How to find release dates for forms and schedules in ProSeries

by Intuit•41• Updated 7 months ago

Every year, the IRS releases tax forms on a rolling basis. Forms and schedules can sometimes be delayed and may not be final or ready to file. Update your ProSeries software regularly to ensure you have the latest release and forms, and check the schedule to learn when forms will be available.

For more Print & PDF resources, check out our Troubleshooting page for Print & PDF where you'll find answers to the most commonly asked questions.

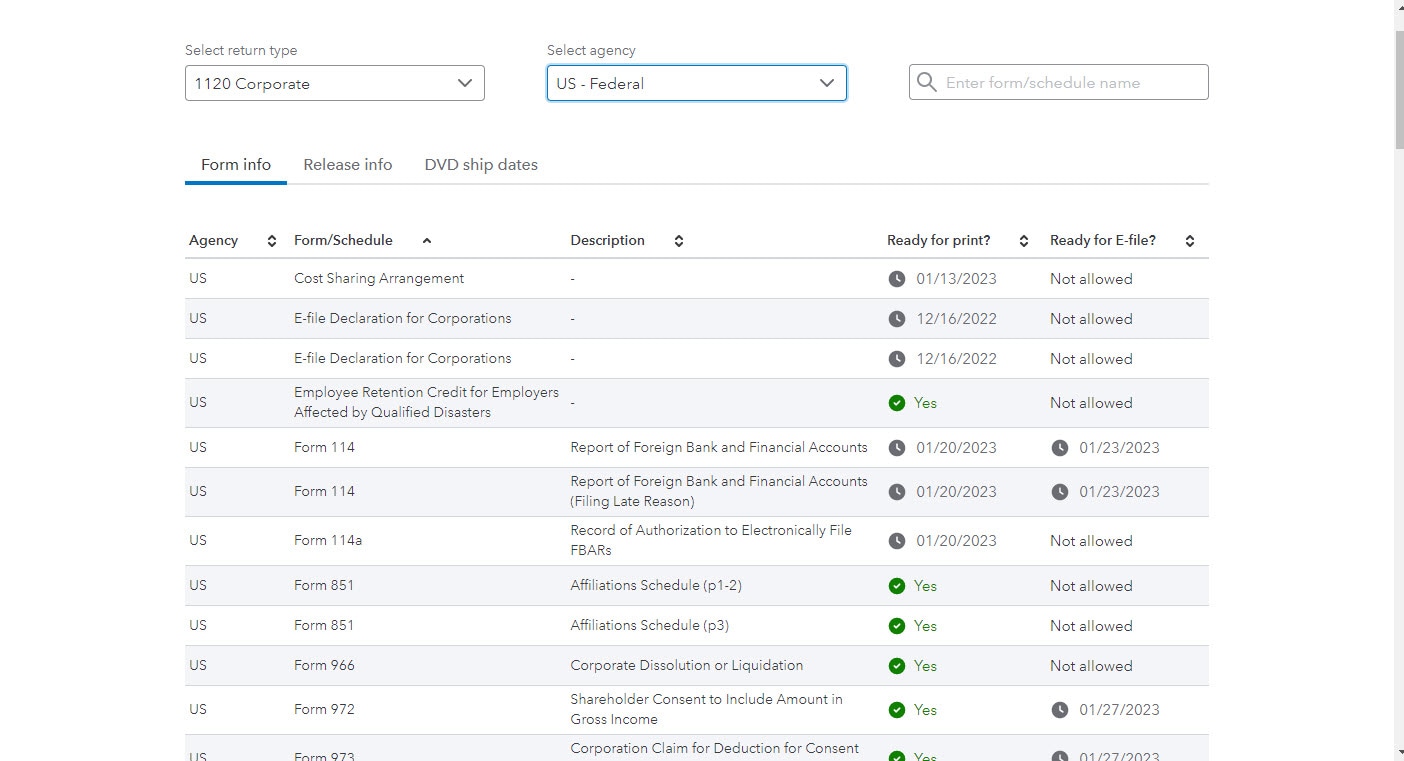

Follow these steps to find out when forms are available:

- Open the ProSeries Tax form finder link.

- From the drop down menus at the top Select return type, then Select agency.

Follow these steps to find a form's release date in ProSeries:

- Open a client file.

- Select either a federal or state return.

- Press the F6 to bring up Open Forms.

- Select the federal or state form in question and click OK.

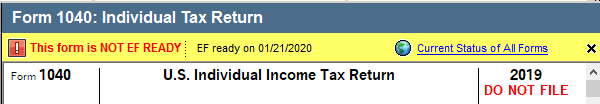

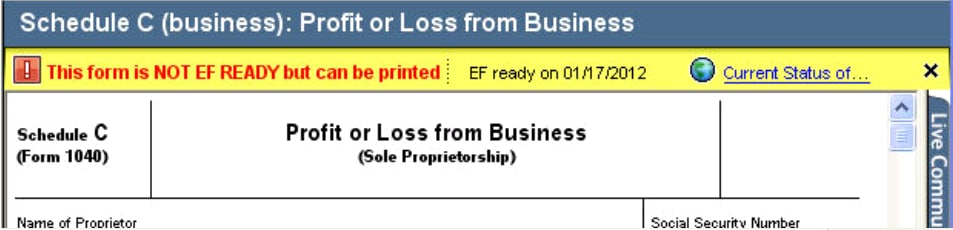

- View the form's status bar to find all current information about the form.

![]() Update your program regularly to make sure that you have the latest release and forms.

Update your program regularly to make sure that you have the latest release and forms.

Finding important state and federal for dates in ProSeries

To find out when the government will release the final version of forms and form instructions, visit the taxing authority's website. Usually, the governing tax authority must approve a form before the final version of the form appears in tax preparation software.

If a form or schedule in your product isn't final or ready to be e-filed, a yellow forms availability bar will be displayed at the top of the form in ProSeries. It'll identify the date the form is expected to be Final or E-File Ready, and it'll provide a link to the online Release Dates page.

When a form is a nonfinal form, a red DO NOT FILE indicator will appear in the upper right corner of the on-screen form. This same DO NOT FILE watermark will appear on printed forms.

When ProSeries is updated to the version containing the final form, the red DO NOT FILE will be removed. If the ProSeries update is released and installed before the date shown on the Forms Availability bar, the yellow bar will continue to show until the date expires, even though the form is in fact final.

When the red DO NOT FILE indicator is no longer being displayed, and the date identified on the yellow Forms Availability bar is in the past, you may file the return.

- This form is NOT FINAL will appear in the yellow alert bar at the top of a form when tax forms or instructions are not complete.

- Printing a form that's marked NON-FINAL or This form is NOT FINAL will generate a DO NOT FILE watermark across the form.

- The watermark can't be deleted.

- Don't file a tax return until the final release is available.

When forms aren't final:

- Calculations may be wrong.

- Amounts may not flow where expected.

- Initial release forms may look very different from final release forms.

- Form instructions may not be up to date.

How to determine which forms aren't final:

- Open ProSeries.

- From the Help menu, select Help Center.

- You may also use the F1 shortcut to access Help Center.

- From the Technical Support section in the left navigation panel, locate ReadMe Information.

- Click on the + (plus sign) to expand the menu.

- Select the applicable tax module.

- Click on the Forms link in the Contents section for that tax module to see information regarding forms availability.

If you believe you're receiving the Do Not File watermark for forms that have already been finalized:

- Download the latest version of the formset from the ProSeries MyAccount website or download product updates. Refer to this article for more information.

You must sign in to vote.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Common questions on downloading ProSeries and updatesby Intuit

- How to create Form 114, Report of Foreign Bank and Financial Accounts in ProSeriesby Intuit

- How to enter and calculate the qualified business income deduction, section 199A, in ProSeries on Form 8895by Intuit

- How to update ProSeries softwareby Intuit