Deliver confidence in every return with built-in powerful, comprehensive tools to help you tackle even the most complex returns for your clients.

Give your clients the best financial outcome with Lacerte Tax

NEW

Intuit Tax Advisor*

Intuit Tax Advisor*

Tax preparation and advisory tools come together at last. Easily build custom tax plans for your clients and show savings in minutes, with data automatically mined from your Lacerte software.

- Personalized tax strategies are generated with less work for you

- Show estimated tax savings by strategy

- Client-friendly reports can be customized with your firm logo and colors

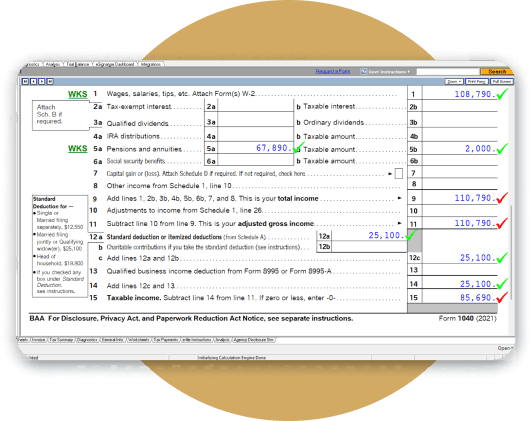

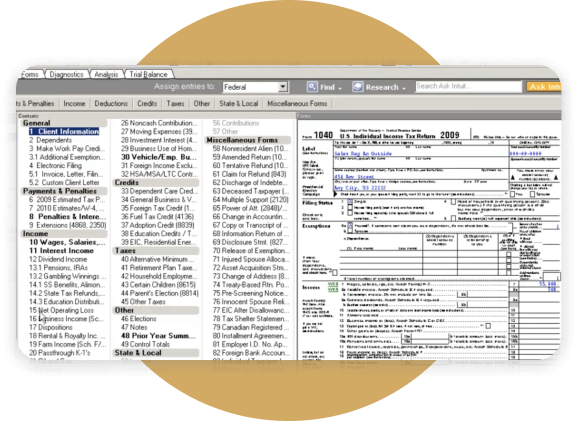

Audit checkmarks

Fix auto-detected errors to reduce rejections and maximize refunds for every return. Green check marks mean everything’s fine. Red check marks indicate that there are issues that need your attention.

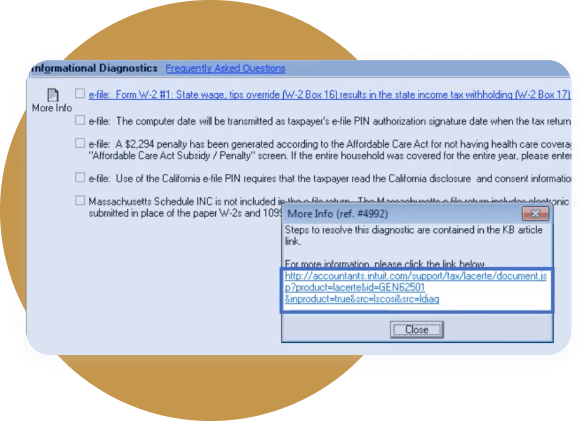

Calculations and diagnostics

Prepare accurate returns fast with comprehensive form sets and deep, automated calculations, and discover mistakes and omissions with more than 25,000 extensive diagnostics.

Reliable multi-user performance

Your staff can work at the same time without slowing down your performance with networking capabilities that help the software perform at consistently high bases, whether you're running on a single PC or over a multi-user network.

More features and tools to save you time

SOLD SEPARATELY

Hosting for Lacerte*

Access Lacerte anytime, anywhere, on any device with Hosting. Move your workflow to the cloud for built-in security, easy access, automatic backups, and less IT stress.*

Financial transaction summary

Get back valuable time with a new summary view that shows what you need from return timestamps to payment amounts and refunds. Share printable worksheets with clients easily.

FREE WITH UNLIMITED

Tax analysis and planning tools

Gain insight into how your clients can reduce their future tax liability, how new tax laws will impact their financial health, and automatically red-flag amounts on the tax return that are more likely to trigger an IRS audit.

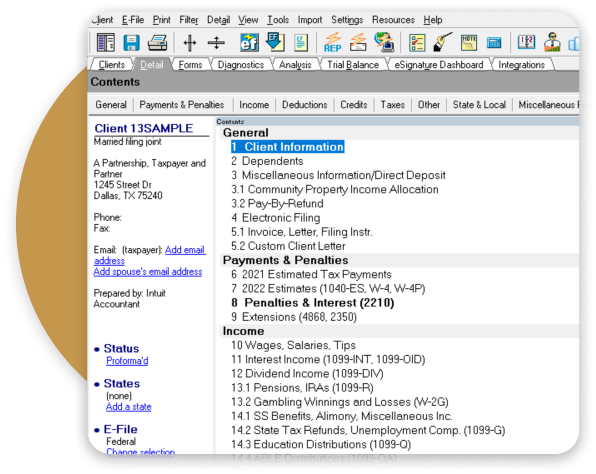

Unique interface

Lacerte helps you complete more returns with ease, designed with tabs that are logically set up to match the common tax workflow.

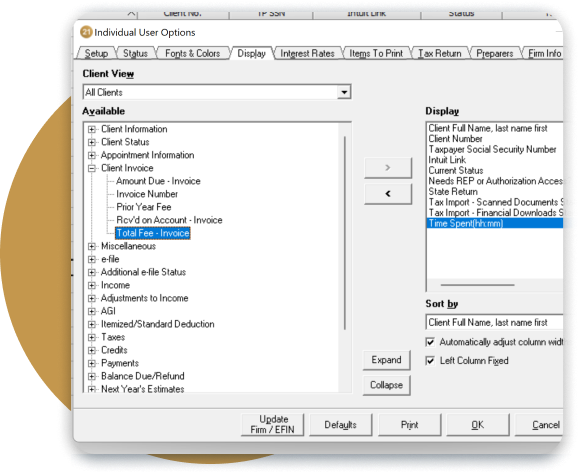

- All clients can be seen at once with customizable columns.

- Direct access to forms, diagnostics, print functions, and more reduces unnecessary clicks.

- Flat worksheet-based design enables fast heads-down data input.

Split-screen and dual monitor support

Enter data into input fields and see how it shows up on the form at the same time, instead of going back and forth. You can do this on the same monitor, or split the view across multiple monitors.

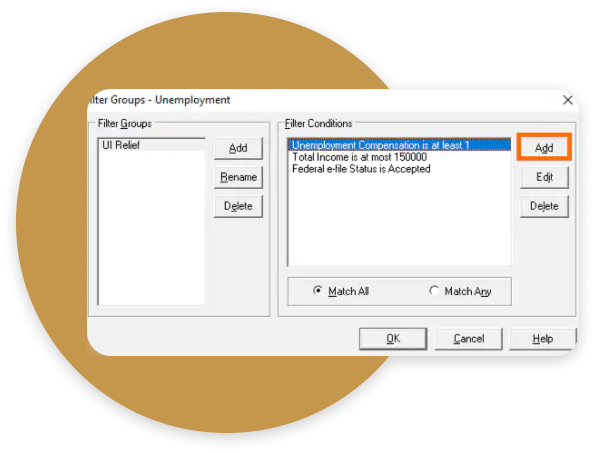

Client list filters

See your client list exactly how you want it with custom filters. You can use more than 500 pieces of information and create different combinations.

More features and tools to save you time

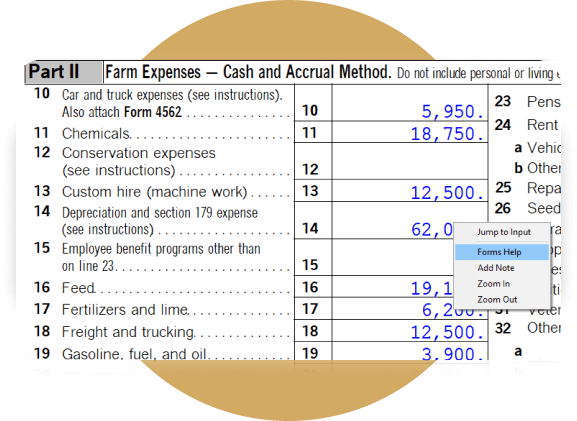

Jump to input

Can’t remember where the entered data on forms came from? Use Jump to input to see the sources and fields highlighted.

Partner search acceleration

Locate and update partner information quickly with the partner search feature, or when filling in and printing out K-1 packages.

Like-kind exchange wizard

Record 1031 exchange transactions in minutes. Plus, easily exchange several assets for one or one asset for another.

Missing client data utility

Flag missing data as you work on a client’s return and send them an email, requesting all the information you flagged in an instant.

Sections and Topics tabs to easily navigate complex forms

Find the right input quickly and accurately using the Sections and Topics tabs. Content categories are sorted into relevant, clickable groups so you can avoid the hassle of scrolling through long forms and reduce the risk of missing an input.

Client list column sorting

Sort data by simply clicking on any column header in the Client List. Similar to Excel, you get one-click convenience and maintain your preferred view.

Intuit Link client portal*

Manage client data in a free, secure, online portal that allows you and your clients to easily exchange information.

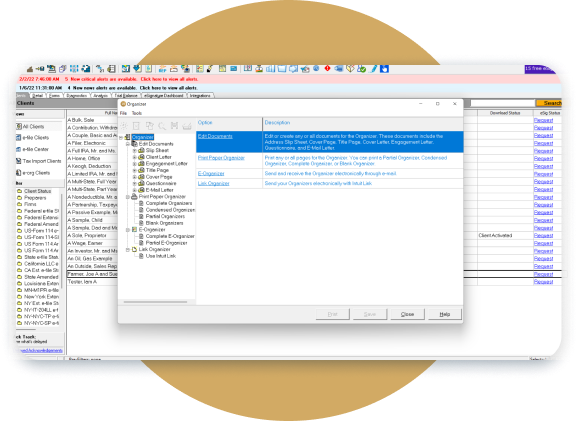

E-organizer

Have a new client? Collect the needed information with a customizable, paper-free, and password-protected file that boosts efficiency and security.

Built-in time tracking

Track the time spent working on a return automatically with a timer that starts and stops when you open and exit a file.

More features and tools to save you time

Proforma wizard

Transfer client files from the previous year to the current year automatically, without manual data entry and human error.

SOLD SEPARATELY

eSignature plus payments*

Attach an invoice with your signature request to get payment and signoff at the same time.

Automatic data conversion

Ready to switch? Import selected tax data from your current software for a hassle-free, smooth transition.

PDF bookmarks

This navigational tool allows you to quickly locate and link to points of interest within a PDF document. This is available whenever you print a PDF, regardless of where it's stored (e.g., DMS, SmartVault, your own hard drive, etc.).

Password protection for PDF files

Easily password-protect any client file when using Print to PDF and save it to your desktop or share it with a client, without leaving your workflow.

PDFs by email

Automatically attach forms that are required to be part of the electronic return as a PDF.

NEXT

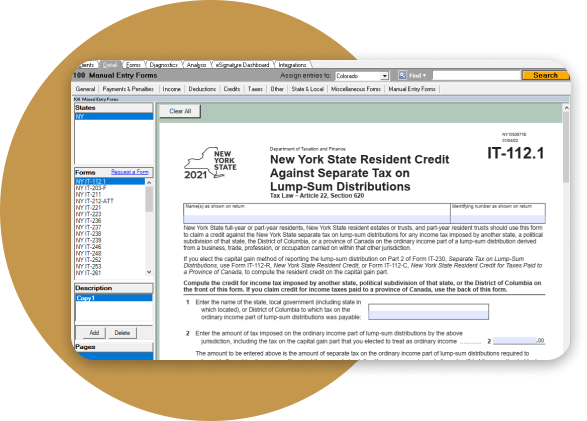

Manual entry forms

Complete editable PDF forms in Individual, Partnership, Corporation, S Corporation, and Fiduciary modules that aren't currently supported by Lacerte, and request additional ones you’ll need.

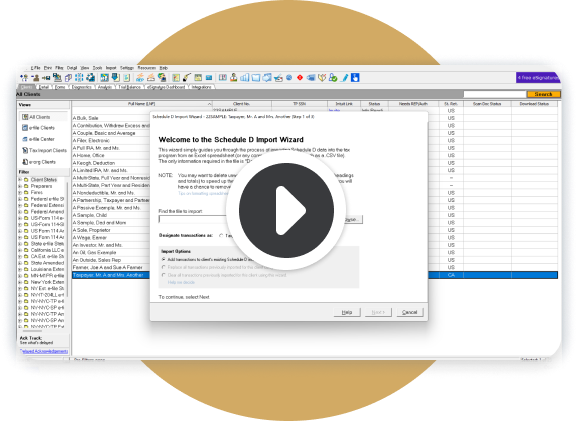

Schedule D import wizard

Import Schedule D information directly from an Excel spreadsheet or any comma-delimited text file to Lacerte for accurate filing.

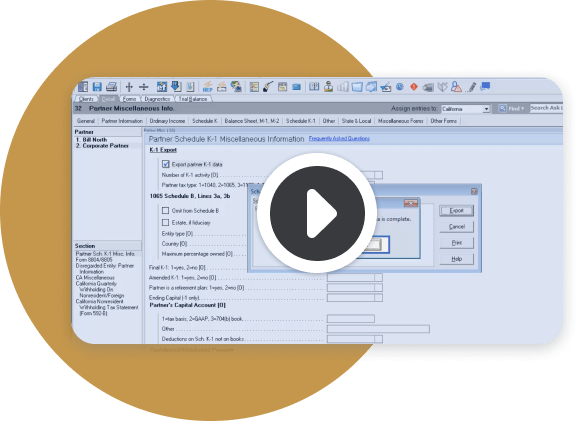

K-1 transfer utility

Automatically transfer partnership, S corp, and fiduciary tax data into individual returns or between business returns.

More features and tools to save you time

Family link

Connect a parent and their child’s returns automatically to calculate the correct tax rate for the child’s investment income and complete Form 8615.

Financial institution download

Save time for both you and your clients by downloading 1099 and W-2 information directly from your client’s preferred financial institution or payroll provider into a tax return. Get access to more than 275 supported partners.

Oil and gas data, and partner data management

Import oil and gas data, and partner data from Excel and update it in Lacerte in minutes instead of weeks in most cases.

Exclusive QuickBooks Accountant integration

Lacerte SmartMap reduces time-consuming prep work and data entry by importing your QuickBooks Accountant trial balance data directly into Lacerte.

Trial balance utility

Save time by doing your trial balance work in Lacerte. Develop a chart of accounts, adjust journal entries, and manage tax line assignments. Trial balance work stays with that client and carries over from year to year.

Fixed asset import tool

Import fixed assets from an Excel spreadsheet—great for new clients or existing clients with several asset purchases in a given year.

NEXT

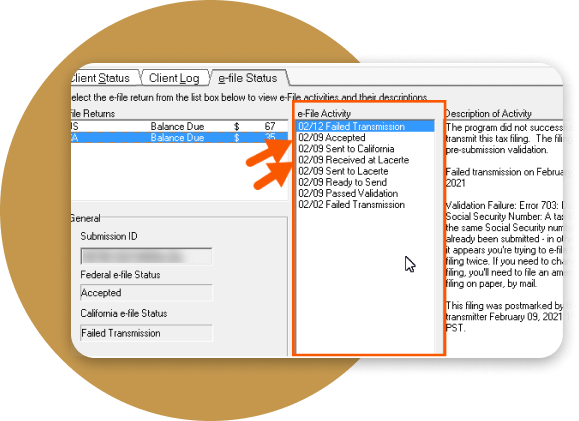

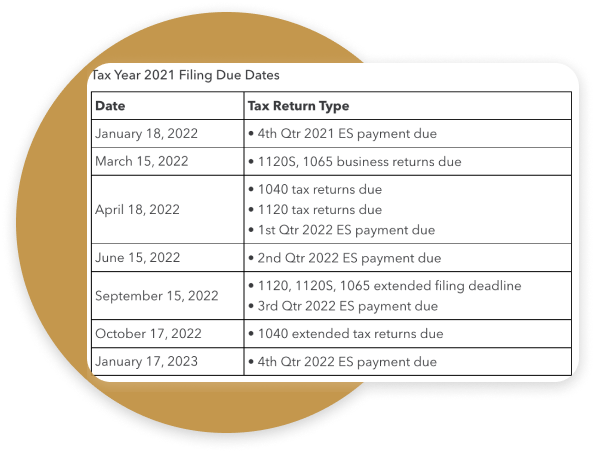

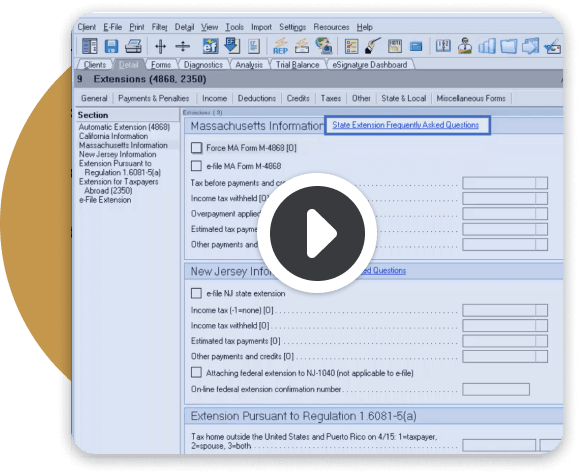

Fast, reliable e-filing

Enjoy built-in, integrated e-filing for supported individual and business form sets. File faster with a streamlined e-file wizard and batch e-file extensions for multiple clients.

Tax accuracy notifications

Get real-time alerts about returns affected by tax law updates or other changes, so you can fix them as needed to reduce rejections and delays to your clients’ refunds.

Expanded e-filing

Year-round e-filing for all open years is included with your Lacerte Fast Path license. There are no separate e-file fees. Plus, since having a comprehensive tax solution is extremely important to you, adding new tax forms and supporting more e-filing options will continue to be our top priority.

More features and tools to save you time

Combined e-file wizard

Reduce the time and hassle of having to file with two separate tools. Use a single e-file wizard for federal, state, and other filings.

Multiple filings per client

Increase productivity with the ability to add multiple instances of filings (franchise, LLC, etc.) within the same client e-file, reducing time spent filing multiple e-file returns for the same client.

Simultaneous e-file for multiple users

Filing instances are supported in a single client e-file. Multi-user and high-volume offices can now e-file at the same time with no disruption to workflow.

Point-of-need guidance

Obtain predictive and proactive content to answer your questions when you need it, while staying in your workflow. Guidance is accessible in data entry screens, as well as in the Diagnostics tab.

Forms Help

Find information on a specific form or calculation immediately, without losing your place in the return. Just press Forms Help at the top of that form or after right-clicking the calculation.*

Lacerte actionable steps for error resolution (LASER)

Quickly self-resolve problems in Lacerte as they arise by making use of actionable links made available when and where you need them to minimize any disruption to your workflow.

More features and tools to save you time

Secure screen share

Resolve questions faster when you connect with our customer success team by allowing them to see your screen in real-time. Intuit SmartLook™ gives you one-click access to video and screen sharing, so you can quickly get the answers you need.

Lacerte Tool Hub

Download a set of tools to help you quickly resolve common system issues and errors, so you can get back to serving your clients.

Tax idea exchange

Share your ideas with us and get updates on their status—under review, accepted or implemented.

NEXT