Per the 1098-T Form instructions for Box 4:

- "Box 4 shows any adjustment made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount may reduce any allowable education credit that you claimed for the prior year. See "recapture" in the index to IRS Pub. 970 to report a reduction in your education credit or tuition and fees deduction. Review IRS Pub. 970 for specific information related to reporting amounts from box 4 of form 1098-T."

To recapture the credit in Lacerte 2021 or newer:

- Go to Screen 38.1, Education Credits.

- Enter the Student Information:

- Enter a 1 or 2 in 1 = taxpayer, 2 = spouse.

- If the student is a dependent use the drop down to select them.

- If the student isn't listed as a dependent, enter their name and Social Security number.

- Enter the number of years in Number of prior years AOC claimed (if applicable).

- Enter the Educational Institution Attended information.

- Scroll down to the Current Year Expenses subsection.

- Enter the Qualified tuition and fees (net of nontaxable benefits).

- Enter the Books and supplies required to be purchased from the institution.

- Enter the Books and supplies not entered above (AOC only).

- Scroll down to the Recapture Prior Year Credit (ERC) subsection.

- Enter a 1 or 2 in 1=AOC, 2=LLC.

- Enter an amount in Total qualified education expenses.

- Enter an amount from Line 4 of the 1098-T in Tax-free education assistance or refunds received after filing 20YY return.

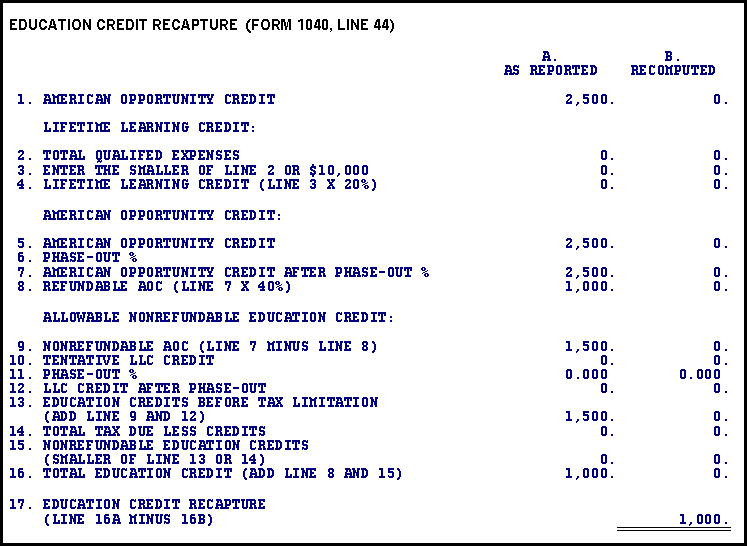

Lacerte will generate an Education Credit Recapture (ECR) Worksheet. The amount will be calculated on the worksheet based on the entries made.