California A.B. 150, also known as the Pass-Through Entity Elective tax or PTET, allows state tax on passthrough income to be paid at the entity level at a flat rate of 9.3%. The law is effective for tax years beginning on or after January 1, 2021, and before January 1, 2026.

Follow these steps to make the election:

- Open the California Information Worksheet.

- Scroll down to Part II for partnerships and LLCs, or Part V for S corporations.

- Check the box under Form 3804 Pass-Through Entity Elective Tax to activate the form.

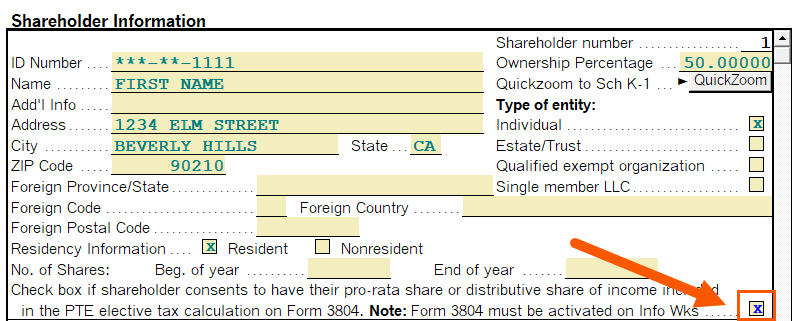

- Open the Schedule K-1 Worksheet.

- Check the Form 3804 box for each shareholder or partner who elects to be included in the PTE filing.

- Review the partner or shareholder information that's been transferred to the Form 3804 Wks and make any adjustments as needed.

The worksheet will be used to calculate Form 3804 - and the amount from Form 3804, line 3, will flow to the tax return.

- If the return is setup for electronic funds withdrawal, the elective tax will be paid electronically with the total tax.

- If paying via WebPay, don't mail in a voucher.

- Otherwise, open Form 3893 and click on Check this box to activate this form. Enter the Amount of Payment that should be made by mail.

To generate the K-1 credit

For a partnership or LLC:

- Open the Form 568 p5-6 or Form 565 p4-5.

- Scroll down to line 15f.

- Enter a description and the full amount of the credit in column (d).

- Use the SA column to specially allocate the amount of credit attributable to each partner. See How to enter special allocations to partners on Form 1065 for more information.

For an S corporation:

- Open the Form 100S p4-6.

- Scroll down to the Schedule K on page 6.

- Enter a description and the full amount on line 13d Other credits.

- Open the shareholder's Schedule K-1.

- Scroll down to line 13d.

- Enter a description and the amount of credit shown for this shareholder from Form 3804, Part II.

- Repeat steps 4-6 for each shareholder who participated in the election.

How do I make the election for 2022?

In order to make the election in 2022, your client must pay the greater of $1,000 or one-half of the 2021 PTE tax by June 15, 2022.

ProSeries can't e-file this estimated payment. Your client should use WebPay or mail in a payment with a 2022 Form 3893.

To generate a 2022 Form 3893 voucher:

- Press F6 to bring up Open Forms.

- Select Form 3893 NTY, and press OK.

- Click Check the box to activate this form.

- Enter the Amount of Payment due.

![]() Starting with tax year 2022, a partner or shareholder may be able to claim an Other State Tax Credit for their pro rata share of PTE tax paid to another state. Review the Schedule S instructions for more information.

Starting with tax year 2022, a partner or shareholder may be able to claim an Other State Tax Credit for their pro rata share of PTE tax paid to another state. Review the Schedule S instructions for more information.