This article will walk you through importing a Schedule K-1 to an individual (1040) return in ProConnect Tax.

Before you start

- You can only import Schedule K-1s from business returns you prepared in ProConnect Tax.

- Verify that the taxpayer and spouse tax identification number (SSN or ITIN) is entered correctly in the Client Information screen.

- Make sure the taxpayer and spouse names within the individual return match what's on the K-1.

Follow these steps to import a K-1

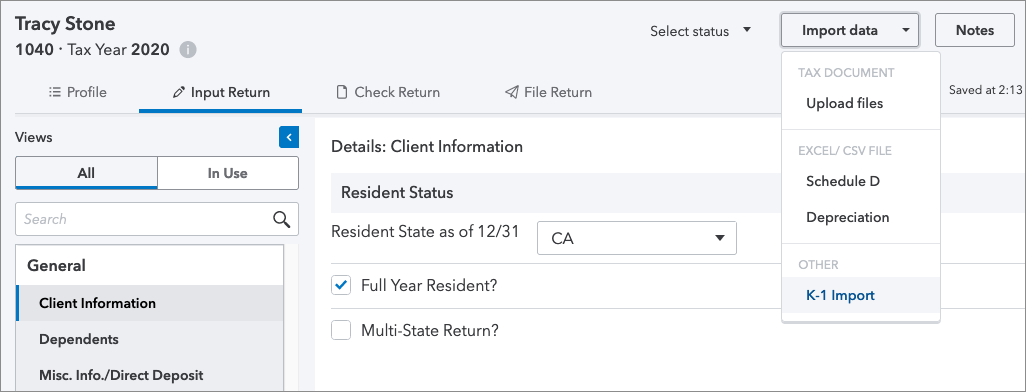

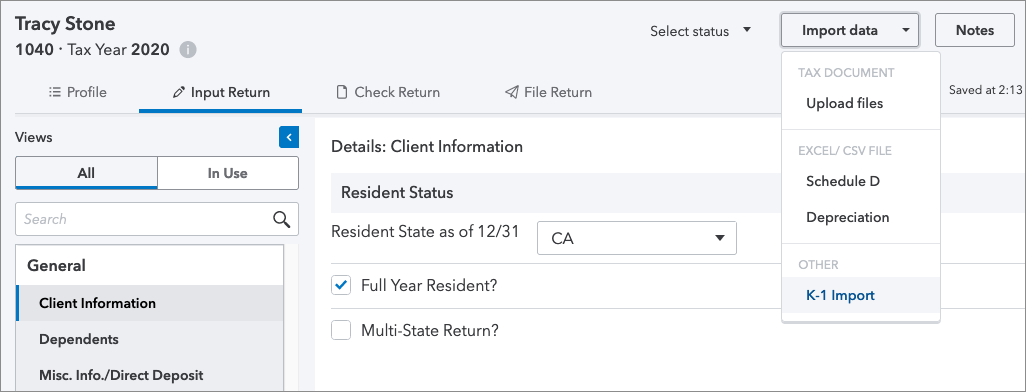

- Open the individual (1040) return, and go to the Input Return tab.

- Click the Import Data button, then select K-1 Import.

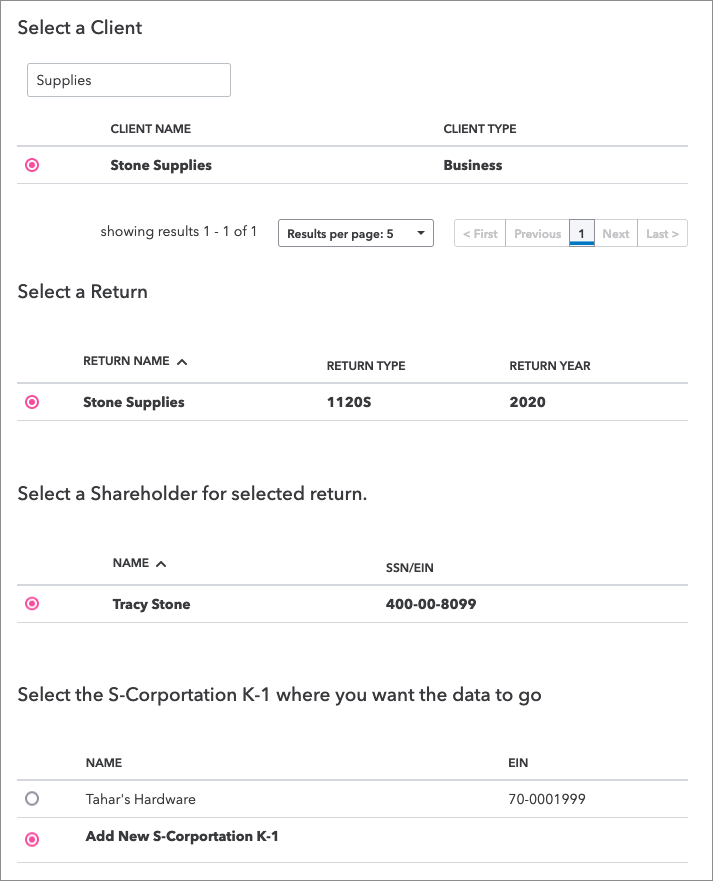

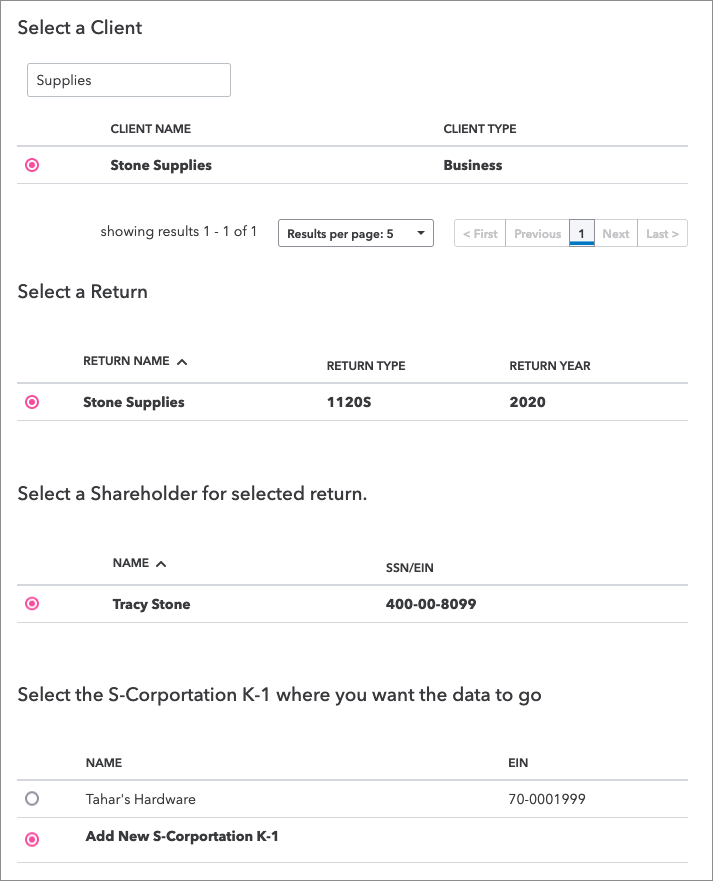

- Select the business client whose K-1 you want to import.

- Select a Return to import from.

- Choose the partner, shareholder, or beneficiary whose K-1 you want to import.

- In the Select the K-1 where you want the data to go section, you can choose an existing K-1, or choose Add New K-1.

- If you import to an existing K-1, your previous entries will be overwritten with the updated data.

- Press Review to continue.

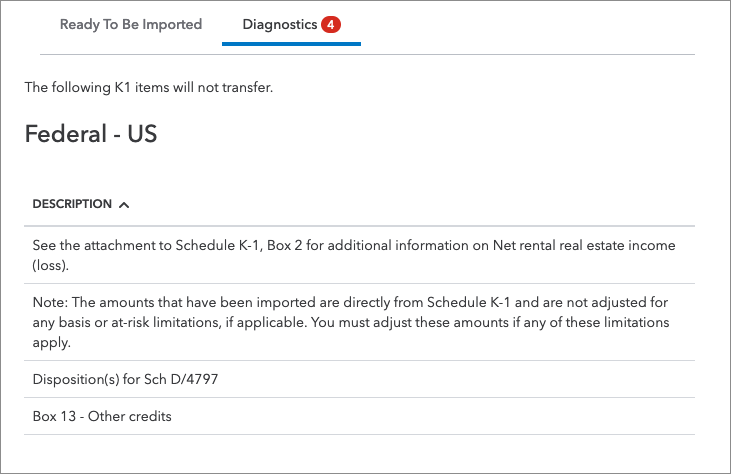

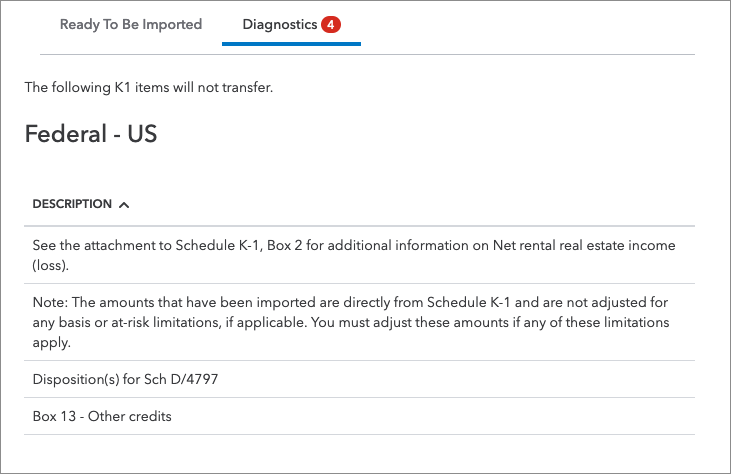

- Review the data on the Ready To Be Imported screen.

- Select Diagnostics to view information about data that can't be imported, and entries that may need review. We recommend you print or screenshot these items for future reference.

- Once you're satisfied with the data, click Import.

You'll be returned to the 1040 input screen where you imported data. Fields containing imported amounts will be highlighted in green.

What if the export didn't work?

There are some situations where the data may not transfer. Check the following items to make sure everything is set up correctly, or to make necessary adjustments:

- Make sure the Schedule K-1 has information to export. If there aren't any income or loss items the K-1 will not export.

- Make sure the Social Security Number (SSN) of the partner(s), shareholder(s), or beneficiary(s) match the SSN for the taxpayer or spouse in the Individual module.

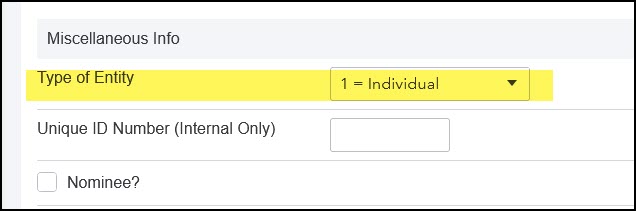

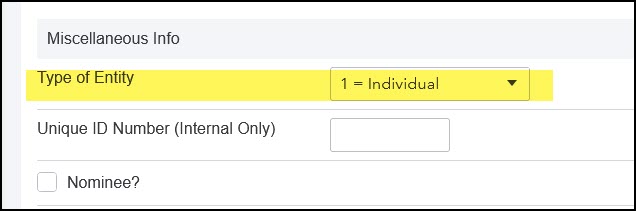

- On the Partnership Information screen, make sure the Type of Entity is set to Individual.

- Check the dates of the return. If the return is on a fiscal year, the K-1 export won't work.

- If you've reviewed all other information and the information still isn't appearing in the Individual module, check to see if the return has been split.

- If it has, ProConnect Tax will export the K-1 information to the single/split return as opposed to the joint return. You may need to back up the MFS return and delete it in order to export the K-1 data to the MFJ return.

- If Schedule K-1 activities already exist within the Passthrough K-1's section of the Individual module, or the SSN is correct and no import box appeared, enter the number of the specific K-1 into the entity's return as the activity number:

- Partnership: Number of K-1 Activity in 1040 [O]

- S- Corporation: Number of K-1 Activity in 1040 [O]

- Fiduciary: Number of K-1 Activity in 1040 [O]

- Grantor Trusts do not generate a K-1 and cannot be exported.

Examples

- If the K-1 corresponded to the second partnership in the Passthrough K-1's section of the Individual return, enter a 2 in the Partnership return, Number of K-1 Activity in 1040 [O] for the specific partner.

- If there are no other K-1s currently present in the Passthrough K-1's screen, enter a 1 in the Number of K-1 Activity in 1040 field in the appropriate business return.

- If a taxpayer and spouse each have a K-1 from the same entity, enter consecutive numbers (e.g. 1 and 2, or 2 and 3 if there is another K-1 already present in the Passthrough K-1's section in the Number of K-1 Activity in 1040 field in the appropriate business return.

Don't forget

Amounts are imported directly from the Schedule K-1 and aren't adjusted for any basis or at-risk limitations.

Many items are transferred directly to the input screen to simplify data entry. However, you should review all items for accuracy and to ensure correct treatment on the 1040.