ProConnect Tax doesn't have one specific entry field for Schedule K-1, Line 20, 'Other'. The firm that prepared the partner's K-1 should have included a description of the information and instructions on how to report the information on the partner's individual return. If the firm didn't include a description or instructions, you'll need to decide where the other information should be reported.

For a full list of items that could be represented on this line, refer to Partners Instructions for Schedule K-1.

What's new for Schedule K-1 for tax year 2023:

For tax year 2023 the IRS has added multiple new codes to the Schedule K-1. Most changes involve new codes for Other Income, Other Deductions, Other Credits and Other Information to provide additional details for when the 1040 is completed. To see the Partnership codes click here, to see the S-Corporation codes click here and scroll down to the code lists on the last pages of the instructions.

.

The K-1 line 20 'other' has changed letters over the years:

- Tax year 2023: ZZ

- Tax year 2018-2022: AH

- Tax year 2013-2017: Z

- Tax year 2012 and prior: Y

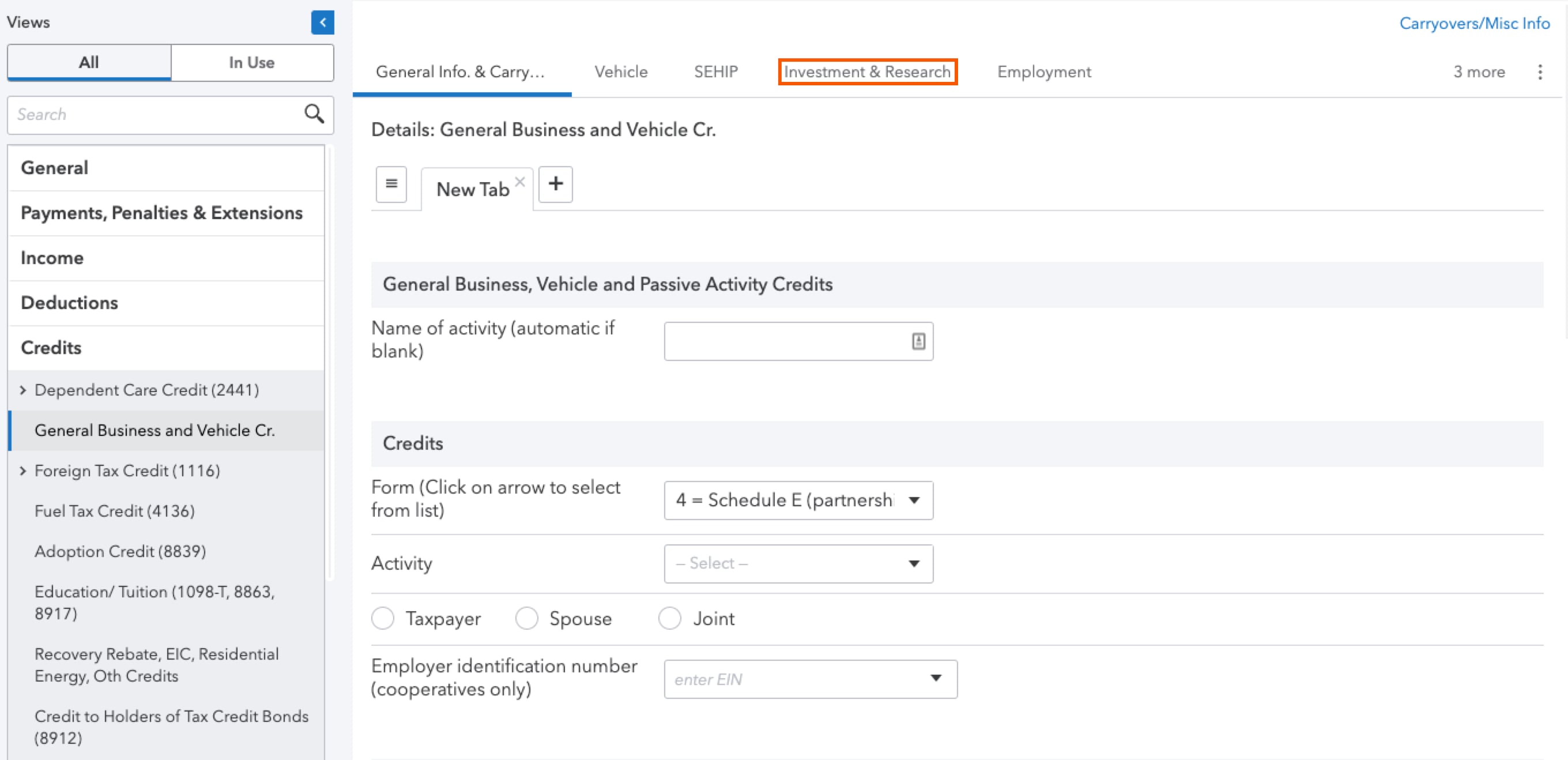

Some of the more common input items in ProConnect Tax are as follows: