Retrieving IRS transcripts in ProConnect Tax

by Intuit•10• Updated 9 months ago

We have added a new Transcripts tab to the Client Profile screen in ProConnect Tax From this tab, you will be able to establish a connection to the IRS, provide the appropriate client information, and download IRS transcripts for the client.

Additional Intuit and IRS resources may be found at the bottom of this article.

![]() In order to download a client's transcripts, you must have authorization to do so on file with the IRS. This requires filing Form 2848 or 8821 for the client with the IRS. This is not handled through the application itself, and will need to be filed separately for each client.

In order to download a client's transcripts, you must have authorization to do so on file with the IRS. This requires filing Form 2848 or 8821 for the client with the IRS. This is not handled through the application itself, and will need to be filed separately for each client.

Table of contents:

| ‣ Requesting (or revoking) transcripts for a client |

| ‣ Frequently asked questions |

| ‣ Additional resources |

Requesting transcripts for a client:

- From either the

hub or the

hub or the  list, go to the desired client's profile.

list, go to the desired client's profile. - Select the Transcripts tab near the top of their profile.

- You will see a list of any transcripts that have already been retrieved, otherwise the list will be empty.

- On the right, click the Request more transcripts button.

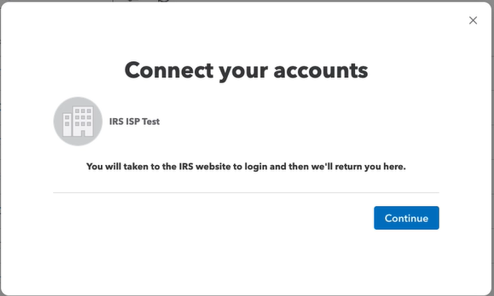

- Select Continue on the modal:

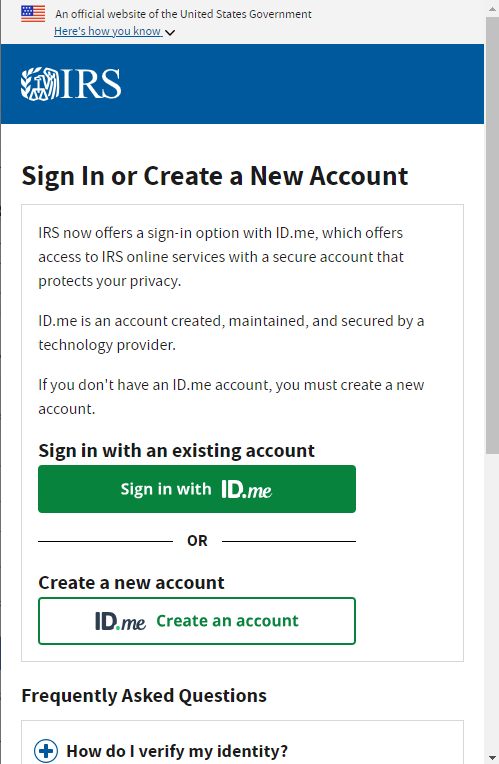

- Sign into IRS account using ID.me in the popup that opens

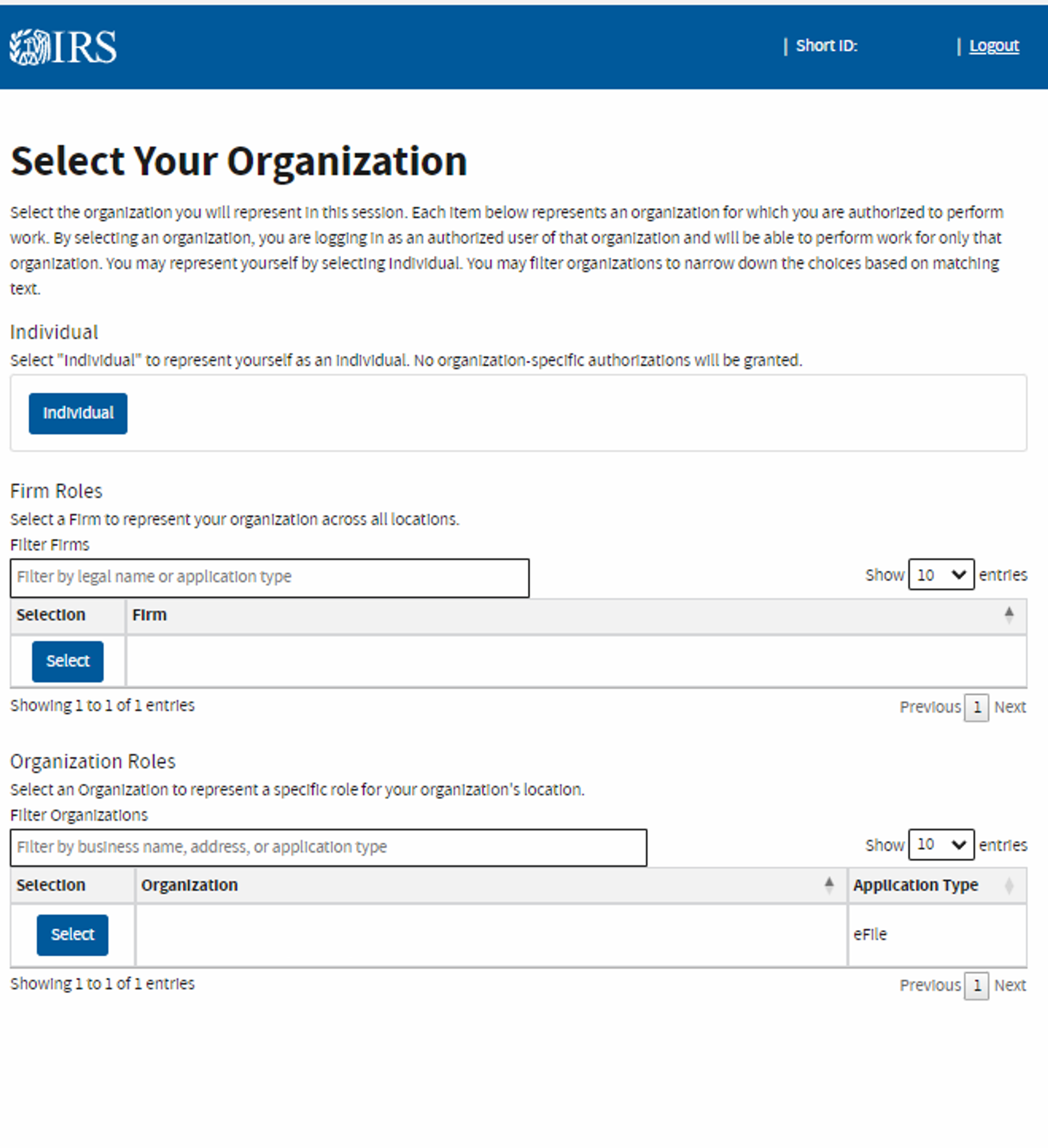

- Select the organization you use if retrieving transcripts via the IRS Transcript Delivery System (TDS)

- The PTO modal automatically proceeds to transcript selection/request screen

- Flow continues the same at this point.

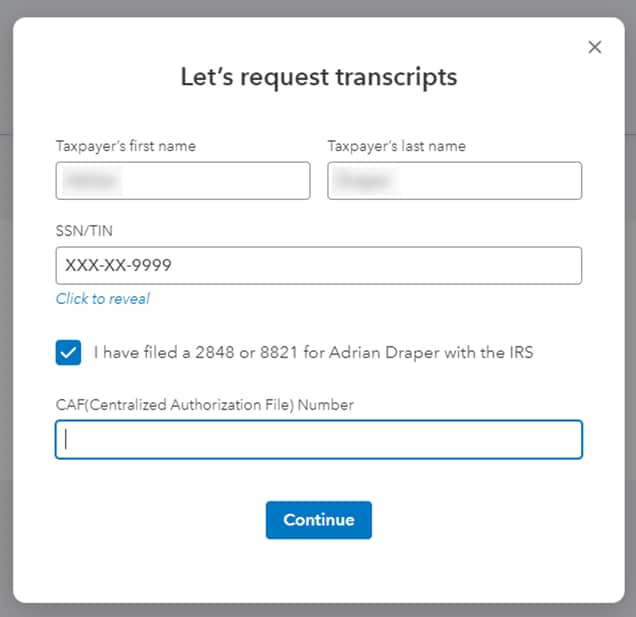

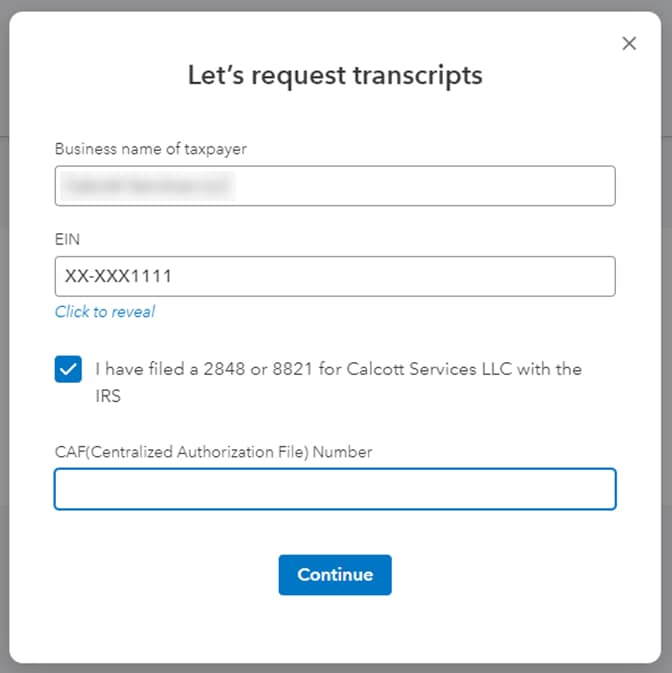

- If needed, update the Client’s name and ID number to match what is on file with the IRS.

- Confirm that you have the appropriate authorization on file with the IRS and enter the CAF (Centralized Authorization File) Number from the IRS in the appropriate box and click Continue.

Individual client

Business client - Select the tax year and which forms for which you would like to retrieve transcripts for this client.

- Forms can be selected individually, by category, or all.

- Click Request transcripts to continue.

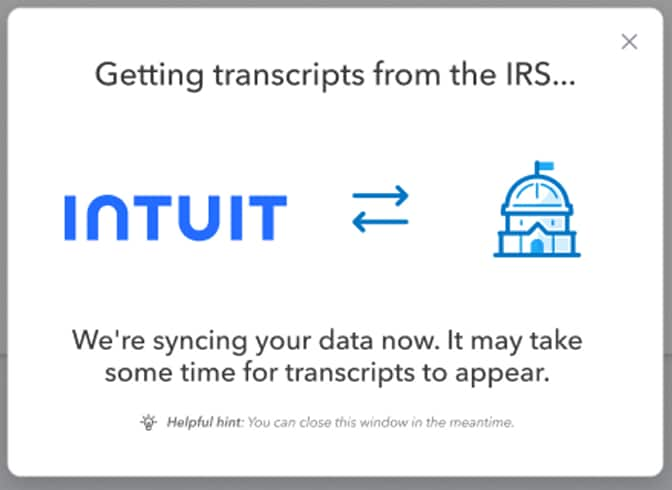

- The system will now begin retrieving the transcripts based on the forms selected.

- This window can be closed while waiting for the retrieval to complete.

- This window can be closed while waiting for the retrieval to complete.

- Once transcripts have been successfully retrieved from the IRS, they will show on the Transcripts tab of the client's profile.

- They can be viewed, downloaded, or removed from here.

- As needed, repeat steps 4-10 for the client.

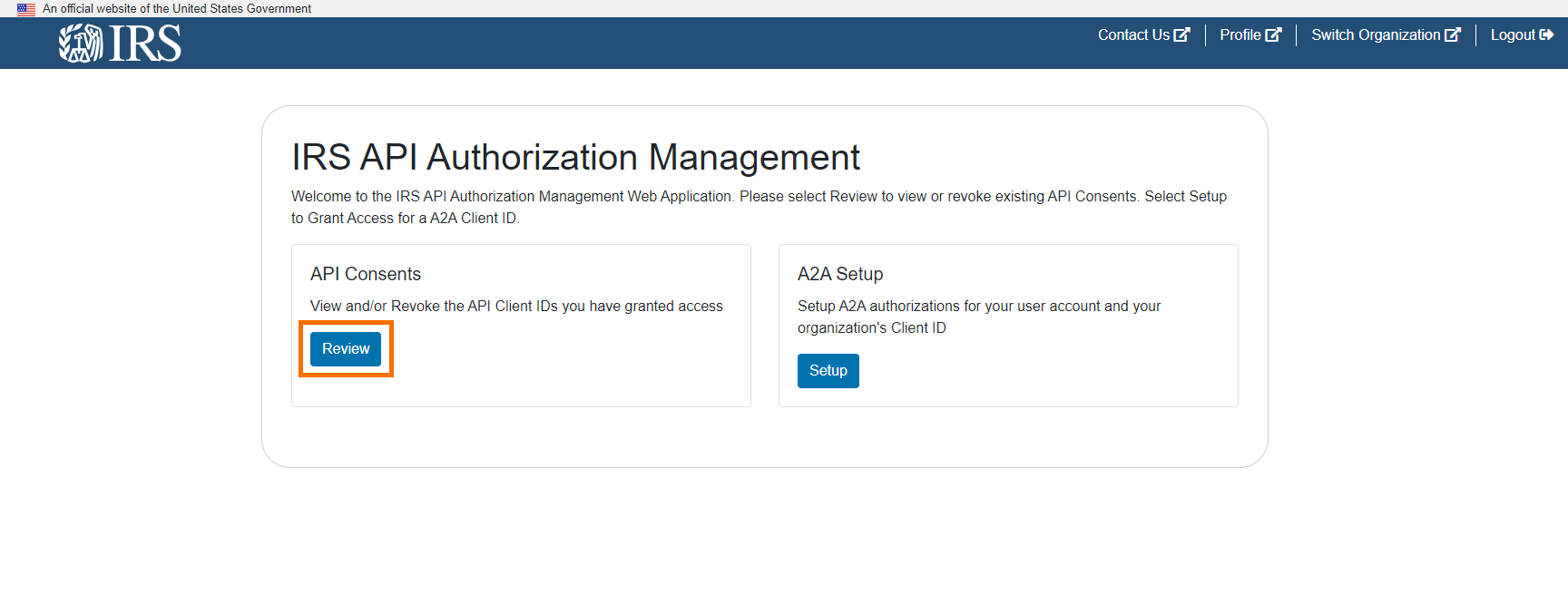

- Go to the IRS API Authorization management Web App.

- Select the Review button to be taken to Authorization Consents.

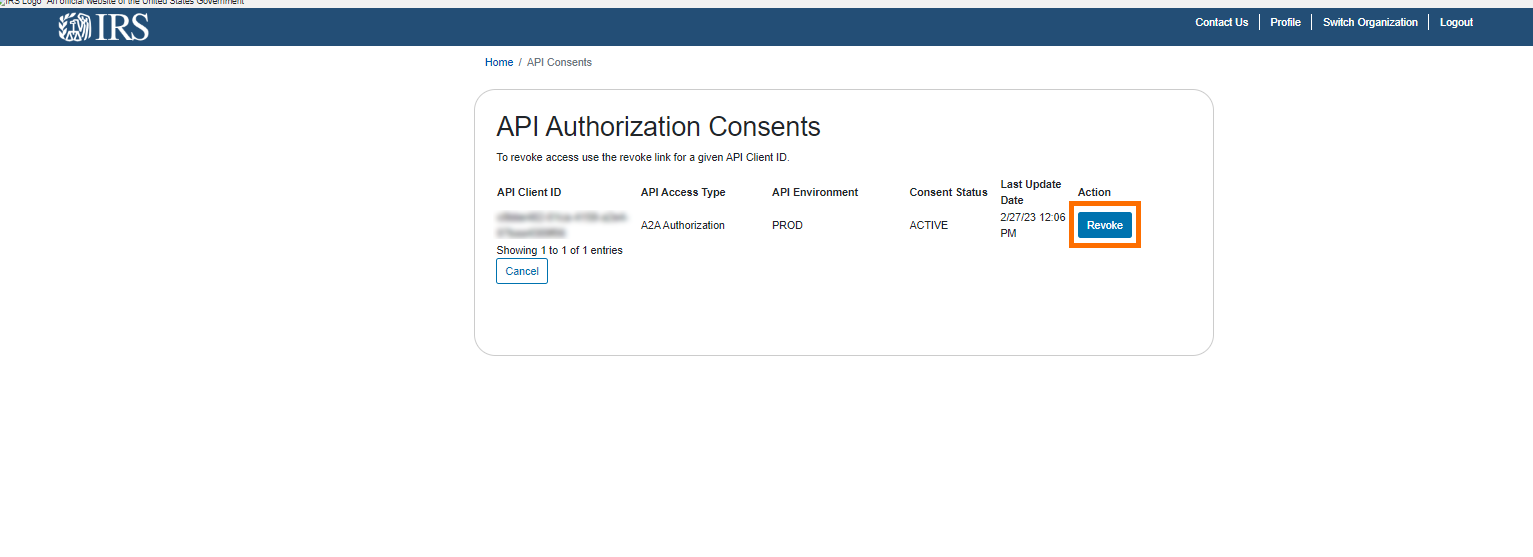

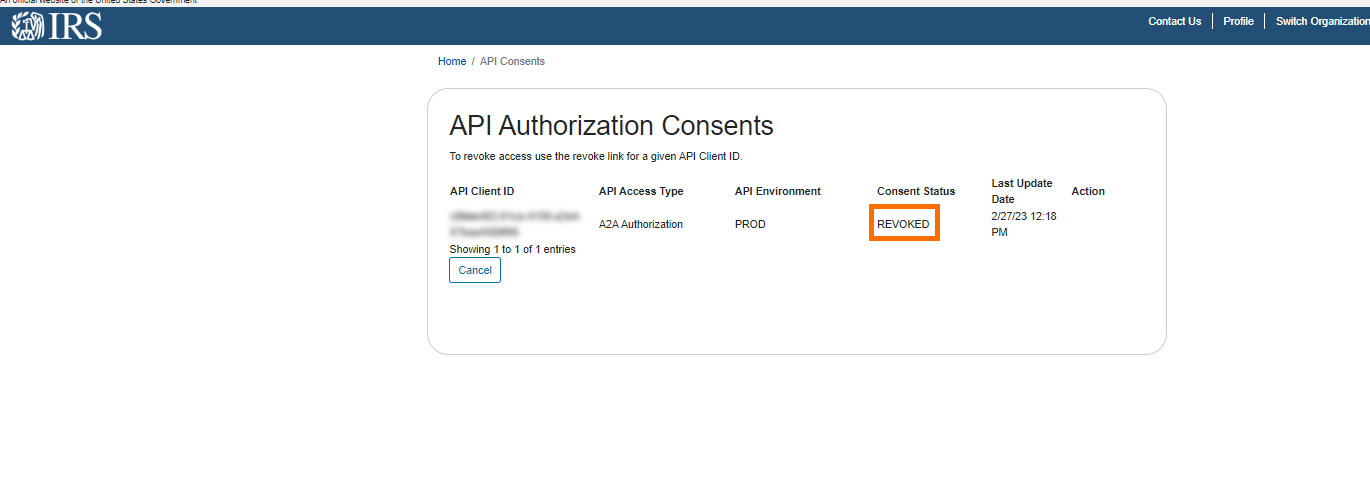

- You will arrive at the API Authorization consents for your specific Client ID. Select the Revoke button to initiate revoke access for the specific API Client ID.

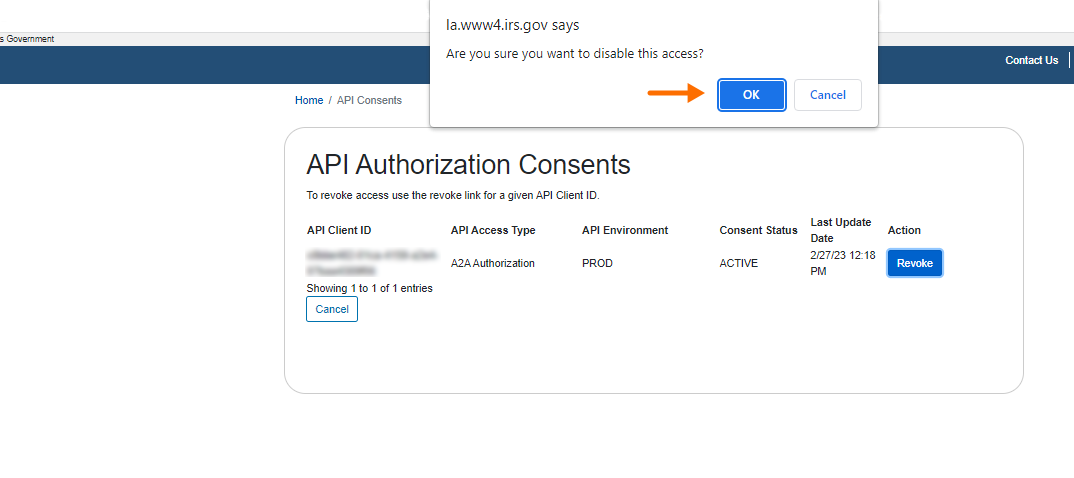

- Select OK when prompted for disabling your firm's access to the IRS transcripts API.

- Once disabled, the Consent Status will update to REVOKED. You will not be able to request anymore transcripts for the client.

Frequently asked questions

The IRS now allows you to collect electronic signatures on Forms 2848 and 8821 from Individual and Business clients, as well as submit those authorization forms electronically.

To use eSignature to collect signatures on these forms, you will need to print the form to PDF and then attach it as an additional document when sending the eSignature request.

Form 2848 and Form 8821 can be submitted electronically to the IRS:

https://www.irs.gov/tax-professionals/submit-forms-2848-and-8821-online

- Tax Return Transcript: This transcript shows most line items from an original Form 1040-series tax return as filed, along with any forms and schedules. It does not show changes made after the original return was filed. This transcript is available for the current and three prior tax years. It is often used by lending institutions offering mortgages.

- Tax Account Transcript: This transcript shows basic data such as filing status, taxable income, and payment types. It also shows changes made after the original return was filed. This transcript is available for the current and nine prior tax years.

- Note: If estimated tax payments were made and/or an overpayment from a prior year return was applied, this transcript type can be requested a few weeks after the beginning of the calendar year to confirm the payments prior to filing a tax return.

- Record of Account Transcript: This transcript combines the tax return and tax account transcripts into one complete transcript. It is available for the current and three prior tax years.

- Wage and Income Transcript: This transcript shows data from information returns received by the IRS, such as Forms W-2, 1098, 1099, and 5498. The transcript is limited to approximately 85 income documents. If there are more documents than that, the transcript will not generate. This transcript is available for the current and nine prior tax years.

- Note: If you receive a message of “No Record of return filed” for the current tax year, it means information has not populated to the transcript yet. Check back in late May.

- Verification of Non-filing Letter: This letter states that the IRS has no record of a processed Form 1040-series tax return as of the date of the request. It does not indicate whether a return is required for that year. This letter is available after June 15 for the current tax year or anytime for the prior three tax years.

- Clients are unable to locate all of their documents, or are unsure if they should have received something.

- Clients receive a notice from the IRS.

- Verify what the IRS has been provided to what you have available.

- Assisting a client with applying for a business loan.

- Assisting a client with sponsoring relatives for immigration.

We will not be able to provide specifics regarding the status of your authorization. If it has not been processed, you will receive an error when attempting to retrieve transcripts for a client. You will need to contact the IRS for specific information.

Yes, the transcripts as well as the history of which transcripts have been retrieved for a client are stored on the Client Profile in ProConnect Tax.

Additional resources

Related articles

IRS pages

You must sign in to vote.