Common questions for Form 1116 in ProSeries

by Intuit•2• Updated 10 months ago

Get answers to frequently asked questions about Form 1116 in ProSeries

Generating the Schedule B for Form 1116 in ProSeries starting in 2021:

- For tax year 2023 you no longer need to attach the 1116 as a PDF attachment.

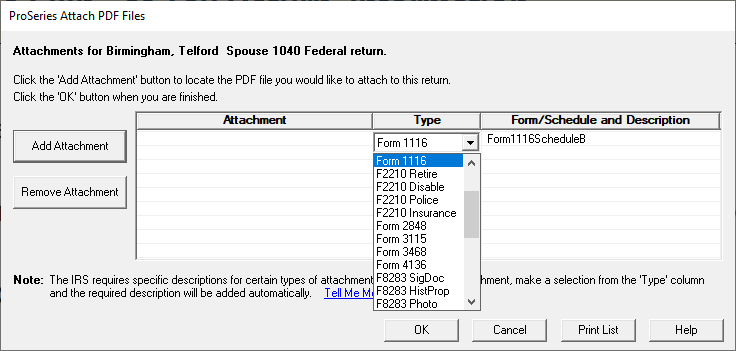

- For tax year 2022 and prior: This form isn't supported in the e-file schema for electronically filed returns and must be manually attached as a PDF attachment. See How do I attach PDF files to federal or state electronic filing for details. When you add the PDF attachment, make sure the Type is set to Form 1116 to prevent the e-file reject code F1116-004-02 (/efile:Return/efile:ReturnData/efile:IRS1116/efile:ForeignTaxCrCarrybackOrOverAmt).

- The Schedule B for Form 1116 will generate automatically when required.

- Starting in tax year 2021, the IRS released a new Schedule B for Form 1116 to reconcile your prior year foreign tax carryover with your current year foreign tax carryover.

To open the Schedule B for Form 1116:

- Press F6 to bring up Open Forms.

- Type 1116 to highlight the Form 1116.

- Select Sch B Form 1116 on the line below and click OK.

- Select the copy of the 1116 you need to review and select Finish.

Foreign Tax Credit Carryovers

- If there are any Foreign Tax Credit carryovers on the return, you'll see them on the Form 1116 - Foreign Tax Credit Comp Wks on page 4.

- Any carryovers eligible for carryover to next year will automatically be calculated in the Foreign Tax Credit Carryovers to next tax year section.

- If your entering a new tax return that has carryovers from the prior year:

- Open Form 1116.

- QuickZoom to Foreign Tax Credit Worksheet for data entry at the top of the form.

- Fill out page 1 to show what types of income the 1116 is for.

- Scroll down to Page 4 - Foreign Tax Credit Carryovers.

- Enter the Foreign Taxes, Disallowed amount, Utilized amount and Carryover amount for each year that had a Foreign Tax Credit Carryover.

- Press F1 to review the tax help for further information.

You must sign in to vote.