INTEGRATED REFUND TRANSFERS

Simplify refund and payment options

Simplify your payment processes with no upfront fees. Plus, get convenient payment and refund transfer options for your clients.

INTEGRATED REFUND TRANSFERS

Simplify your payment processes with no upfront fees. Plus, get convenient payment and refund transfer options for your clients.

Want to speak to a specialist? Call us at 800-926-3796.

MOST EFFICIENT

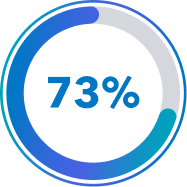

73% of taxpayers expect their tax professional to provide them with the best option to get their refund back the quickest.*

Pay-by-Refund helps pros collect tax prep fees easily and clients receive quicker refunds.

Pay-by-Refund is available through these participating banks to bring you more choices to work for your clients and your firm.

PLUS–CASH ADVANCE

If eligible and approved, both banks offer cash advance loans. Refund Advantage offers cash advance loans of up to $1,000 per taxpayer and up to $2,000 per taxpayer for Santa Barbara Tax Products Group (TPG).*

Not sure which bank is right for you?

Your clients pay your tax prep fee directly from their refund. So they won't have to worry about coming back to pay you later.

Tax year 2023 enrollment now open!

You can choose to enroll for Pay-by-Refund at your convenience, either through your My Account login or within your software (ProSeries, Lacerte, or ProConnect).

Enrollment for Refund Advantage and Santa Barbara Tax Products Group are now open for tax year 2023.

You might be surprised by how many of your clients are interested.

Now your clients can have the convenience of Pay-by-Refund, coupled with strong identity-theft protection and restoration—all designed to bring more peace of mind.

Once your clients opt for Pay-by-Refund, they'll automatically be enrolled for these comprehensive services by IDnotify, a part of Experian: