This article will help you:

- Understand when Schedules K-2 and K-3 are required,

- Automatically fill out the K-2 and K-3 when there’s no foreign activity on the return,

- Complete the required schedules, and

- Specially allocate amounts in Part II and Part III of the K-2.

Who must file Schedules K-2 and K-3?

Generally, any partnership or S corporation must file if they:

- Have international income, assets, credits, or activity;

- Have an international owner (partner or shareholder); or

- Have owners who claim a credit for foreign taxes paid on their return (Form 1116 or 1118).

Domestic filing exception

New for tax year 2022, certain domestic partnerships and S corporations don't need to file Schedules K-2 and K-3 if they meet all of these criteria:

- No or limited foreign activity;

- All direct partners are U.S. Citizens or resident aliens;

- Notify all partners or shareholders that they won't receive a K-3 from this business no later than when the K-1 is furnished;

- No partner or shareholder requests a K-3 within by the "1-month date", meaning one month before the date the partnership or S corporation files their tax return.

For more information about this exception and examples, review the Schedule K-2 and K-3 instructions.

To claim the domestic filing exception:

- On the left-side menu, select Other Forms.

- Click on the Sch. K-2 screen for your tax type:

- Partners' Distr. Share Items - Int'l. (Sch. K-2) or

- Shareholders' Pro Rata Share Items - Int'l. (Sch. K-2)

- Check the box labeled Qualified for exception to filing Schedule K-2.

- The program will attach a statement to Schedule K, line 16 with exception text. This statement is automatically e-filed with the return.

- If desired, check the box for Include partner notification on Schedule K-1.

- When checked, the program will print a partner or shareholder notification on the pages that follow each K-1.

To complete the K-2 and K-3 when there's no foreign activity on the return:

If the partnership or S corporation only has U.S. source amounts, and you only need to furnish the Schedules K-2 and K-3 because partners or shareholders may need the information to claim a foreign tax credit on their own return (from other income sources), the program can automatically complete Part II of these forms.

- Go to the applicable Schedule K-2 screen for your tax type.

- Other Forms > Partners' Distr. Share Items - Int'l. (Sch. K-2) > International (Schedule K-2)

- Other Forms > Shareholders' Pro Rata Share Items - Int'l. (Sch. K-2) > International (Schedule K-2)

- Locate the Partnerships with No Foreign Activity (U.S. Source Only) (Partnership) or S Corporations with No Foreign Activity (U.S. Source Only) (S corporation) section.

- Check the box labeled Compute U.S. source gross income and deductions (if no foreign activity).

- From the left of the screen, select Parts II & III - Foreign Tax Credit Limitation & Foreign Taxes.

- Make sure there isn't any Foreign country or U.S. possession selected under the General Information section, or on any other tab of this screen.

- Any countries entered will prevent the automatic calculation.

The program will automatically carry amounts from the return to Schedules K-2 and K-3, Part II.

These automatically calculated gross income items, or their overrides entered on the International (Schedule K-2) screen, can be specially allocated on the Special Allocations tab.

To complete the K-2 and K-3 when the return contains foreign activity:

The majority of these Schedules K-2 and K-3 aren’t automatically calculated at this time. Exceptions, such as certain total columns in Part X, are noted with an [Override]. Review the form instructions to determine which sections and attachments you’re required to complete.

- Go to the applicable Shareholder Overrides - Int'l. (Sch. K-3) for your tax type:

- Other Forms > Partner Overrides - Int'l. (Sch. K-3) (Partnership)

- Other Forms > Shareholder Overrides - Int'l. (Sch. K-3) (S-Corporate)

- Scroll down to the Part I - Partnership’s Other Current Year International Information (partnership) or Part I - Shareholder's Share of Corporation's Other Current Year International Information (S corporation) section.

- Complete the required entries.

- All items entered on this screen can be allocated using the Schedule K-3 Overrides screen.

- Go to the applicable Parts II & III - Foreign Tax Credit Limitation & Foreign Taxes screen for your tax type:

- Other Forms > Partners' Distr. Share Items - Int'l (Sch. K-2) > Parts II & III - Foreign Tax Credit Limitation & Foreign Taxes

- Other Forms > Shareholders' Pro Rata Share Items - Int'l. (Sch. K-2) > Parts II & III - Foreign Tax Credit Limitation & Foreign Taxes

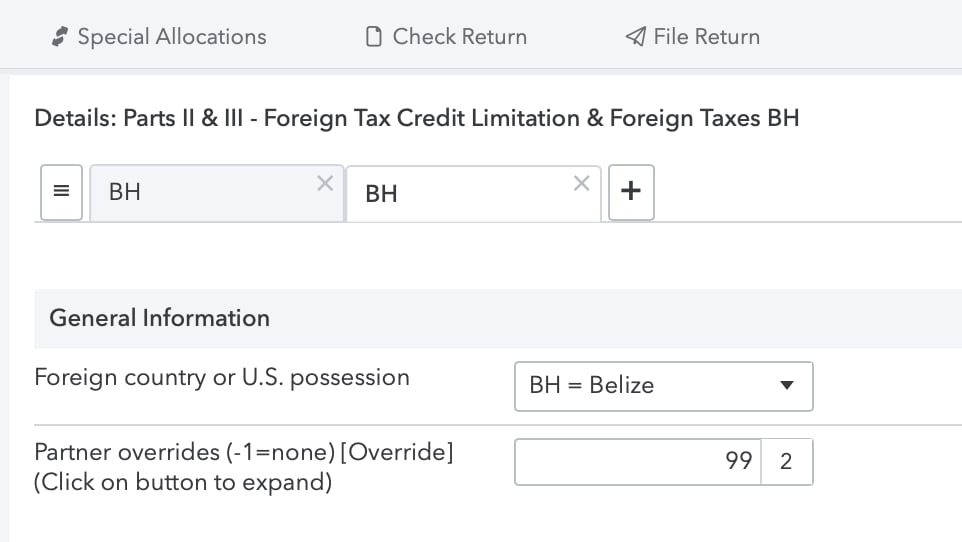

- Enter the name of the Foreign country or U.S. possession this applies to.

- Complete all applicable entries for this country.

- Click the plus sign (+) at the top of the screen to add another country, if necessary.

How do I specially allocate part II and part III amounts?

Since a single return can have multiple instances of the Parts II & III screen for different countries, those entries can’t be allocated to partners or shareholders using the single Schedule K-3 Overrides screen.

Instead, you can set different Partner/Shareholder overrides for each country, or instance, you create on this screen.

To enter partner or shareholder overrides:

- Select the country/instance you need to allocate using the tabs at the top of the screen.

- Locate the General Information section.

- Open the applicable Partner overrides (-1=none) [Override](Click on button to expand) or Shareholder overrides (-1=none) [Override](Click on button to expand) field.

- Select or enter each partner, and the percentage of this country/instance they should receive.

- As with other special allocations, enter a -1 for any partner or shareholder who should receive none. Your total won’t equal 100%, but this is correct.

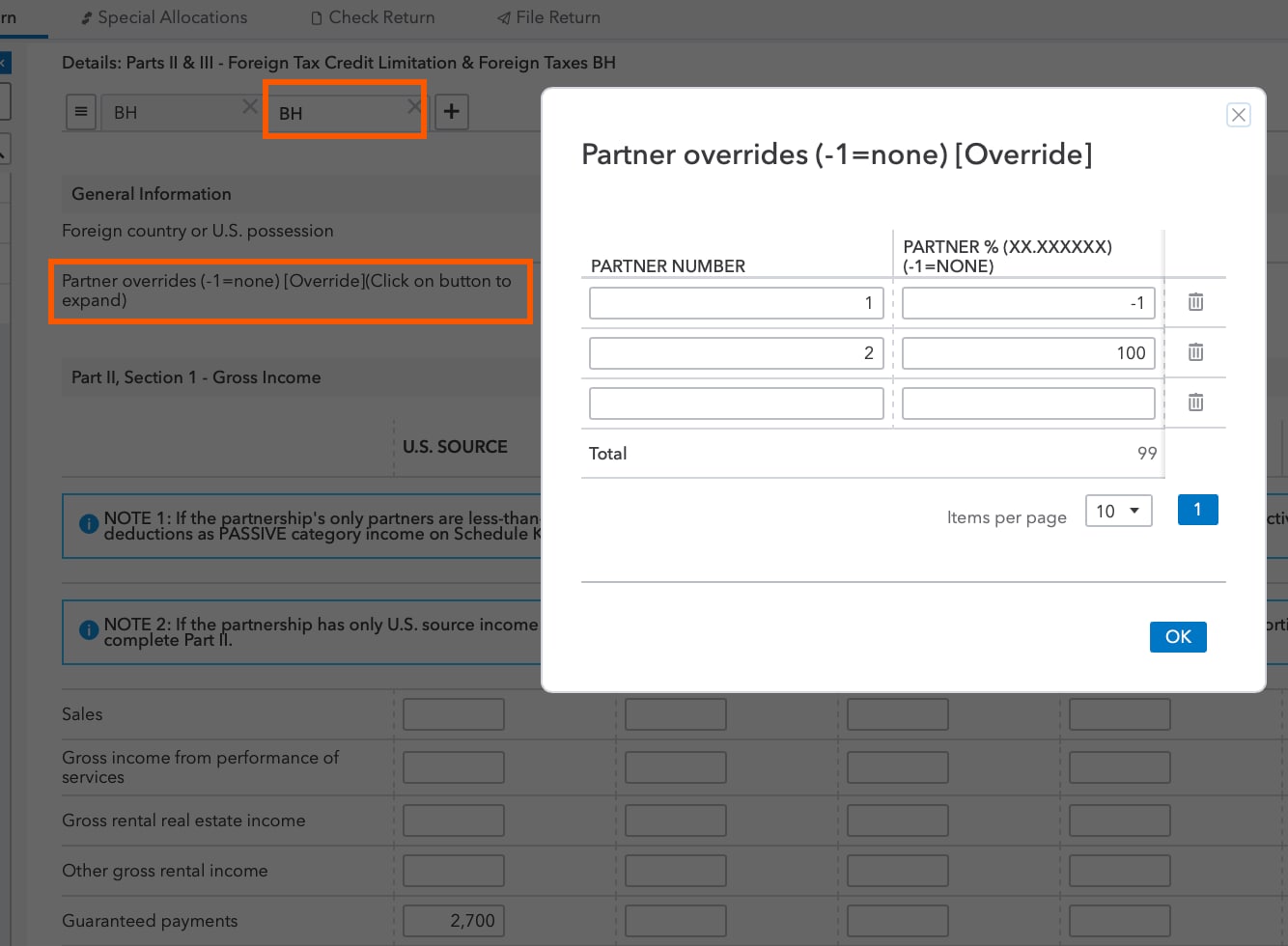

- If only one item for the country needs to be specially allocated, add a new instance using the plus sign (+) at the top of the screen, for the same country. Only enter the specially allocated item on this instance.

Example: Allocating only guaranteed payments

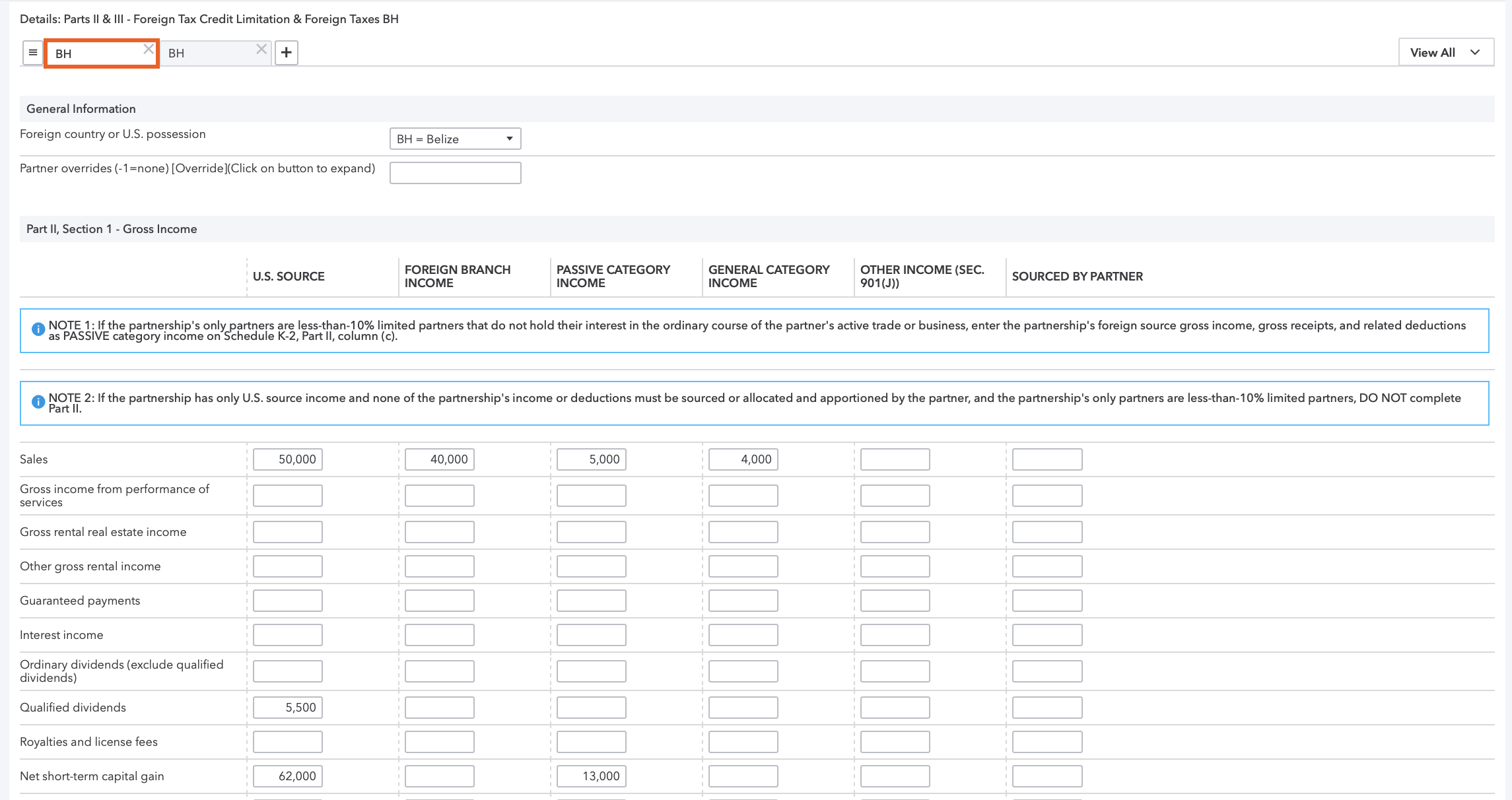

In this example, the partnership is reporting foreign income from Belize. While the sales, dividends, and capital gains should be allocated according to partners’ percentages, all of the guaranteed payments were attributable to only one partner.

- Enter the items that should be allocated by ownership percentage on one country/instance. Leave the Partner overrides field blank.

- Click the plus sign (+) to create a new country/instance.

- Select the same Foreign country or U.S. possession.

- Enter only the Guaranteed payments.

- Use the Partner overrides field to allocate 100% of the guaranteed payments to partner 2.

Country/instance 1 - Belize items sourced by ownership percentage:

Country/instance 2 - Belize guaranteed payments allocated 0% to partner 1, and 100% to partner 2:

When you allocate an amount using the partner overrides, and any partner receives 0%, your total on the input screen will appear to be less than 100% due to the -1 entries. The Schedule K-3 will print correctly.