This article will show you how to add or edit preparer information in ProSeries.

Follow these steps to add or edit the preparers:

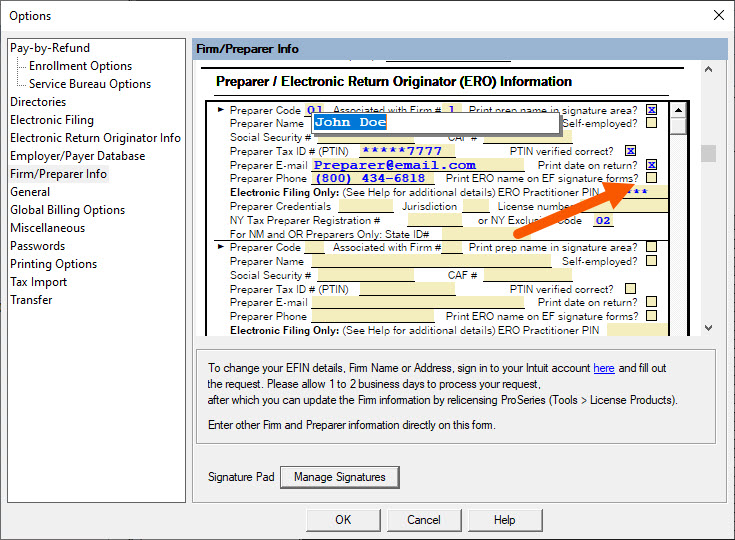

- From the Tools menu, select Options.

- Select Firm/Preparer Info from the left navigation panel.

- Enter the appropriate information in each of the fields.

- If you right click on a field, there will be a brief description of what's required.

- Click OK when finished.

- Add the preparer code to the worksheet in the return.

What is the Preparer Code? How do I get a Preparer Code?

The Preparer Code is a character code that can be up to three characters long. This code is one that you create to identify the preparer (for example, the preparer's initials or a number code). Each Preparer Code must be unique for the firm(s). Use this same code on the client's Information Worksheet (for Individual returns) or in the preparer's section on the signature form (for other returns). The relevant preparer and firm information prints in the Paid Preparer area on the tax form.

Follow these steps to enter the Preparer Code:

- From the Tools menu, select Options

- Select Firm/Preparer Info from the left navigation panel.

- Enter up to three characters in the Preparer Code field located in the Preparer/Electronic Return Originator (ERO) Information section.

![]() If you're preparing a return for which you are not paid, enter a preparer code of XNP for Non-Paid Preparer or XSP for Self Prepared in each return as needed. This will remove your firm and preparer information from the printed return.

If you're preparing a return for which you are not paid, enter a preparer code of XNP for Non-Paid Preparer or XSP for Self Prepared in each return as needed. This will remove your firm and preparer information from the printed return.

New for tax year 2023: Printing ERO name on EF signature forms:

Starting in ProSeries 2023 you can now have ProSeries print your ERO name on signature forms such as the 8879. Here's how:

- Open ProSeries 2023.

- From the Tools menu, select Options.

- From the left side of the screen select Firm/Preparer Info.

- Scroll down to the Preparer/Electronic Return Originator (ERO) Information section.

- Check the box Print ERO name on EF signature forms?