Before you start:

- To e-file Forms 940 and 941, you must first complete Form 8633 to get your Electronic Filing Identification Number (EFIN) and ETIN/PIN.

- You must also complete Form 8655 for each client return you wish to e-file.

First, complete Form 8655 Reporting Agent Authorization

To participate in the IRS e-file program for federal employment taxes and to act as a reporting agent:

- Complete Form 8655 Reporting Agent Authorization for each client you wish to e-file.

- This will establish you as a reporting agent for your client.

- Complete Form 8633 Application to Participate in the IRS E-file Program.

- This will grant you an EFIN and ETIN.

- If you e-file tax returns, you still must complete this form for information returns.

If you haven't completed and submitted these forms to the IRS, they will reject your e-file submission.

For more information, see 940/941 Efile Reject: 5-digit PIN & 6-digit EFIN Combination is not Valid Signature.

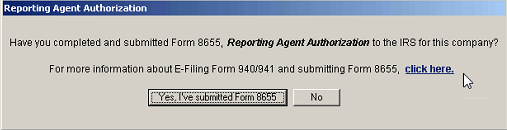

The program will ask you if you've completed Form 8655 for each client before creating the e--file for Forms 940 and 941.

![]() Don't change the Company EIN to match the Paid Preparer EIN. This will result in a rejection notification.

Don't change the Company EIN to match the Paid Preparer EIN. This will result in a rejection notification.