Practical webinars, brilliant learning opportunities, and answers to everything ProSeries

Onboarding guide

Get up and going quickly with onboarding assistance and tools

Practical webinars, brilliant learning opportunities, and answers to everything ProSeries

Get up and going quickly with onboarding assistance and tools

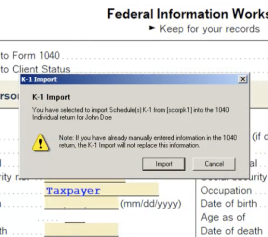

Convert previous tax year data from your current tax preparation software, including taxpayer personal information, names of interest, important carryover amounts, and more.

Get expert help from our ProSeries specialists. Whether you need tax or system support, our agents are trained in the most advanced topics to help you without transferring your call.

Get the exact instructions you need, when you need them. You will receive personalized, step-by-step emails and a webpage checklist to speed you through installation, data conversion, EFIN verification, and more.

See how ProSeries can make your daily workflows more efficient

In this live demo, see new innovations and learn how ProSeries Tax saves you time in every part of your workflow.

Find the forms and schedules that ProSeries Professional and ProSeries Basic supports.

Stay a step ahead with online learning resources—and earn free CPE and IRS CE credits.

Earn free CPE and IRS CE credits with self-paced courses and immersive virtual conferences.

In-depth videos and documents for customers only can be found within My Account.

Tax Pro Center

Access tax updates, tips on offering advisory services, and answers to your tax-related questions.