![]() Lacerte doesn't have a specific entry field for Box 13, code W, since this box is used for various other deductions. The firm who prepared the partner's K-1 should have included a description of what the deductions are, and instructions on how to report the deductions on the partner's individual return. Refer to the Partners instructions for Schedule K-1 for Schedule K-1 for a complete list of deductions that may be reported in Box 13 with code W.

Lacerte doesn't have a specific entry field for Box 13, code W, since this box is used for various other deductions. The firm who prepared the partner's K-1 should have included a description of what the deductions are, and instructions on how to report the deductions on the partner's individual return. Refer to the Partners instructions for Schedule K-1 for Schedule K-1 for a complete list of deductions that may be reported in Box 13 with code W.

To report Schedule K-1, Box 13, code W without having descriptions or instructions about the deductions:

- Go to Screen 20, Passthrough K-1's.

- Select Partnership Infomation from the left menu.

- Scroll down to the Separately Stated Income and Deductions subsection.

- To report the deduction as passive:

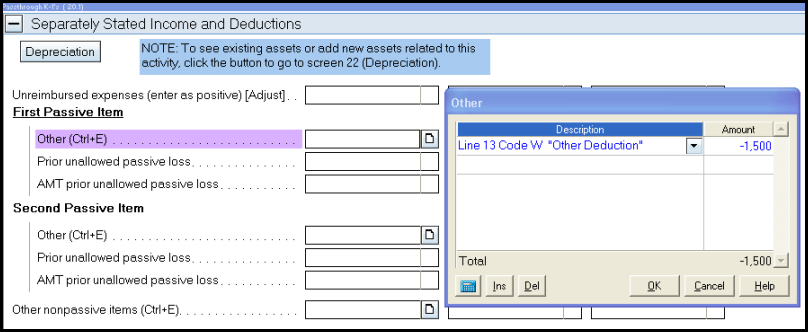

- Locate the First Passive Item subsection.

- In the field Other (Ctrl+E) enter Ctrl+E or select the expander icon to open the input box.

- Enter the Description.

- Enter the Amount as a negative number.

- Select OK.

- If the loss is allowed after passive limitations are applied, the entry will flow to the Schedule E, Page 2, Line 28 column (f), Passive loss allowed (attach Form 8582 if required).

- To report the deduction as nonpassive:

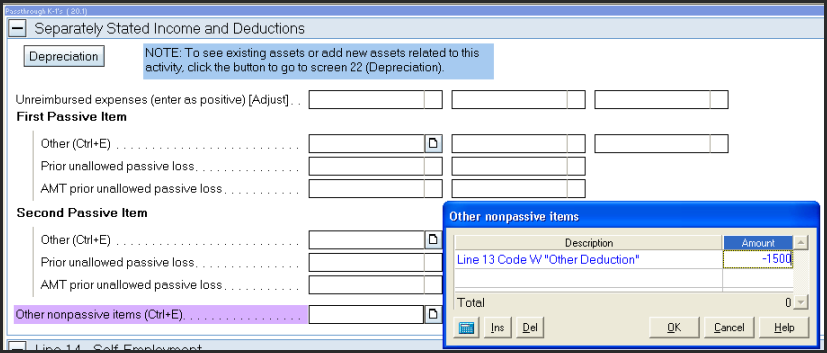

- In the field Other nonpassive items (Ctrl+E) enter Ctrl+E or select the expander icon to open the input box.

- Enter the Description.

- Enter the Amount as a negative number.

- Select OK.

- This entry will flow to the Schedule E, Page 2, Line 28 column (h) Nonpassive loss from Schedule K-1.

- To report the deduction as passive:

If the partnership provided details on Box 13, code W amounts, you can find additional information on codes by selecting the Frequently Asked Questions link in the Line 13 - Other Deductions section bar, or by referring to Schedule K-1 Partnership input for box 13 on Individual returns.

For Box 13, code W amounts that are not specifically listed here, use the Partners instructions for Schedule K-1 to decide where the item should be reported on the partner's 1040.