UPGRADE YOUR TAX FIRM TO OUR GOLD STANDARD

Powerful tools to supercharge your firm

Here are some key resources to help you see that Lacerte's the perfect fit for your practice.

Easy Start onboarding

Get up and running fast with our Easy Start onboarding program that sets you up for success. Get assigned a dedicated program manager. Receive a success guide, with timely instructions to help ensure you’re completely set up with installation, EFIN verification, and more.

Get more information

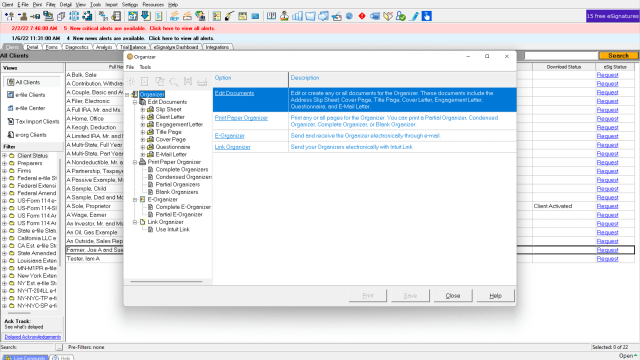

Automated data conversion

Receive quick, accurate, and hassle-free conversion of existing client files into your Lacerte software, fully guided by an Easy Start coach.

Learn how to import dataPersonalized training

Learn what’s relevant to your firm, and earn CPE/CE credits with free, live webinars and training sessions. Plus, stay informed all year long with our informative Tax Pro Center.

Discover all training resourcesStrong customer support

Get answers to your questions from U.S.-based agents, and take advantage of our tax professional community that’s accessible 24/7.

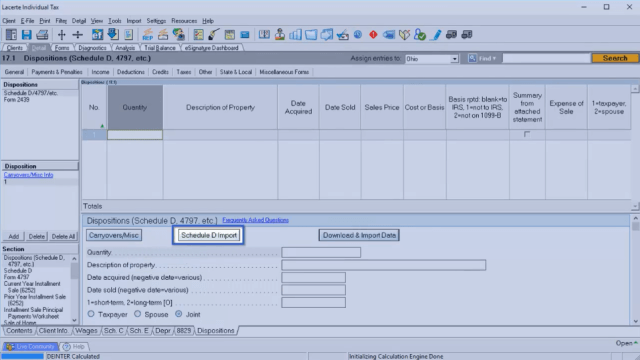

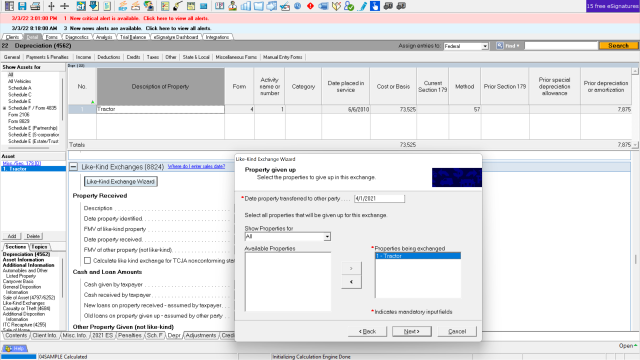

Visit online communityExtensive tax forms availability

With Lacerte, you can access more than 5,700 state and federal forms that span a wide variety of individual client or business tax scenarios.

View available formsCloud convenience and security

Connect your Lacerte software to the cloud and receive best-in-class security, reduced IT hassle, multi-user access, and top-tier reliability.

Explore HostingYou’re unique, and we know there's no "one-size-fits-all"

Customize Lacerte with integrated tools that help you make a bigger impact on your clients' success.

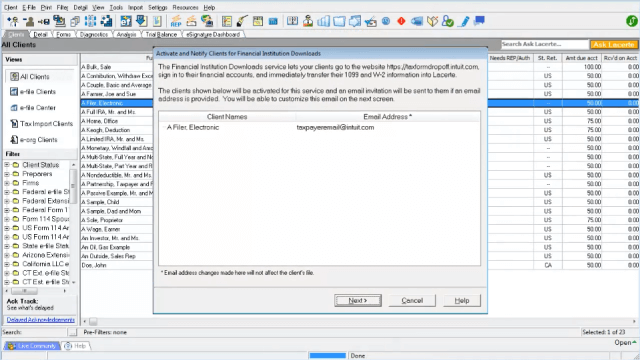

eSignature Plus Payments

Get documents signed securely in a matter of hours, not days. eSignature is fully compliant with IRS requirements and fully integrates with your tax workflow for quick and easy use. Plus, track the statuses of all requested signatures in a single dashboard.*

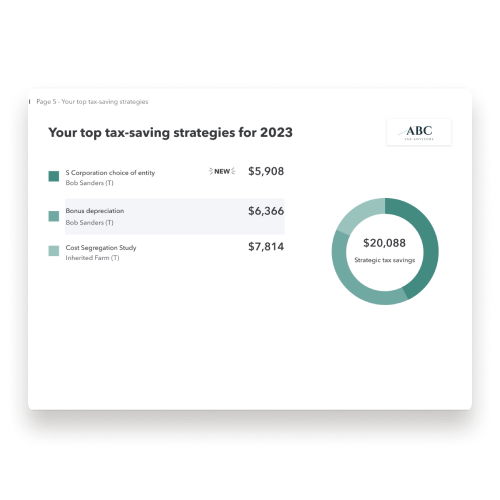

Intuit Tax Advisor

Now you can generate custom tax-savings plans for your clients in minutes using data automatically mined from a Lacerte tax return.*

Protection Plus

Give your clients peace of mind all year long with an added layer of protection. Have a team of CPAs and EAs on your side in case your clients receive a notice, are audited, or are victims of identity theft.*

Still need help finding your right plan?

Your questions are important to us, and we’re here to help you.

Check out our most frequently asked questions to get your questions answered.

If you still can’t find what you’re looking for, we’re only one call away.

© 2024 Intuit Inc. All rights reserved. Intuit, the Intuit logo, ProConnect, and Lacerte, among others, are trademarks or service marks of Intuit Inc. in the United States and other countries. Other parties' trademarks or service marks are the property of their respective owners and should be treated as such. Terms and conditions, features, support, pricing, and service options subject to change without notice.