Generating Form 8915 in ProSeries

by Intuit•1• Updated 1 year ago

Before you start:

- The 8915-F is a new form starting in tax year 2021 for Qualified Disaster Retirement Plan Distributions and Repayments.

- The 8915-E is for entering and tracking coronavirus-related retirement plan distributions.

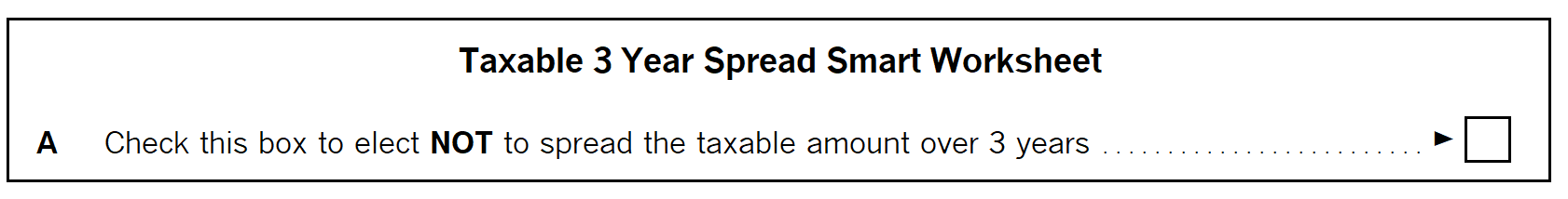

- In tax year 2020 this form is used to elect to spread the distributions over three years.

- In tax year 2021 the 8915-E is a worksheet will show the distribution and track the information to generate the 8915-F.

- The information from Form 8915-F and 8915-E will be e-filed with the tax return as an IRS approved statement.

For tax year 2022 and newer entering qualified disater distributions to generate the 8915-F:

- Open the 1099-R Worksheet.

- Complete the information from the 1099-R received.

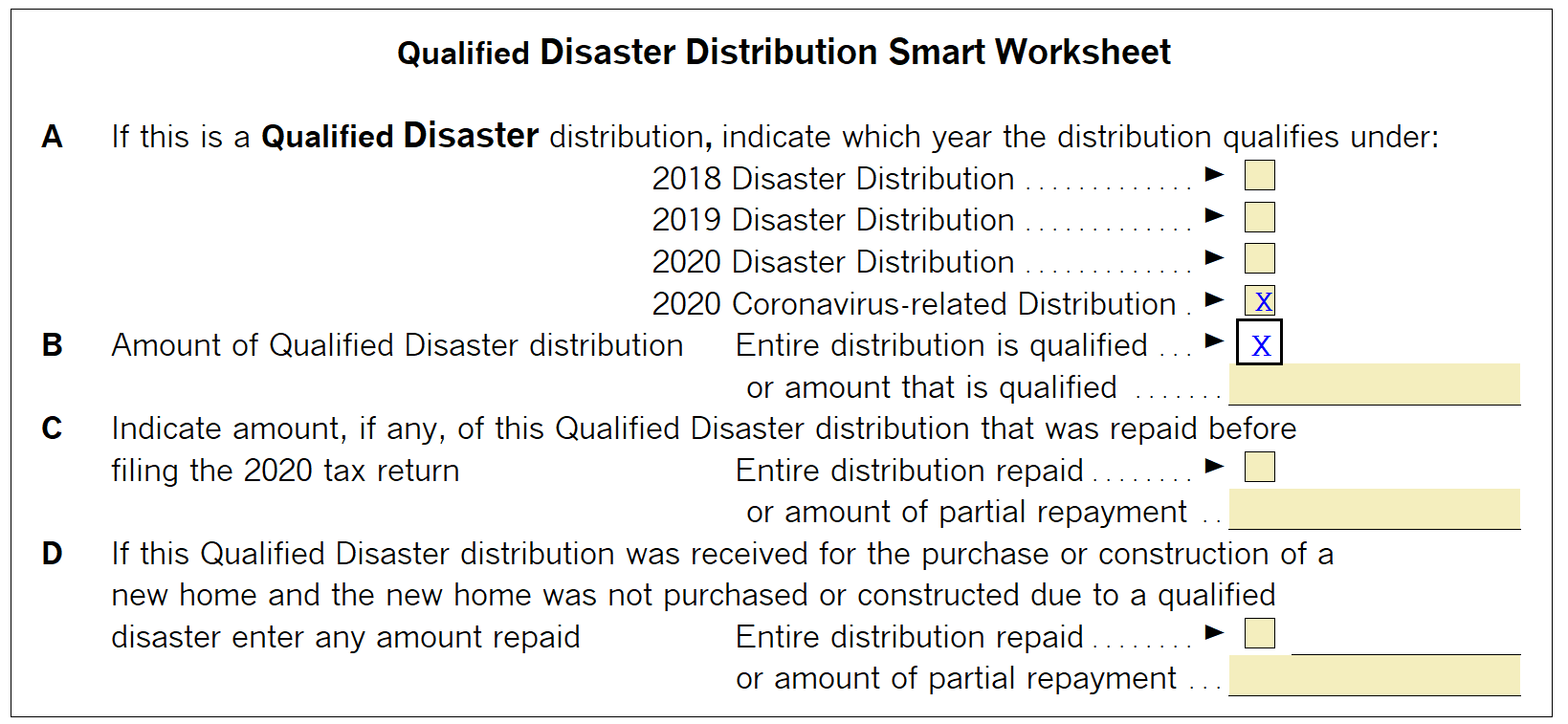

- Scroll down to the Qualified Disaster Distribution Smart Worksheet.

- On line A check the box to indicate which year the disaster distribution was for.

- On line B, check the box if the full distribution was for a qualified disaster, or enter the partial amount.

- Complete line C and D, if needed.

- Go to the 8915-F for taxpayer or spouse.

- Complete the Form 8915-F Smart Worksheet.

Reviewing the transferred amounts for tax year 2021 and 2022:

- Open the Individual return.

- Press F6 to bring up Open Forms.

- Type 8915E to highlight the Form 8915E-T for taxpayer or Form 8915E-S for spouse.

- Click OK to open the Qualified 2020 Disaster Retirement Plan Distributions and Repayments Worksheet.

- If this return was transferred to ProSeries 2021 after the updates on 02/24/2022 review the amounts that transferred from the prior year. The Form 8915-F will generate based on these amounts and be automatically calculated and e-filed with the return.

- If this return was transferred to ProSeries 2021 prior to the updates on 02/24/2022 the carryover amounts will not be available on the 2021 return and will either need to be manually entered, or the return can be deleted and retransferred depending on the amount of work completed in 2021. Select the method below to manually enter the carryover, or re-transfer the return:

You must sign in to vote.