This article will help you create and file Form 1040-X, Amended U. S. Individual Tax Return in Intuit ProSeries.

Before you start:

- If you're recreating a 1040 filed by someone else:

- Start a new tax return for the client.

- Enter the tax return, as originally filed. Avoid using overrides as this can impact the calculation of the amended return. Then start with step 1 below.

- You can e-file amendments even if you didn't file the client's original 1040. See "Which amended returns can I e-file?" below for more details.

To complete Form 1040X:

- Open the client’s original return.

- Open the Federal Information Worksheet.

- Scroll down to the Electronic Filing section and remove all checkboxes for Federal and State e-file.

- This will ensure the copy does not show in the EF Center when filing the amended return.

- From the File menu, select Save as.

- Save the return using a different name. For example, SmithCopy.22I

- Go to Homebase.

- Open the originally filed return (not the copy you just created). Use the File name column to tell them apart.

- Press F6 to bring up Open Forms.

- Type X to highlight Form 1040-X in the list.

- Click OK.

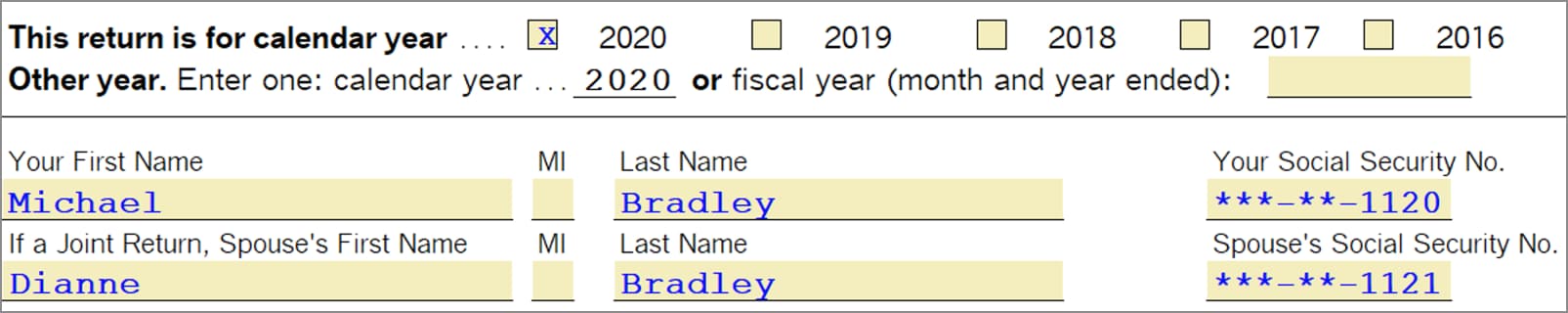

- Scroll down to the This return is for calendar year line.

- Check the box for the year you’re amending.

- Checking the current year box tells ProSeries to freeze the “Original amount” figures for column A at that moment. However, columns A-C won’t show any numbers until you enter changes on the return.

- Scroll down to Part III and enter an Explanation of Changes.

- Make the amended changes on the original form or worksheet.

- For example, if you’re amending to add another child to the return, go to the Federal Information Worksheet. Or, to report additional sole proprietor income, go to the Schedule C.

- After you enter your change(s) on the original forms, review the 1040X.

ProSeries will automatically complete the lines of the 1040X that are required based on the change you’re reporting.

To e-file the amended return:

- Open the Federal Information Worksheet.

- Click the QuickZoom button to jump to Part VII - E-file extend/amend.

- Check the box to File federal amended return electronically.

- If not already checked, mark the box for Check if original federal return was successfully e-filed.

- Manually check if the original return was accepted in a different data file, or if the original return was submitted by a different program or tax preparer.

- This option is not available in ProSeries 2019 or prior. See "Which amended returns can I e-file?" below.

- Run Final Review to check for errors or diagnostics.

- Save the return, and go to the EF Center or EF Clients Homebase view.

- Highlight the client. Look in the Amended Return column to see which line is Marked for EF if you’re not sure which file to transmit.

- Their EF Status will show as Duplicate SSN, since the copy you created is also listed here.

- Go to the E-file menu and select Electronic Filing.

- Click on Convert/Transmit Returns and Extensions…

- You’ll see a warning that another taxpayer with the same SSN is present. Click Yes to continue with transmitting the return.

- Convert and transmit the client's amended individual return.

Make sure to check for e-file acknowledgements after e-filing.

To paper file the amended return:

If your client doesn’t meet the conditions for e-filing, you can still file a paper return. You may also need to paper file if you’re unable to resolve an e-file rejection for the 1040X.

- Scroll down to Part VI of the Federal Information Worksheet and remove any checkboxes for electronic filing.

- Run Final Review.

- Print the return(s). Have your client sign and mail them to the address shown on the Filing Address Smart Worksheet at the bottom of the 1040X in ProSeries.