Unleash the power of Intuit Lacerte Tax with enhanced features and new tax preparation capabilities.

Get the most out of tax season with tax software built to keep you going strong.

Background Updater NEW

SafeSend Integration

Intuit Tax Advisor

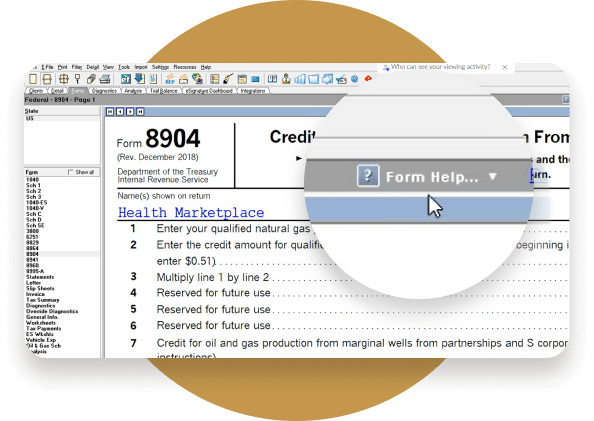

Forms help

Get more information about a specific tax form or calculation directly from that form or tax line in Lacerte. Press Forms Help at the top of a form or after right-clicking a calculated field to open a Community article and get answers to your questions while you work, without leaving the return.

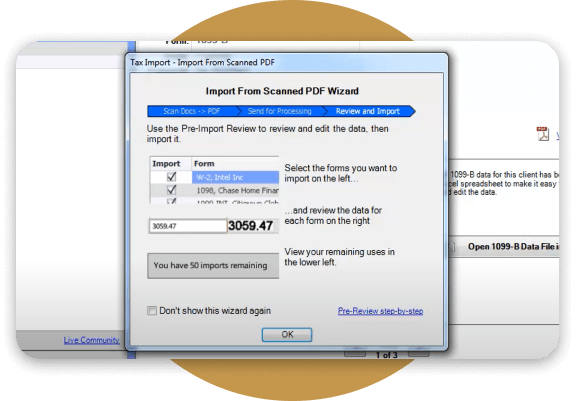

Tax scan and import ($)

Quickly and reliably import data into your return with just a few clicks. The form reviewer tool allows you to check and edit data before importing.

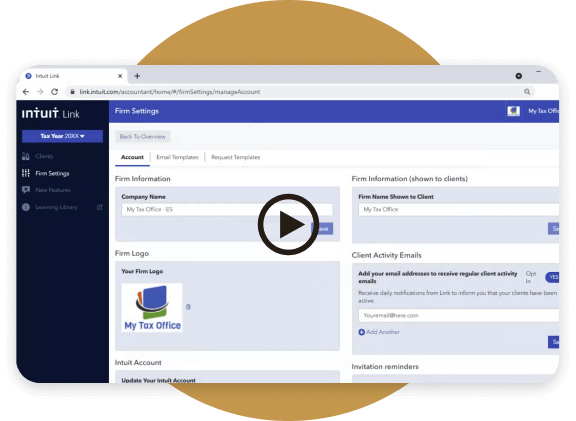

Intuit Link (Updated)

Gather client tax documents securely, cut down on data entry with smart integrations, and make the whole process much simpler for your clients.

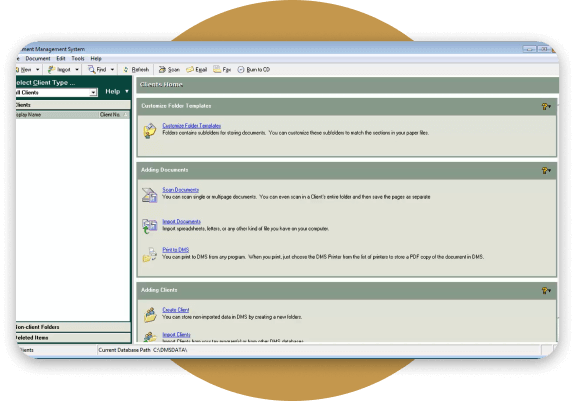

Document management

Choose between SmartVault® or Document Management System (DMS) to go paperless and easily store and share almost any type of document.

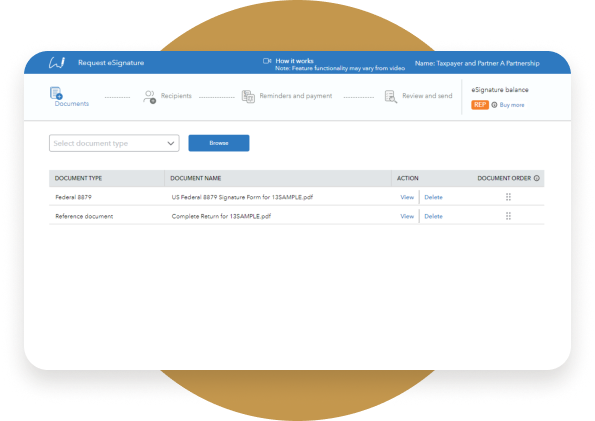

eSignature (5 folders included*)

Request signatures with quick clicks, and track the status of them all on one simple dashboard. Get any form or document signed securely, and give your clients the convenience they expect.

Don’t stress yourself out. Gear up for tax season with My Account.

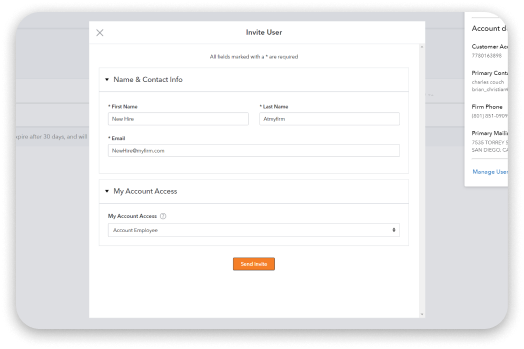

As you prepare for another successful tax season, we wanted to remind you of all the ways that My Account can help you be even more efficient. You can:

- Verify that your account information is correct.

- Manage your EFIN or get one if you don’t have one yet.

- Add or change users or their permissions.

- Add integrations to boost your productivity, like Hosting for Lacerte, Intuit eSignature, or Pay-by-Refund.*

- Access your personalized training portal.

- Manage your payment options.

*Auto-renewed orders are processed at the discounted rate during the time of enrollment.

IMPORTANT UPDATE

Be proactive. Get your computer setup correctly for a smooth installation.

Spend less time waiting to access your new software, and download Lacerte 2023 within minutes. Plus, get all the information you need about Lacerte's system requirements to get ready early.

Latest news: Microsoft has ended support for Windows 8.1, so the Lacerte 2023 software will no longer support this version of Windows. Your security is our highest priority, so we encourage you to upgrade to Windows 10 or higher.

Elevate your firm with integrated tools to maximize productivity.

Access the power of Hosting for Lacerte*

Use the software you love, now online with enterprise-level security, automated backups and updates, and fully remote capabilities. Work from anywhere, at any time, on any device, so you can hire top talent no matter where they are, and keep growing your firm.

- Expedite the installation process and eliminate the need to download and install using traditional methods.

- Get an improved onboarding experience to get your firm up and running in just days.

- Plus, EasyACCT is now supported in the hosting environment.

New Move your firm to advisory with Intuit Tax Advisor

(Get started free with 3 credits)*

Sync your clients’ returns with Intuit Tax Advisor to build custom tax-savings plans in minutes.

- See it all in one place to enhance your tax practice with a proactive planning tool.

- Select from over 25 strategies that will help you make a bigger difference in your clients’ lives.

- Generate and share easy-to-understand reports to keep everyone on the same page.

Get the improved eSignature experience

(Get started with 5 free folders)*

Request signatures with quick clicks and track their status on one simple dashboard.

- Collect eSignatures on any form or document.

- Enhance security with identity authentications options.

- Track client progress with eight eSignature statuses.

Protect your clients with firm-level Protection Plus

Demonstrate that your services go beyond typical tax return preparation, and defend your clients from tax notices, audits, and identity theft with Protection Plus.

- Receive access to a bilingual team of expert CPA and EA case resolution specialists.

- Get 24/7 access to identity theft restoration advocates who’ll help your clients restore stolen identities and remediate refund fraudulent claims.

Discover the convenience of Pay-by-Refund

Give your clients a simple way to pay for your tax preparation without worrying about any upfront, out-of-pocket costs.

- Sign up easily right from your Lacerte software or My Account.

- Get flexible disbursement options by choosing between two participating bank partners.

- Help ease client’s minds with automatic enrollment in identity-theft protection and restoration services.*

Get in touch. Our team is always here to help provide one-on-one and self-serve assistance.

Intelligent voice assistant

Get what you need faster with this tool that directs you to self-serve solutions so you don't have to stay on hold to talk to an agent.

Tool hub application

Quickly resolve common system issues and errors, so you can get back to serving your clients with this tool.

Get support on your schedule

Request a support appointment or have the support team call you back at a time that’s most convenient for you.

Training: Keeping you up to date

Live and pre-recorded webinars

Attend live and watch pre-recorded webinars on topics that matter most to you, at times that work best with your schedule. More than 30,000 pros signed up for webinars last year, and new sessions, like tax law, ethics, and product courses are continually added.

Personalized training portal

Access bite-sized training modules with content that’s recommended just for you.