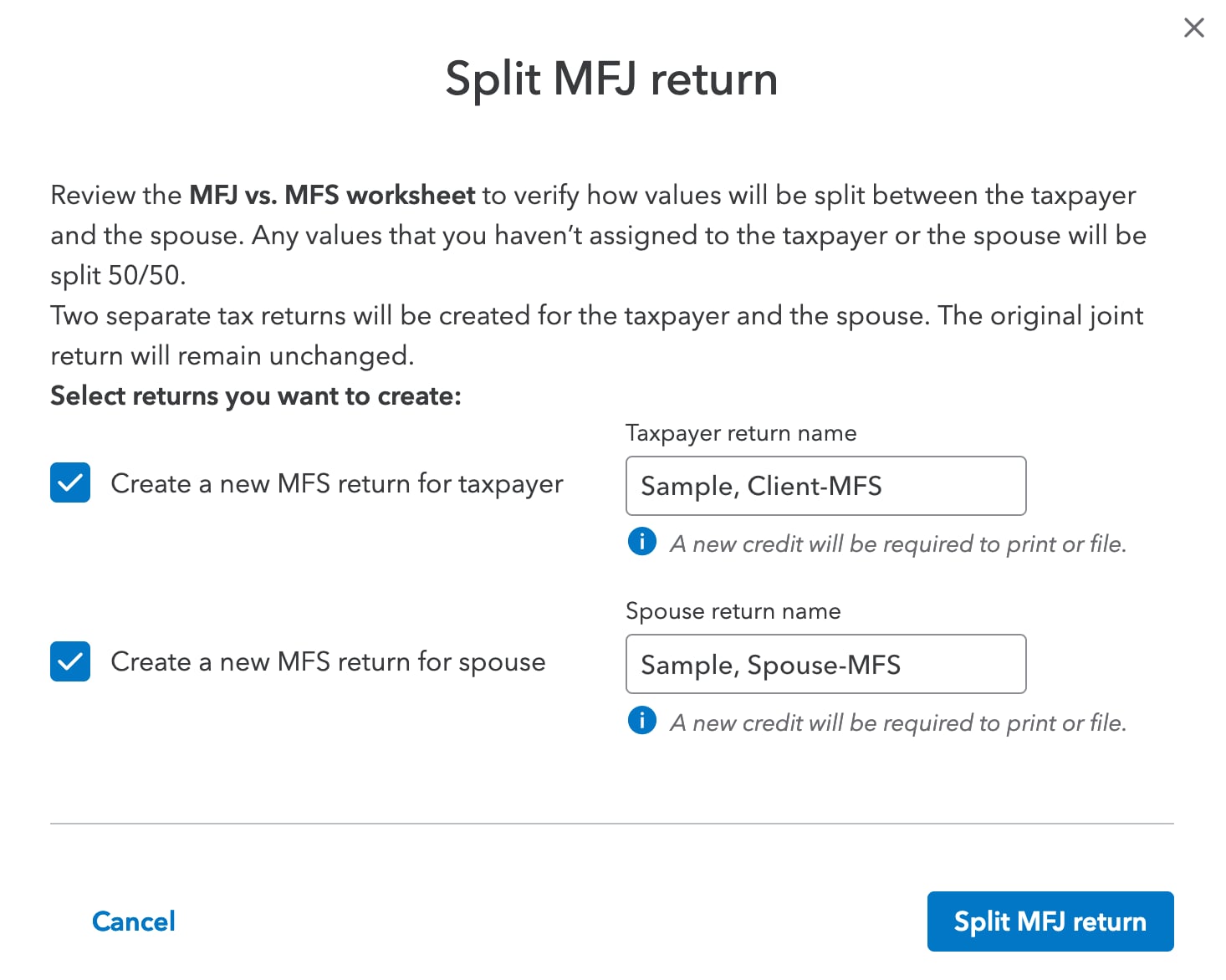

- Review the returns that will be created. You can change the return names here if desired.

- Press Split MFJ return.

- Open the MFS returns your created and review the client and dependent information that transferred.

You can always refer back to the original, joint return when you need to.

Related topics

Community property states and the MFJ / MFS worksheet

MFJ / MFS Worksheet home office deduction splits fully to taxpayer or spouse

Generating Form 8958 Allocation of Tax Amounts