You may see a lower section 179 deduction than you expected due to the Business Income Limitation. This is how it works:

- The total qualified section 179 cost that can be deducted is limited to your taxable income from the active conduct of a trade or business during the year. This business income limitation is calculated on Form 4562, line 11.

- If the business income isn't large enough for the full section 179 expense amount to be deducted, a section 179 carryover is calculated on line 13.

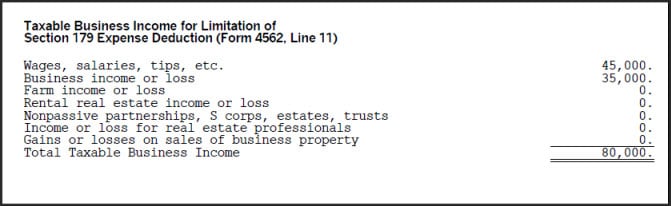

- A worksheet will generate for Form 4562, line 11, that shows the different types of income from the active conduct of a trade or business and their respective amounts.

![]() Refer to the Instructions for Form 4562 for more information about the business income limitation.

Refer to the Instructions for Form 4562 for more information about the business income limitation.