Prepare, finish, and file tax returns quickly and confidently with easy-to-use software, so you can deliver more for your clients like you never have before

ProSeries Tax—the smarter, easier way to file tax returns

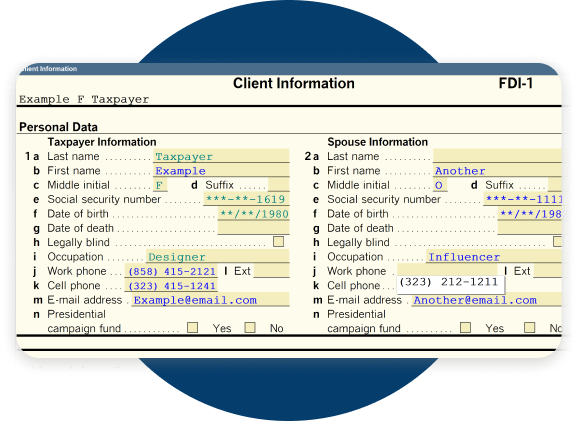

Quick entry sheets

Enter data faster with less scrolling on many forms, such as Schedule D and Schedule K-1. Easily toggle between quick entry mode and form entry mode by typing Ctrl + M.

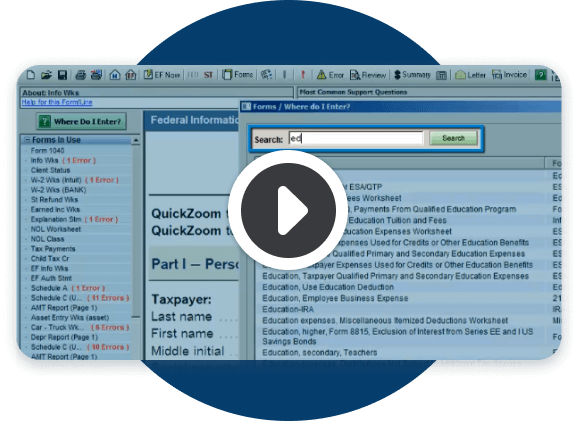

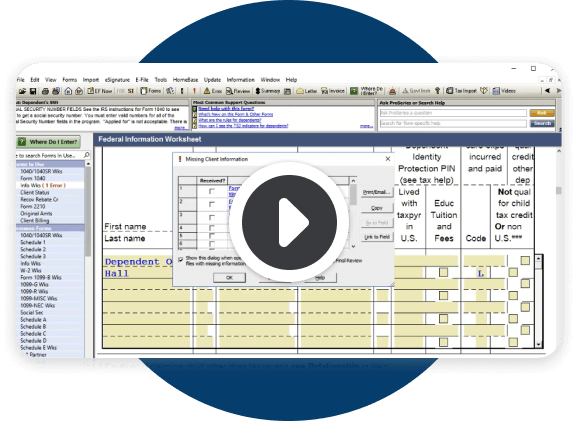

Where do I enter

Not sure where to enter certain data in a return? Use this tool for federal 1040, 1065, 1120, and 1120S products to find the right form and field. You can also search by keywords.

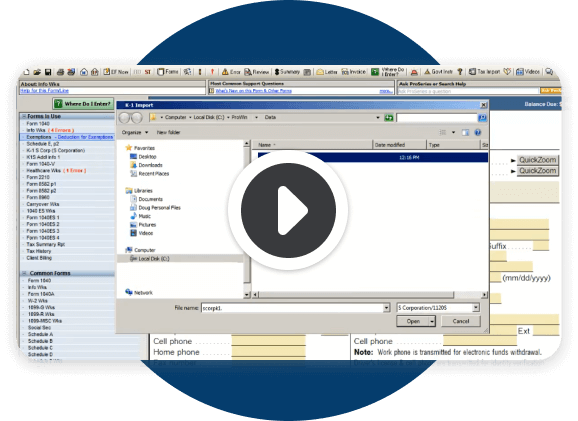

K-1 data import

Automatically transfer data to individual returns.

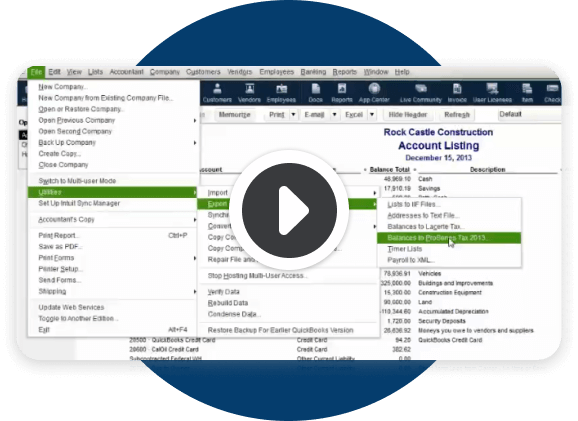

Importing from QuickBooks and TXF files

Import financial data directly to ProSeries from key resources, including QuickBooks and TXF (Tax Exchange Format) files.

More features and tools to save you time

Downloading data from financial institutions

Download your clients’ 1099-B, 1099-INT, and 1099-DIV data directly from participating financial institutions via a website that’s easy for you and your clients to use. It’s fully integrated and included with ProSeries.

SOLD SEPARATELY

Importing from fixed asset manager

Import assets into various activities in ProSeries, such as Schedule C and Schedule E, directly from ProSeries Fixed Asset Manager.

PROFESSIONAL ONLY, SOLD SEPARATELY

Client integration with SmartVault

SmartVault integrates seamlessly with ProSeries to provide a secure and reliable document management system with an integrated client portal. Clients in ProSeries can be imported to SmartVault and returns printed from ProSeries directly to the correct folder in SmartVault, where they are immediately available to the client.

PROFESSIONAL ONLY

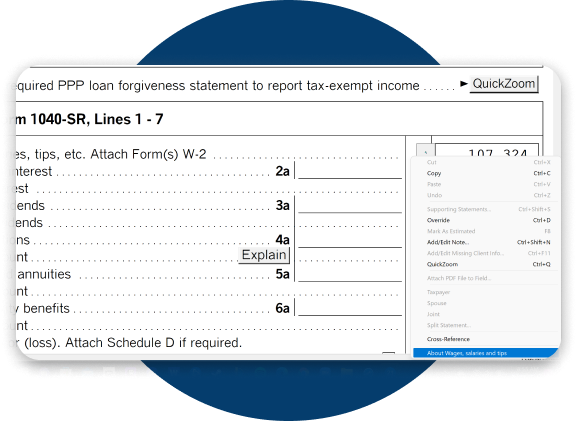

"Forms" bar

Use this feature to guide your tax return input, locate errors, and fix them fast. This powerful feature can help you be more efficient in locating tax forms and entering data.

BASIC ONLY

Tax return input guidance

Guidance in three places:

- Left-side navigation categories of input

- Checklist to easily select types of input based on client's situation

- Tabs for forms that require input/output

PROFESSIONAL ONLY

Splitting married filing joint returns

Use this feature to split a married filing jointly individual return into two married filing separately returns for the taxpayer and the spouse. You won’t have to calculate anything by hand, prepare multiple returns, or change the original return.

Client checklist

Create a list of items needed for this year's return, based on last year's return. Also, an encrypted version of the list can be emailed.

Missing client data

Flag missing data as you work on a client’s return and send them an email, requesting all the information you flagged in an instant.

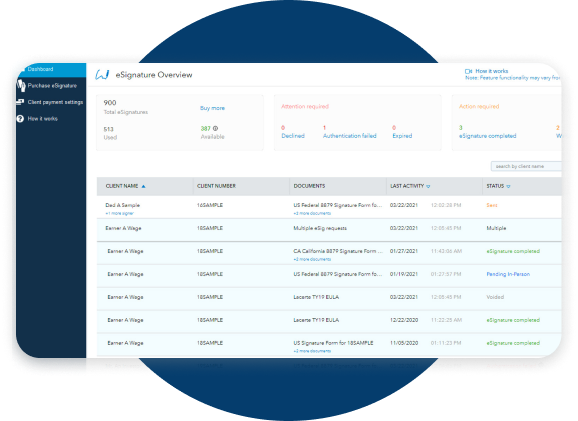

eSignature*

Streamline your signing workflow and let clients sign important documents digitally from anywhere, at any time, on any device with an Internet connection.*

More features and tools to save you time

PROFESSIONAL ONLY

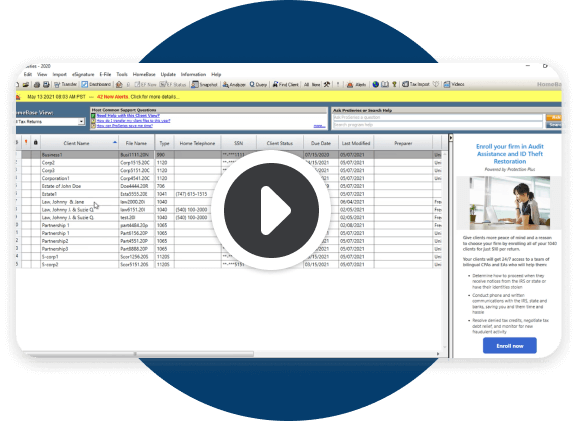

Client analyzer

Get a better understanding of your client base by breaking down groups of clients by return type, which you can also print or export to a spreadsheet.

Tax planner

Tap into advisory tools like the client analyzer to identify opportunities and create custom tax plans for clients, from pro forma estimates to projections.

PROFESSIONAL ONLY

Client presentation

Show a client their bottom line, income and deductions, and comparisons to prior years with easy-to-understand and appealing visuals. You can also generate a list of up to 73 tax planning suggestions on how that client can help reduce their future taxes.

Intuit Link client portal*

Manage client data in a free, secure, online portal that allows you and your clients to easily exchange information.

Client status

Review and keep track of the progress and status of a client return. You can use this worksheet as a planning tool, as a status report, or as a checklist for events completed.

NEXT

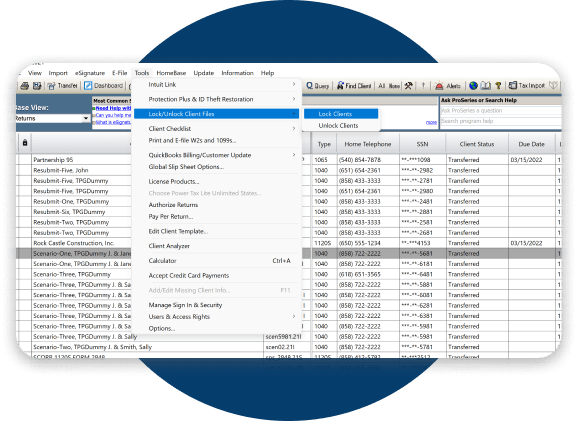

E-file locked returns

File confidently with the ability to lock returns so calculations don’t change. If you lock the return and ProSeries detects calculation updates, you’ll get a notification so you have the control to decide when to make any changes and when to e-file.

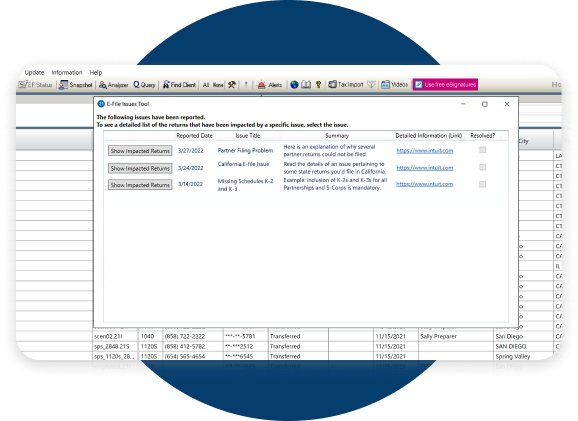

Tax accuracy notifications

Reduce the stress and hassle of finding returns that were affected by tax law or other changes after you filed them. You’ll receive proactive notifications of these events, which of your clients were impacted, and what you need to do.

PDF attachments for e-filed returns

Automatically attach forms that are required to be part of the electronic return as a PDF.

More features and tools to save you time

E-file status

Stay on top of e-file status with ProSeries automatically checking for acknowledgements of what’s complete or outstanding.

Multi-year e-filing

E-file returns for the current year and two years back, for all federal and state returns that are supported for electronic filing.

PROFESSIONAL ONLY

Password-protected PDFs by email

Email password-protected client returns directly from within ProSeries.

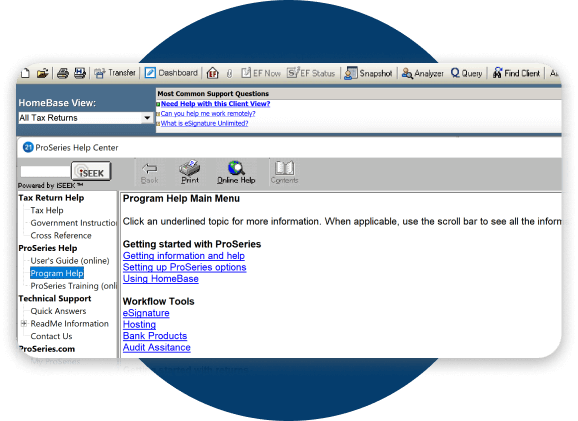

Constant on-screen help

Get the help you need fast via the Ask ProSeries or Search Help field. Or use the F1 key and your cursor when working on a form.

Line-sensitive help

Can’t remember where the entered data on forms came from? Use this tool to trace the source of the data and to understand what information to include in a particular field.

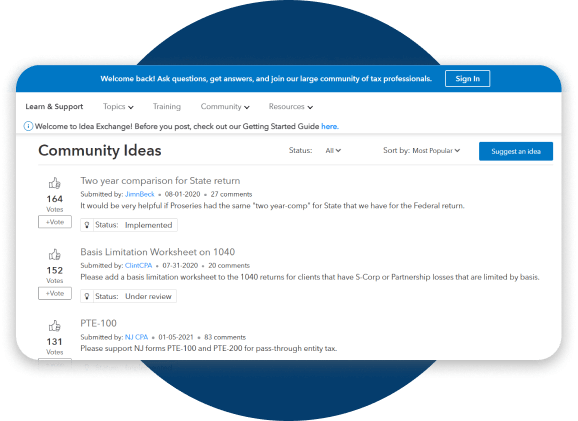

Tax idea exchange

Share your ideas with us and get updates on their status—under review, accepted or implemented.

NEXT

Hosting for ProSeries*

Access ProSeries anytime, anywhere, on any device with Hosting. Move your workflow to the cloud for built-in security, easy access, backups, and less IT stress.*

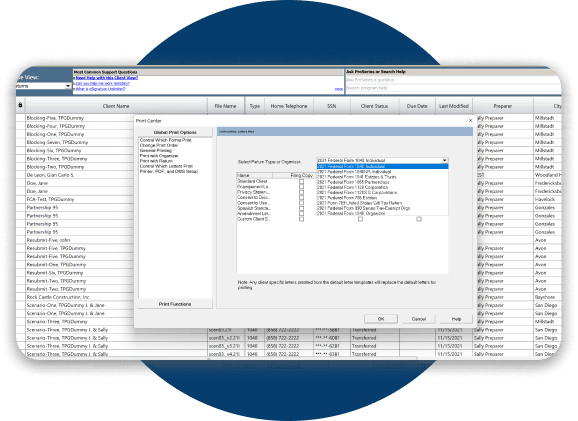

Multiple client letters

Choose from 18 standard client letters, including a standard engagement letter, amendment letter, Spanish client letter, and privacy statement for 1040 clients. For business clients, access the standard client letter plus a standard engagement letter and a privacy statement.

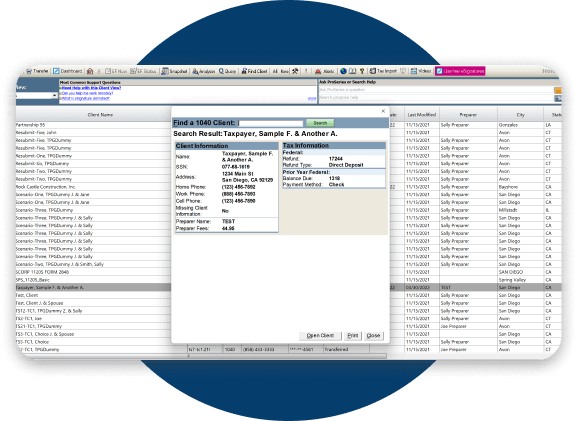

Client snapshot

Quickly access and review summary information on the client return.

More features and tools to save you time

Undo/Redo

Quickly undo data entry mistakes and more easily run scenarios for your clients with the Undo/Redo feature. Simply click to undo previously entered data, and then have the option to revert back again using the redo function.

Background updater

ProSeries automatically downloads, verifies, and installs updates whenever they’re available, so you can keep on working with the confidence that your software is running at its best.

Download next year’s product

Use this year's ProSeries to automatically download next year's version.

Find out morePROFESSIONAL ONLY

Client-specific billing options

Set up client-specific billing options using different billing methods (flat fees, hourly fees, or charges per form). It also includes a billing clock and editable invoice.

Advanced diagnostics

Rely on 1,000+ straightforward diagnostics to instantly pinpoint errors and show you where to fix them with a click.

Elevate to ProConnect Tax.

It’s in the cloud and anything but Basic.