This article will help you with entering state apportionment for business returns in ProSeries. For business returns, states will determine the amount of income produced in the state based on an apportionment factor.

Select the state below for instructions:

California

California apportionment is calculated on the Schedule R.

Follow these steps to activate the Schedule R:

- Go to the California Information Worksheet.

- Check the Prepare Schedule R box found in the following section:

- Part II - Information Needed to Complete California Return (Corporate, Partnership)

- Part V - Miscellaneous (S-Corporate)

Selecting the apportionment method

Schedule R-1 which is on Schedule R, p3-4 is used to select the apportionment method.

Entering apportionment information

The apportionment information is entered in Part A of the Schedule R-1 for the Single Sales Factor Formula and Part B for the Three-Factor Formula.

New Jersey

Select what type of return you are working on below:

Corporation

- Open the client return.

- From the File menu, select Go to State/City.

- Select the New Jersey return.

- Press F6 bring up Open Forms.

- Type in "9" and press Enter to open Form CBT-100, page 9.

- Locate the Schedule J - Computation of Allocation Factor section.

- Enter any applicable information.

S-Corporation

- Open the client return.

- From the File menu, select Go to State/City.

- Select the New Jersey return.

- Press F6 to bring up Open Forms.

- Type in "8" and press Enter to open Form CBT-100S, page 8.

- Locate the Schedule J - Computation of Allocation Factor section.

- Enter any applicable information.

Partnership

- Open the client return.

- From the File menu, select Go to State/City.

- Select the New Jersey return.

- Press F6 to bring up Open Forms.

- Type in "J" and press Enter to open Schedule J - Computation of Allocation Factor.

- Enter the applicable information for Part 1 and Part 11.

- This information will flow to Form NJ-1065, Schedule J.

New York

Corporate

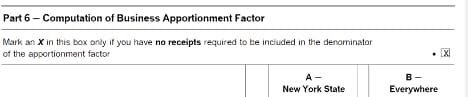

The business apportionment factor is calculated on CT-3 Part 6 - Computation of Business Apportionment Factor.

For each apportionment item, Enter in Column A the portion that is applicable to New York State and enter in Column B the Everywhere Total.

The business apportionment factor is then calculated on line 56.

This factor then flows to Part 3 to calculate the tax on business income base and Part 4 to calculate the tax on capital base.

S-Corporate

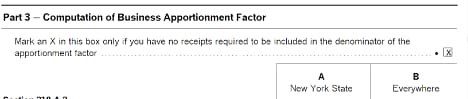

The business apportionment factor is calculated on CT-3-S Part 3 - Computation of Business Apportionment Factor.

For each apportionment item, Enter in Column A the portion that is applicable to New York State and enter in Column B the Everywhere Total.

The business apportionment factor is then calculated on line 56.

This factor flows to page 1 of the CT-3-S line C as well as to the Schedule K-1 for each shareholder.

Ohio

Select what type of return you are working on below:

S-Corporation

To enter the information for Form IT 1140, Pass-through Entity and Trust Withholding:

- Open the client return.

- From the File menu, select Go to State/City.

- Select the Ohio return.

- Press F6 to bring up Open Forms.

- Type in "403" and press Enter to open IT 1140, page 3.

- Locate Schedule 111 - Qualifying Pass-Through Entities Apportionment Worksheet.

- Enter any applicable information

To enter the information for Form IT 4708, Composite Tax Return for Certain Investors:

- Open the client return.

- From the File menu, select Go to State/City.

- Select the Ohio return.

- Press F6 to bring up Open Forms.

- Type in "p4" and press Enter to open Form IT 4708, page 4.

- Scroll down to Schedule IV - Apportionment Worksheet.

- Enter any applicable information.

Partnership

To enter the information for Form IT 1140, Pass-through Entity and Trust Withholding:

- Open the client return.

- From the File menu, select Go to State/City.

- Select the Ohio return.

- Press F6 to bring up Open Forms.

- Type in "403" and press Enter to open IT 1140, page 3.

- Locate Schedule 111 - Qualifying Pass-Through Entities Apportionment Worksheet.

- Enter any applicable information

To enter the information for Form IT 4708, Composite Tax Return for Certain Investors:

- Open the client return.

- From the File menu, select Go to State/City.

- Select the Ohio return.

- Press F6 to bring up Open Forms.

- Type in "p4" and press Enter to open Form IT 4708, page 4.

- Scroll down to Schedule IV - Apportionment Worksheet.

- Enter any applicable information.

Pennsylvania

Select what type of return you are working on below:

Corporation

- Open the client return.

- From the File menu, select Go to State/City.

- Select the Pennsylvania return.

- Press F6 to bring up Open Forms.

- Type in "12" and press Enter to open Form RCT-101, page 2.

- Scroll down to the Schedule C-1 Apportionment Smart Worksheet section.

- Mark the following applicable checkboxes to activate Form RCT-106:

- Single sales factor

- Special Apportionment

- 100% apportionment to Pennsylvania

- Click the QuickZoom button next to the next applicable checkbox(es) to complete Form RCT-106 for sales factor or special apportionment.

S-Corporate

- Open the client return.

- From the File menu, select Go to State/City.

- Select the Pennsylvania return.

- Press F6 to bring up Open Forms.

- Type in "H" and press Enter to open Schedule H.

- Mark the checkbox labeled Check this box to activate this form.

- Complete Schedule H using the sections for Property Factor, Payroll Factor, or Sales Factor.

Partnership

- Open the client return.

- From the File menu, select Go to State/City.

- Select the Pennsylvania return.

- Press F6 to bring up Open Forms.

- Type in "H" and press Enter to open Schedule H.

- Mark the checkbox labeled Check this box to activate this form.

- Complete Schedule H using the sections for Property Factor, Payroll Factor, or Sales Factor.