Easily track your clients’ fixed assets throughout the year and calculate their depreciation automatically in both client and tax files.

Fixed Asset Manager

Available for Intuit ProSeries Tax professional only or as a stand-alone software. Included in PowerTax Library and PowerTax Lite.

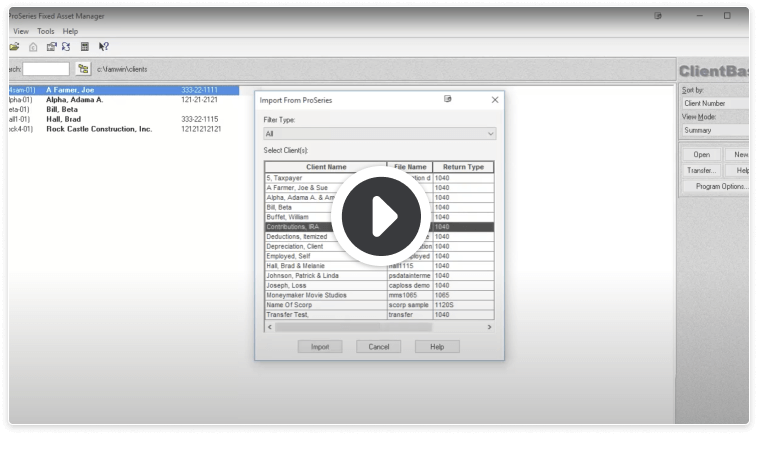

How to import and export assets

Fixed Asset Manager includes:

- Unlimited asset tracking and automatic depreciation calculation. Updates include increased section 179 expense deduction limit, adjusted luxury vehicle and truck limitations, updated tax worksheets, and other depreciation changes to support tax reform

- Separate values for book and tax depreciation

- Ability to track asset purchases and sales throughout the year

- Different Modified Accelerated Cost Recovery System (MACRS) depreciation methods

- Reporting for client property tax return

- Easy-to-understand depreciation schedule (including categories) along with tax returns

- Toll-free, U.S.-based technical support

- Service and delivery

- Asset splitting into two or more new assets

- Printing monthly depreciation reports

- Information changes to multiple assets at one time

- Transfer of asset data to any ProSeries federal tax program

- Automatic creation of clients in Fixed asset manager, imported from ProSeries

- Asset grouping by common categories you define

- Depreciation calculation on up to six different asset bases: book, federal, state, Alternative Minimum Tax (AMT), Adjusted Current Earnings (ACE) and custom

- Creating your own reports with Report Wizard

- Over 35 predefined reports, including General Ledger (G/L) reconciliation, personal property projection and several depreciation reports

- Client template setup, so you only enter common general ledger account numbers and categories once

- Printing tax worksheets for Forms 4562, 4626 and 4797

- Section 179 expense tests and mid-quarter determinations and calculations

- Automatic calculation of tax preference amounts, prior-year depreciation, and gains and losses on asset sales

- Project depreciation through the life of an asset

- Copying assets from within a company or from one company to another

- Interim depreciation calculation

- Calculations and limitation of all listed property and luxury auto

- Built-in safeguards to validate entries and ensure their accuracy

- Data entry screen customization to remove unused fields

Additional professional tax software integrations

Extend the functionality of your professional tax preparation software with these time-saving tools.

Intuit Tax Advisor

Included with:

ProConnect Lacerte

The only integrated tax advisory tool where you can access a library of tax strategies to build custom tax plans in minutes, not hours.

Hosting

Available for:

Lacerte ProSeries

Work-from-anywhere capabilities mirror your desktop setup for a seamless integrated workflow. Plus, attract top talent with remote access.

eSignature

Available for:

ProConnect Lacerte ProSeries

Digital signing solution where you can manage signatures right within your tax software, and clients can sign whenever and wherever they want.