To complete Form W-9, as required by the IRS, it's necessary to collect the following information. Payments can only be issued when this information has been provided:

- Tax Identification Number (TIN) or Social Security Number

- Business name, primary contact, address, phone number, and email address.

To send Form W-9 to Intuit:

- Download a blank copy of IRS Form W-9.

- Fill out the information accurately to reflect the information that the IRS has for your business. It's helpful to include your Customer Account Number (CAN) as either the filename or written on the form.

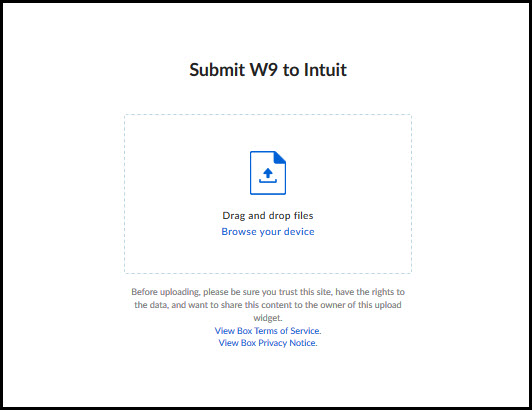

- To send in your form, go to Intuit's Secure Upload Page.

- Drag and drop the file into the box, or browse your computer to upload it.