This article will show you how to access California Form 568 for a CA LLC return in ProSeries Professional.

California Form 568 for Limited Liability Company Return of Income is a separate state formset. It isn't included with the regular CA State Partnership formset.

Follow these steps to access the CA LLC-568 formset:

- Open ProSeries

- Open the Federal return.

- Click the File menu, and select Go to State/City.

- Select California Limited Liability

- Click the OK button.

Note: If California Limited Liability does not appear in the Go to State dialog box, the CA LLC-568 formset is not installed. See below for steps to install.

Follow these steps to install the CA LLC-568 formset:

Note: For Network installations complete the follow steps from the ProSeries Admin computer.

- Go to the Update menu and choose Select and Download New Products.

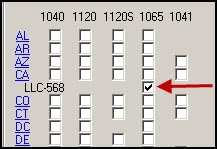

- Under CA, find the line that says LLC-568 and check the box under the 1065 column.

- Click Next. This will download and install the CA 568.

- Pay-Per-Return charges may apply to this return type.