Below, you'll find questions to frequently asked questions on Schedule C in the Individual module of Lacerte.

Table of contents:

Follow these steps to generate Schedule C in the Individual module:

- Go to Screen 16, Business Income (Sch. C).

- Locate the Business Income (Schedule C) section.

- Complete the applicable information about the business.

- Scroll down to the General Information section.

- Complete any applicable information.

- Scroll down to the Income section:

- Enter Gross receipts or sales

- Enter Returns and allowances

- Enter Other income (Ctrl+E)

- Scroll down to the Cost of Goods Sold section.

- Complete any applicable information.

- Scroll down to the Expenses section.

- Enter the applicable expenses that pertain to this business.

- Scroll down to the Other Information section.

- The Other Information section was added in Lacerte Tax 2013. In prior years, these entries can be found under the General Information section.

- Complete any applicable information about this business.

Where do I enter line 9 - Car and truck expenses?

You can enter vehicle expenses on Screen 16, Depreciation and link them to this Schedule C.

If you're deducting actual expenses, rather than the standard mileage rate, the depreciation portion is reported on line 13, and lease payments will flow to line 20a.

To verify where expenses are being reported:

- Click on WKS: Vehicle Expenses.

- Scroll down to the Vehicle Expense Allocation.

To force the standard mileage rate or actual expenses:

- Select the vehicle on Screen 22, Depreciation.

- Scroll down to the Automobiles and Other Listed Property section.

- Under Automobile Mileage, enter a 1 or 2 in 1=force actual expenses, 2=force standard mileage rate.

Why isn't depletion calculating on line 12?

Deductions for oil and gas depletion are subject to certain income limitations, particularly when claiming percentage depletion. If you enter the info for both percentage and cost depletion, Lacerte will optimize the calculation to take the greatest allowable deduction.

Follow these steps to see the calculation for the limitation:

- Go to the Forms tab.

- Go to the Oil & Gas Sch.

- Under Description in the left navigation panel, select Inc. Limitation for Depletion.

- This worksheet shows the calculation for the income limitation.

How does Lacerte calculate depreciation and section 179 expense for line 13?

When you have multiple assets linked to the same Sch F, the fastest way to review their depreciation is on the current year Federal Depreciation Schedule the program produces.

To override current-year depreciation on a single asset:

- Go to Screen 22, Depreciation.

- Select the applicable Asset from the left of the screen.

- Locate the Asset Information section.

- Scroll down to the Regular Depreciation subsection.

- Enter the override in Current depreciation/amortization [O].

- If you overrode the total depreciation on the Schedule F screen, this field won't do anything. Only use on override.

How do I enter benefit programs for line 14?

- Go to Screen 16, Business Income (Sch. C).

- Scroll down to the Expenses section.

- Enter the applicable amount in Employee benefit programs.

![]() The amount you enter in Employee benefit programs will be reduced by any amount entered in Health insurance premiums reduction for Form 8941 credit before it prints on the return, per form instructions.

The amount you enter in Employee benefit programs will be reduced by any amount entered in Health insurance premiums reduction for Form 8941 credit before it prints on the return, per form instructions.

How do I report lease payments on line 20a?

- Go to Screen 22, Depreciation.

- Scroll down to the Automobiles and Other Listed Property section.

- Locate the Actual Vehicle Expenses subsection.

- Enter the lease payments in Vehicle rent or lease payments.

- Make sure that the Vehicle rent or lease payments is greater than the Inclusion amount (enter as positive). If that's already the case, and result still isn't showing on Schedule C, line 20a, the vehicle is most likely taking the standard mileage rate. To report the lease payment expense separately, you must force actual expenses by using the 1=force actual expenses, 2= force standard mileage rate field on Screen 22, Depreciation.

How do I fill out the square footage of a home on Schedule C?

These lines will be blank if your client is taking a deduction for actual expenses rather than the simplified method.

If you want to force the simplified method:

- Go to Screen 29, Business Use of Home (8829).

- Enter a 2 in the field 1=use actual expenses (default), 2=elect to use simplified method.

For more information about using the simplified method, refer to this article.

How do I mark the "All investment at risk" checkbox on Schedule C, line 32a?

The program won't check either box under Schedule C, line 32a unless there's a loss on the Schedule C. The text under Schedule C, line 31 says that you shouldn't complete line 32a when there's a profit.

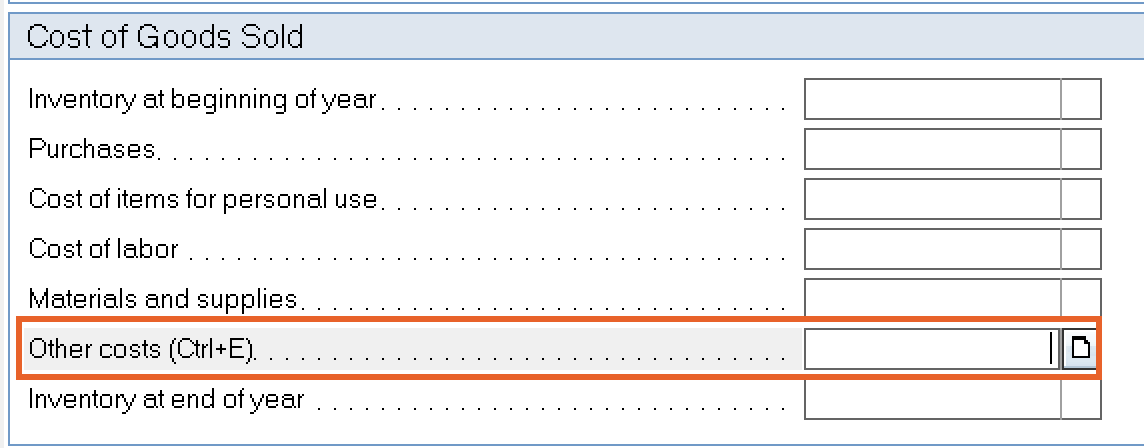

Where do I enter line 39 - Other costs?

- Go to Screen 16, Business Income (Sch. C).

- Scroll down to the Cost of Goods Sold section.

- Enter the Other costs (Ctrl+E) field.

Why isn't vehicle information printing on Schedule C, Part IV, line 43?

Usually, when vehicle information isn't printing on Schedule C, Part IV, it's because a Form 4562 is generating for this Schedule C. Part IV of the Schedule is only filled out when the business doesn't have to file a Form 4562.

If the business is required to file a Form 4562, you can view the vehicle information on Form 4562, Part V.

For more information, refer to this article.