Over 5,700 forms

You can rely on Lacerte to handle even the most complex tax scenarios with confidence.

Ensure accuracy on the most complex returns.

25k diagnostics

Data import

Download 1099 and W-2 information directly

Thousands of automated calculations

End-to-end data protection

Do more with Lacerte so you can deliver more than just a tax return.

Get the tried-and-true features of the desktop software, but with the benefit of remote access on the cloud. With Hosting from Lacerte, you free yourself from IT and security hassles while giving you and your team the ability to access files from anywhere, at any time, on any device. Get 50% off Hosting for four months when you buy Lacerte now.*

Enhance advisory services.

Spend more time strengthening your relationships with clients, answering their questions, and offering advice to improve their financial lives. Let Lacerte be your partner in making sure their families and businesses thrive, so your practice will too, for generations to come with helpful tools like:

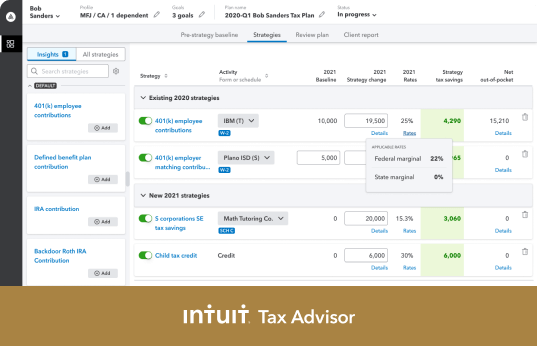

- Intuit Tax Advisor* [NEW]—build custom tax-saving plans for your clients in minutes, using data automatically mined from your Lacerte tax return.

Learn More

- Tax Analyzer—advise your clients on how new tax laws will impact their financial health and flag amounts on their returns that will likely trigger an IRS audit.

- Tax Planner—easily project your clients' future tax liability under multiple scenarios using actual current and future tax rates built in.

- Intuit Tax Advisory Center—learn from leading experts at Intuit and the profession on how to boost your practice with advisory services.

Visit Now

Continuing education benefits you and your clients.

Access year-round training to both meet credit requirements and better help your clients navigate the ever-changing financial landscape.*

Personalized training portal

View upcoming training opportunities and others recommended especially for you, whether online or in-person.

Live webinars

Learn along with other CPAs and tax professionals, join their discussion, and earn CPE credits even from the comfort of your own home.

Recorded webinars

Continue your professional education on your schedule, wherever you are, on your preferred device online.

Explore all of these tools, features, and opportunities and you’ll see why CPAs like you have trusted Lacerte for over 40 years.

Thank you

We will be in touch with you shortly.