Quick Summary

- Intuit Link is a cloud-based platform that facilitates collaboration and communication between accountants and their clients.

- It allows accountants to securely share and request financial documents, exchange messages, and monitor the status of work in progress.

- If you're new to Intuit Link, see here.

Customize your Link settings and organizer templates

- Select Intuit Link on the left side of your screen.

- Select Settings at the top right.

- Click the pencil button next to any item you wish to edit.

- Make your changes, then select Save.

- Scroll down to the Organizer templates section.

- If you used the PDF checklist before it was a part of Link, we saved a copy of your old checklist here for reference.

- Click Create a new template to start an organizer template from scratch - or select Duplicate on a Quickstart template to modify it.

- Select Edit to make changes to any portion of the organizer as needed.

- When you're satisfied with your settings, select Done.

Invite your clients to Link

- Select Intuit Link on the left side of your screen.

- Select Create request.

- Select the client you wish invite.

- Select Continue.

- You may be prompted to enter the client's email address. If so, enter the email, then press Save.

- Your default organizer will appear. Select Edit to customize any item for this client, or Preview to check what will be sent.

- Once you're satisfied with the organizer, select Continue.

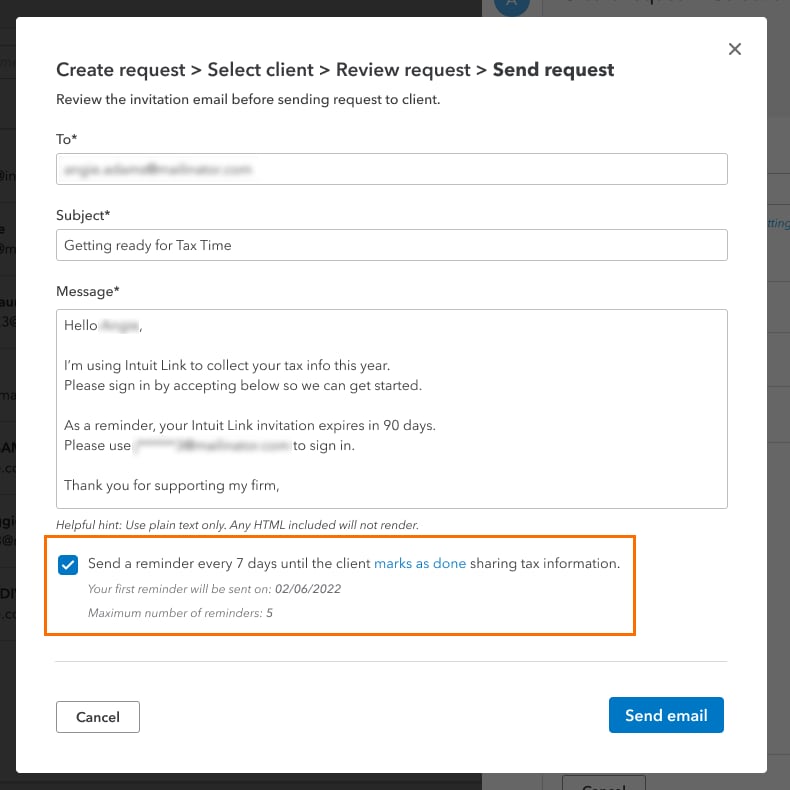

- Edit the invitation email for this client if desired.

- By default, your client will be sent reminders every 7 days for a total of 5 durations, or until the client marks the request as done. If you do not want to send your client reminders, unmark the Send a reminder every 7 days until the client marks as done sharing tax information checkbox.

- Reminders will stop if:

- a request is deleted,

- a request is marked as done by the client, (or)

- the maximum numbers of reminders (5) has been sent.

- Reminders will stop if:

- Once done and ready to invite the client, select Send email.

For information on how the taxpayer uses Intuit Link see How do taxpayers use Intuit Link for ProConnect Tax?