Starting in tax year 2019:

- Under the Tax Cuts and Jobs Act, the individual shared responsibility payment was reduced to $0 for months beginning after December 31, 2018.

- Form 1040 no longer has a Full-year health care coverage or exempt box.

- Form 8965 for Health Coverage Exemptions is no longer used.

- Form 1095-B and 1095-C are no longer required to be entered into the tax return and should be kept by the taxpayer for their records.

- Form 1095-A for Health Insurance Marketplace Statement still needs to be entered to generate the Form 8962 to reconcile any advance payments of the premium tax credit or claim the premium tax credit. Click here for more information.

For tax years 2023-2025:

Taxpayers with a household income that exceeds 400% of the federal poverty line for their family size may be allowed a PTC. For more information, click here.

Entering Form 1095-A:

ProSeries provides a Form 1095-A Health Insurance Marketplace Statement worksheet for data entry.

To enter Form 1095-A, Health Insurance Marketplace Statement:

- Press F6 to bring up Open Forms.

- Type 1095-A and press Enter.

- Select Create new copy and enter the Marketplace-assigned Policy Number.

- Select Create.

- Check the Owned by box for taxpayer or spouse, and if applicable, check Spouse is covered by plan.

- In Part I Recipient Information enter:

- Box 1 Marketplace identifier.

- Box 2 Marketplace-assigned Pol. No. (if not already entered)

- If the policy number is longer than 15 characters, enter the last 15 characters of the policy number.

- The policy number can be digits, alpha letters, and some special characters.

- Example - If the policy number is 12345678901234A:123456, enter 8901234A:123456 in ProSeries.

- Box 3 Policy Issuer's Name (entered when creating copy of Form 1095-A).

- Box 4, 5, and 6 are completed by the program based information entered in part 1 of the Federal Information Worksheet.

- Box 7, 8, and 9 are completed if the "Spouse Covered" box is checked.

- Box 10 Enter the Policy start date.

- Box 11 Enter the Policy termination date.

- Box 12, 13, 14, and 15 are completed by the program

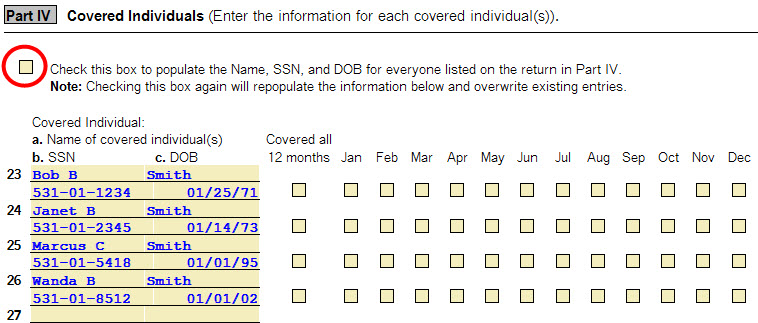

- In Part II Coverage Household enter on lines 16 through 20, columns A through E, information for each individual including the recipient and the recipient's spouse if covered under the policy.

- Tip: To quickly populate Part II with the Name, Social Security Number, and Date of Birth for the taxpayer, spouse, and each dependent already entered on the Federal Information Worksheet, mark the check box* located beneath the Part II 'Coverage Household' heading. You may then complete each row by entering the Start Date and Termination Date.

- If using this check box results in Part II entries for individuals not documented on the taxpayer's Form 1095-A, simply remove the unwanted individuals. To easily remove a row (individual), right-click on the Covered Individuals Name and in the menu that appears select Delete Line in Table. The row will be deleted.

- In Part III, Coverage Information (Household Information in tax year 2014), lines 21 through 32 enter the information in Columns A, B and C for each month of coverage as reported on the Form 1095-A received.

Resolving reject error F8962-070

Starting in tax year 2023, if the taxpayer, spouse, or dependents enrolled in the marketplace, even if they never activated their policy, the marketplace may have issued them a 1095-A. If the return is e-filed without the 1095-A the IRS will reject the return with error F8962-070, which reads as:

"The e-file database indicates that Form 8962 or a binary attachment with description containing 'ACA Explanation' must be present in the return."

To solve this reject, you'll want to attach a PDF - explaining why the 1095-A wasn't reported with the return, and in ProSeries Attach PDF Files window, under the Type column, select ACA Explanation.

If the taxpayer is unsure, have them contact HealthCare.gov to search for all the SSN's on the tax return.