The following are frequently asked questions about partnership Other Schedule K Items, deductions, self-employment, foreign transactions, and nondeductible expenses in Lacerte

What's new for Schedule K-1 for tax year 2023:

For tax year 2023 the IRS has added multiple new codes to the Schedule K-1. Most changes involve new codes for Other Income, Other Deductions, Other Credits and Other Information to provide additional details for when the 1040 is completed. To see the Partnership codes click here, to see the S-Corporation codes click here and scroll down to the code lists on the last pages of the instructions.

.

Before you start:

This article will help you enter items on Form 1065, Schedule K. If you received a K-1 from a partnership and need to enter it in an individual (1040) return, see:

How do I enter foreign taxes for schedule K, line 21?

- Go to Screen 22.1, Other Schedule K Items.

- Scroll down to the Other Information section.

- Enter the Total foreign taxes paid or accrued.

The partnership must complete Schedule K-2, Parts II and III.

The partnership must complete Schedule K-2, Parts II and III.

Where do I enter self-employment for box 14?

The program can generate three different types of self-employment earnings for Schedule K-1, line 14.

Box 14, Code A

Box 14, Code A relates to net earnings from self-employment and is automatically calculated for anyone indicated as a General Partner/LLC Manager on the Partner Information screen.

The Schedule K-1 instructions state that you should enter input related to net earnings from self-employment for each general partner.

Box 14, Code B

Box 14, Code B reports gross farming and fishing income and is automatically calculated, but an adjustment entry is available. Partners (whether limited or general) need this amount to figure their net earnings from self-employment and prepare their individual returns.

Box 14, Code C

Box 14, Code C reports gross nonfarm income, and isn't calculated by the program. Partners (whether limited or general) may need this amount to figure their net earnings from self-employment and prepare their individual returns.

2020 returns: Why are amounts printing on K-1 line 16 when there's no foreign income?

For tax year 2020, the IRS introduced new partnership box 16 codes AA–AI. These codes report gross receipts and base erosion tax benefits under Regulations 1.59A-7(e)(2) (Base Erosion Tax 8991).

Business entity partners (corporations, LLCs, and partnerships) will generate multiple codes for current year and prior year gross receipts, as well as base erosion tax information. These items will populate automatically if the Partner is a Partnership, LLC, or Corporation, and can't be suppressed.

Business entity partners (corporations, LLCs, and partnerships) will generate multiple codes for current year and prior year gross receipts, as well as base erosion tax information. These items will populate automatically if the Partner is a Partnership, LLC, or Corporation, and can't be suppressed.

These items are for informational purposes to help the K-1 recipient complete their tax return, and they don't mean that any foreign income or activity is present on the partnership's return.

The program automatically enters these amounts based on the Form 1065 Schedule K-1 instructions. They can be specially allocated to the partners.

To override box 16 in Lacerte:

To override code AA, current year gross receipts:

- Go to Screen 22, Other Schedule K Items.

- Scroll to the Foreign Transactions section.

- Enter an amount in Gross receipts per Reg. 1.59A-7(e)(2) [O] .

- Enter -1 to set the amount to zero.

Codes AB, AC, and AD represent three preceding years' gross receipts. The totals for all partners are based on your entries or proforma'd amounts on Screen 5, Other Information (Schedule B).

To override these amounts for a specific partner:

- Go to Screen 32.1, Schedule K-1 Misc.

- Scroll down to the Gross Receipts per Regulations 1.59A-7(e)(2)[O] (Partnership, Corp, or LLC Partners Only) section.

- Enter the amounts for the first, second, and third preceding tax year. Enter -1 to set the amount to zero.

To override box 16 in ProConnect:

To override code AA, current year gross receipts:

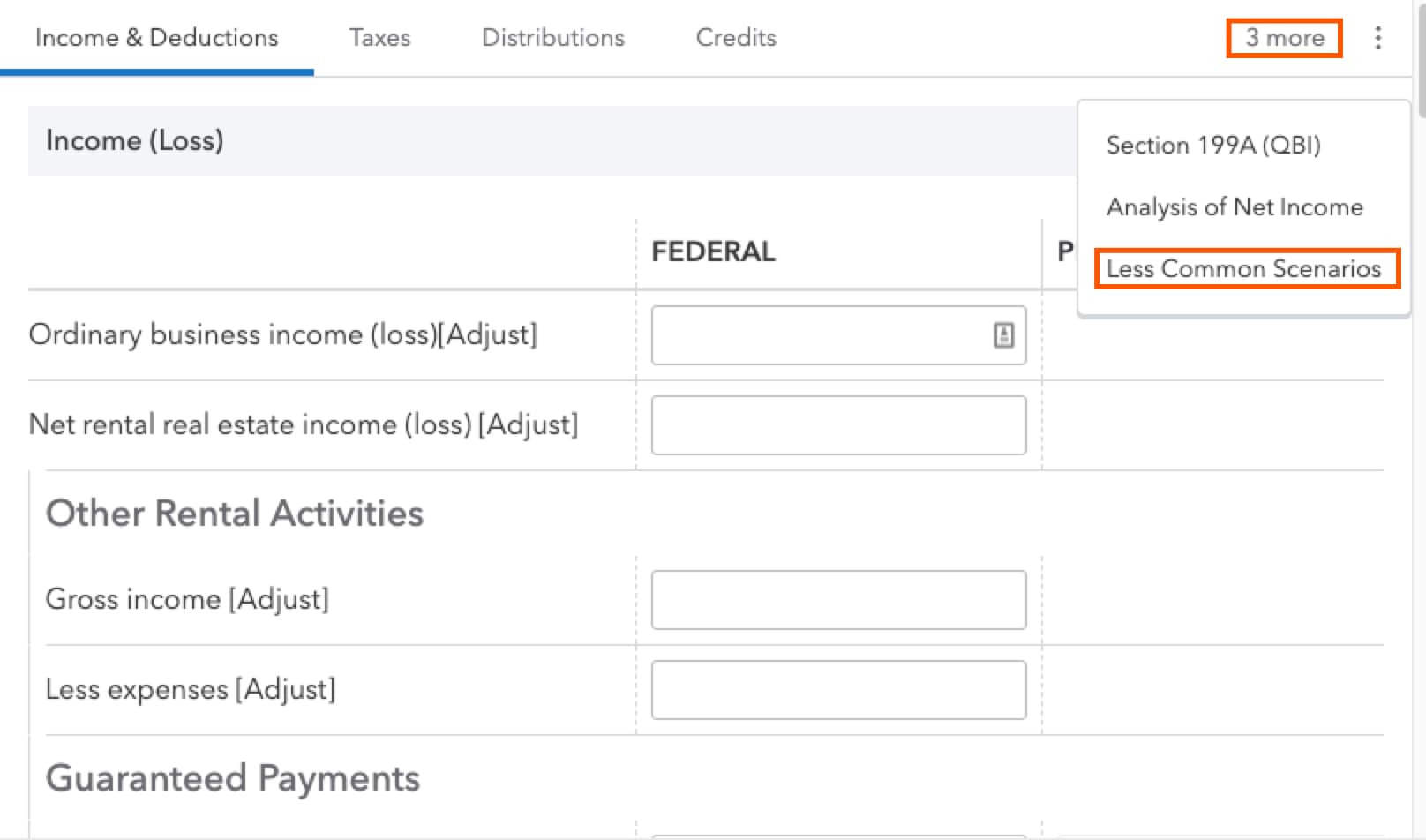

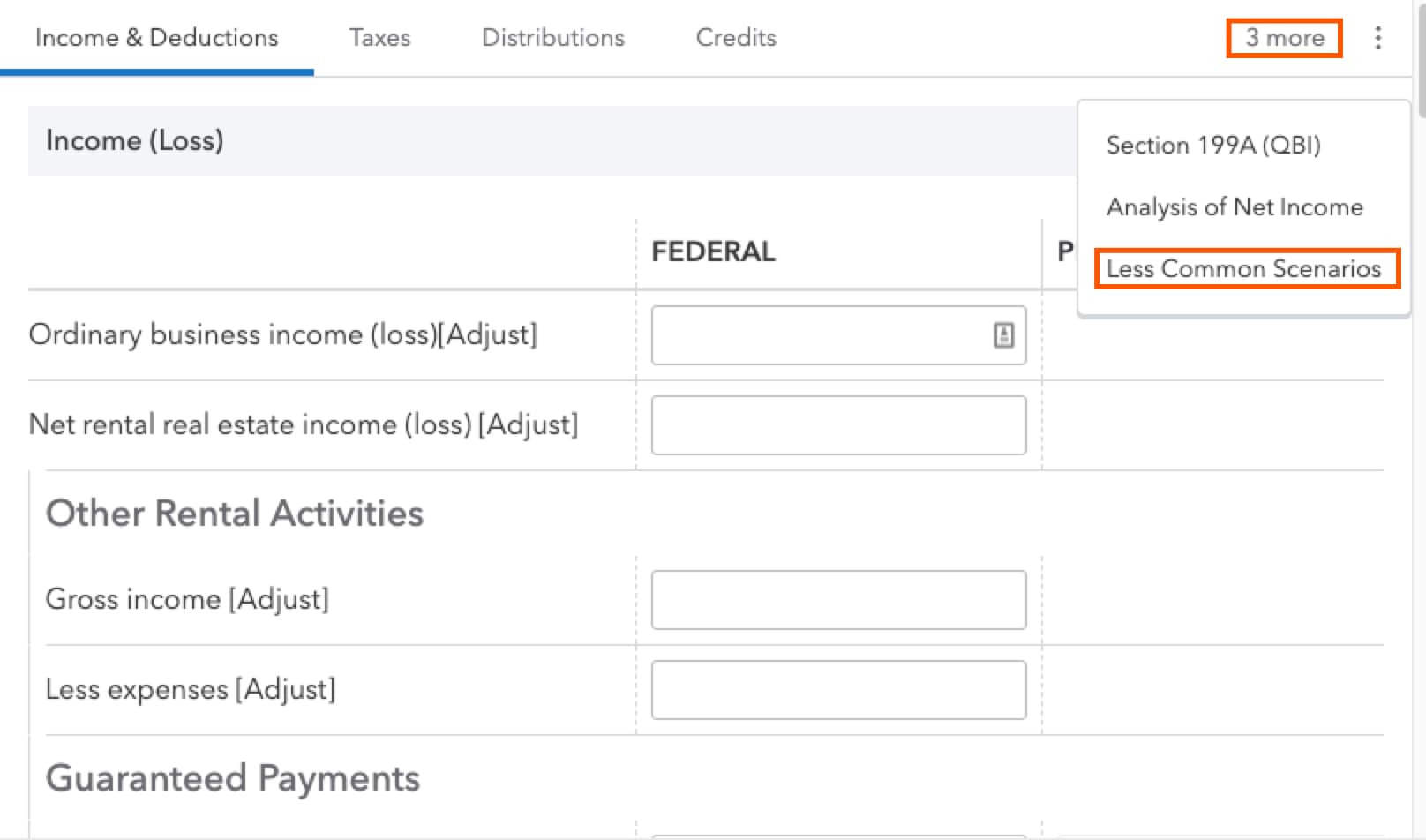

- Under Input Return, select Schedule K.

- Select Other Schedule K Items, then select Other Schedule K Items.

- Select the 3 more tab, then Less Common Scenarios.

- Enter an amount in Gross receipts per Reg. 1.59A-7(e)(2) [Override] .

- Enter -1 to set the amount to zero.

Codes AB, AC, and AD represent three preceding years' gross receipts. The totals for all partners are based on your entries or proforma'd amounts on the Other Information (Schedule B) screen.

To override these amounts for a specific partner:

- Under Input Return, select Schedule K-1, then Schedule K-1 Miscellaneous.

- Scroll down to the Gross Receipts per Regulations 1.59A-7(e)(2) [Override] (Partnership, Corp, or LLC Partners Only) section.

- Enter the amounts for the first, second, and third preceding tax year.

- Enter -1 to set the amount to zero.

Related topics

![]() The partnership must complete Schedule K-2, Parts II and III.

The partnership must complete Schedule K-2, Parts II and III.