Experience how Intuit ProConnect Tax, QuickBooks Online Accountant, and Intuit Tax Advisor all work together as a digital books-to-tax-to-advisory workflow from end to end. Smooth.

- ProductsProducts

- Professional tax softwareProfessional tax software

- Intuit Lacerte TaxTap into highly powerful tools designed for complex returns and multiple preparers.

- Intuit ProConnect TaxGain added flexibility delivered fully on the cloud with nothing to download.

- Intuit ProSeries TaxGet simple forms-based screens and one-click access to calculation details.

- See all tax software

- Workflow add-onsWorkflow add-ons

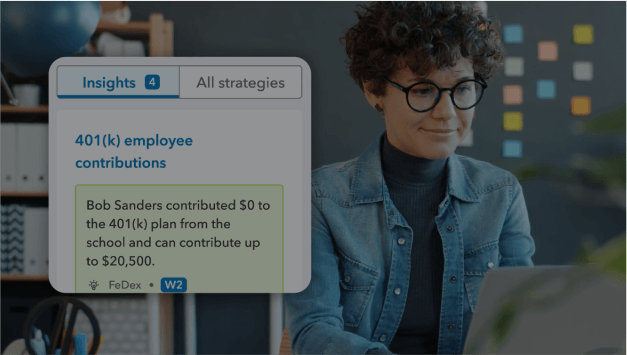

- Intuit Tax AdvisorCreate automatic tax plans for clients using tax return data mined from your ProConnect Tax or Lacerte software.

- Hosting for Lacerte and ProSeriesPut your Lacerte or ProSeries software on the cloud for built-in security, automatic backups and less IT stress.

- eSignatureGet any document signed securely from any online device, all done with quick clicks inside your tax software.

- Protection PlusProtect your clients from audits, tax notices and identity theft with $1 Million Tax Audit Defense™.

- Pay-by-RefundGive your clients the option of no upfront, out-of-pocket costs and give yourself an easy way to get paid with refund transfers.

- Intuit Select Pro StaffingBuild capacity, grow your business and increase productivity when you work with tax experts vetted by Intuit.

- See all workflow add-ons

- Accounting solutionsAccounting solutions

- QuickBooks Online AccountantAccess all your QuickBooks clients, resources, and tools under one login from anywhere.

- QuickBooks Accountant DesktopGet all the power of QuickBooks in a one-time purchase accounting software installed on your office computer

- EasyACCTGain a proven solution for write-up, A/P, A/R, payroll, bank reconciliation, asset depreciation, and financial reporting.

- Training & EducationTraining & Education

- Learning, news, and insightsLearning, news, and insights

- Events and virtual conferencesEvents and virtual conferences

- SupportSupport

- Online forum

- Contact us

- Looking for QuickBooks help?Looking for QuickBooks help?

- For Sales: 844-877-9422

- Sign in

ProConnectTM

Unleash the power of the #1 online professional tax software*

Save a whopping 25% off ProConnect today!*

*Limited time only

It all works together

Connected

Get the best of books and tax, all in one place. With ProConnect, you can work seamlessly with QuickBooks Online Accountant to streamline work between your bookkeeping and tax clients in one sign-on experience.

Link Client Portal

Simplify data collection and organization with Link client portal. This free, integrated client portal and document management system enables you to request client data and skip manual data entry for pinpoint accuracy. Returns are ready to review in just a few clicks.

IRS transcript direct access

Get access to years of client IRS transcripts right within ProConnect. With Transcripts, get a single source of truth to double-check a return before you file so you don’t miss anything. Plus, complete returns faster and more accurately with less client back-and-forth. Best of all, this is included at no additional cost.

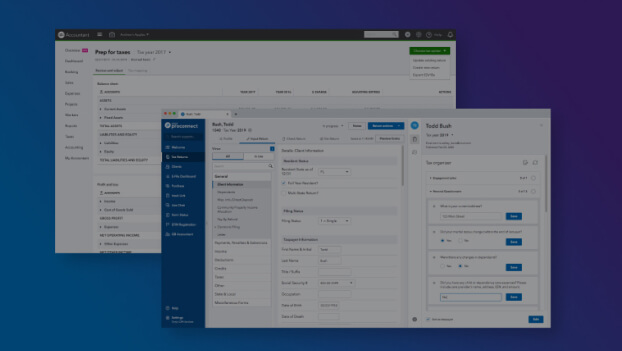

Just like that

Streamlining your workflow is critical. That’s why ProConnect has over 20,000 automated calculations; 25,000 critical diagnostics and suggestions, plus more than 5,700 forms at your fingertips. But perhaps the biggest time-saver of all is Prep for Taxes. This automation enables you to review, adjust and map client data to specific line items on the tax return.

Get exactly what you need

No matter how many returns you file annually, or whether they are for businesses or individuals, we offer deep discount bundles that can literally save you thousands of dollars each tax season. What’s nice is, you only pay when you eFile or print your documents.

How many users?

Another great feature of ProConnect is that it enables you to invite an unlimited number of users right from within the program settings. All team members who access ProConnect must first be invited as a user. But like we mentioned, you can invite as many users as you need to get the job done.

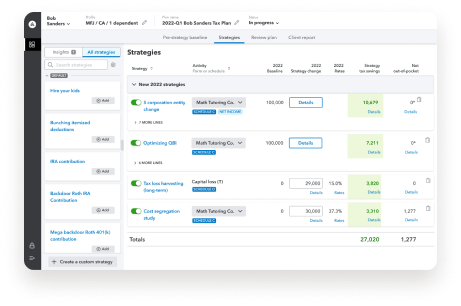

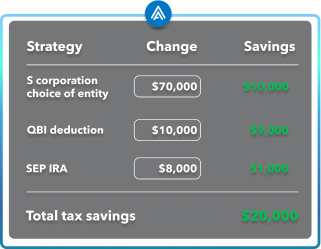

Your introduction to advisory starts now—

Hello, Intuit Tax Advisor

Hello, Intuit Tax Advisor

Proactive

Intuit Tax Advisor

The only integrated tax advisory tool

Tax strategies mined from client's tax returns

Advisory services increase your value

Client-friendly reports that show ROI

Far more accuracy, far less time

Fully online.Fully integrated.

QuickBooks Online Accountant shares data seamlessly. Client data flows from QuickBooks into ProConnect where it is mined by Intuit Tax Advisor. Fast. Accurate. Seamless performance.

Productive

QuickBooks Online

Accountant

Accountant

Digital, end-to-end, time-saving solutions

Integrates with Intuit ProConnect

Automates forms, totals and diagnostics

Streamlines digital books-to-tax workflow

Save more time, make more money

More great pro tax solutions

Drive your business with our tried-and-true professional tax software products

Easy to get started. Even easier to use.

Learn moreA powerful tax tool for complex returns.

Learn more#1 professional tax software on the cloud: Based on Intuit internal data of the number of paid users of ProConnect for tax year 2020 compared to publicly available statements from competitors for the same time period.

QuickBooks Online Accountant available separately.

Taxpayer claims information: Based on blind survey of taxpayers who used a tax professional in the 12 months prior to June 2022.

Call Sales: 844-877-9422

© 2024 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, ProConnect, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

By accessing and using this page you agree to the Terms and Conditions.