![]() Starting in tax year 2022 the IRS has redesigned the 1040 line 1. Instead of a single line 1 there is now 1a through 1i showing the breakdown of earned income from various sources. This will not change your data entry or calculations but it will change how amounts are displayed on the 1040. See the 1040 instructions for more information.

Starting in tax year 2022 the IRS has redesigned the 1040 line 1. Instead of a single line 1 there is now 1a through 1i showing the breakdown of earned income from various sources. This will not change your data entry or calculations but it will change how amounts are displayed on the 1040. See the 1040 instructions for more information.

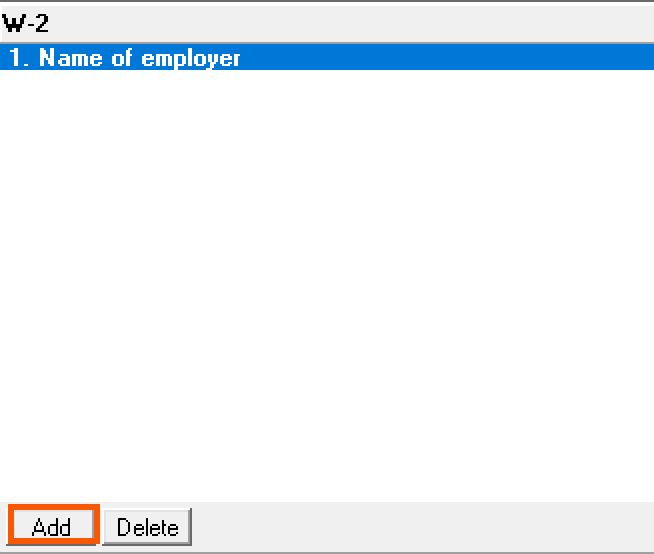

Follow these steps to enter Form W-2 information:

- Go to Screen 10, Wages, Salaries, Tips.

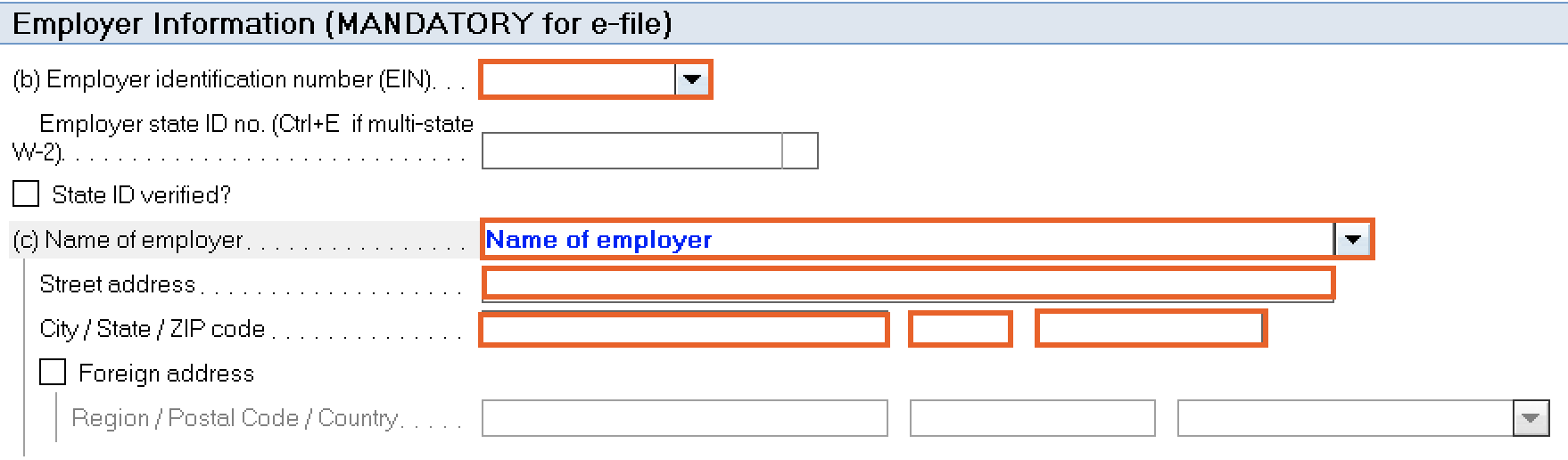

- Scroll down to the Employer Information (MANDATORY for e-file) section.

- Enter and complete any applicable fields with information about the employer:

- (b) Employer identification umber (EIN)

- (c) Name of employer

- Street address

- City / State / ZIP code

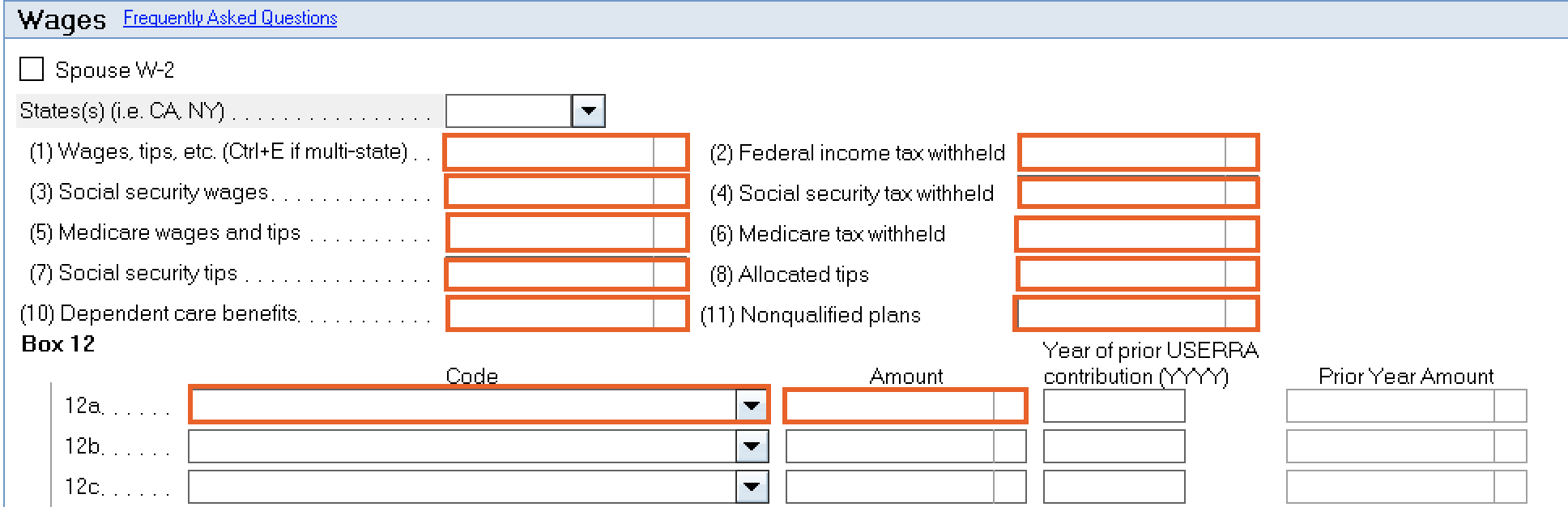

- Scroll down to the Wages section.

- Enter the information reported on the W-2.

- The numbers next to each field correspond with the Form W-2 boxes.

- You can also use the Grid to report the wages, federal withholding, Social Security wages, Social Security withholding, Medicare wages, Medicare withholding, and state withholding.

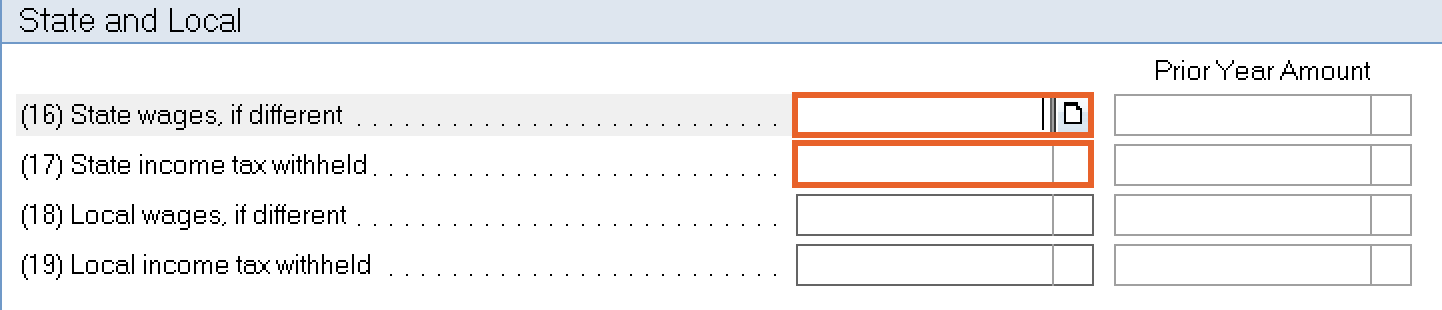

- Scroll down to the State and Local section.

- Enter the (17) State income tax withheld.

- When working with a multi-state return, only enter amounts in (16) State wages, if different when the total for state wages is different than the federal amount. Otherwise, enter the combined state wages in box one with the state indicators next to each item. The total will be reported on the federal 1040. Refer to this article for more information.

- Click Add from the left navigation panel to add additional W-2s.