Before you start:

- New starting in tax year 2023: The 7203 is automatically included in the e-filed return and no longer needs to be added as a PDF attachment.

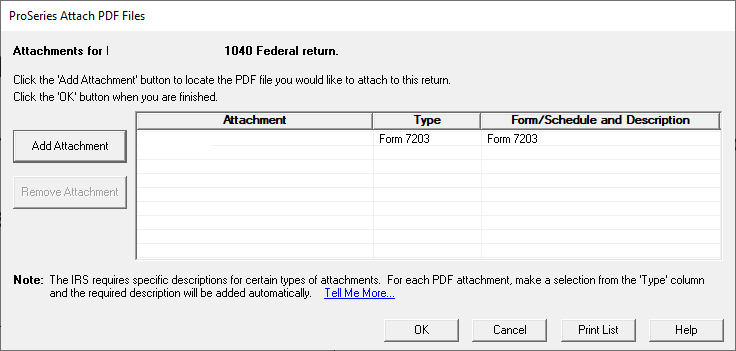

- For tax year 2021 and 2022: This form isn't supported in the e-file schema for electronically filed returns and must be manually attached as a PDF attachment. See here for details.

- When you add the PDF attachment, make sure the Type of Form 7203.

- When you add the PDF attachment, make sure the Type of Form 7203.

- For tax year 2021 and 2022: This form isn't supported in the e-file schema for electronically filed returns and must be manually attached as a PDF attachment. See here for details.

- The allowable losses on the 7203 won't automatically flow to the Schedule K-1 Worksheet and will need to be manually entered.

- The 7203 isn't required on the 1120S return and needs to be completed on the 1040 return by the shareholders. Who must file: Form 7203 is filed by shareholders who:

- Are claiming a deduction for their share of an aggregate loss from an S corporation (including an aggregate loss not allowed last year because of basis limitations),

- Received a non-dividend distribution from an S corporation,

- Disposed of stock in an S corporation (whether or not gain is recognized); or

- Received a loan repayment from an S corporation

- If the shareholder had multiple Stock Blocks in the S-Corporation, additional copies of Form 7203 would need to be manually completed and attached for each additional Stock Block.

Step 1 - Complete the 7203 in the individual return:

- Open the Individual return.

- Press F6 to bring up Open Forms.

- Type S to highlight K-1 S Corp and click OK.

- Select the K-1 you need the 7203 for.

- Scroll down to Part II - Information About the Shareholder.

- Select the QuickZoom to Form 7203 for stock and basis limitations.

- Complete Part I to show and calculate the Shareholders Stock Basis.

- Complete Part II to show and calculate the Shareholders Debt Basis.

- In Part III enter any current year losses and deductions on line 35-46 column (a).

- In Part III enter any basis carryover losses and deductions on line 35-46 column (a).

- You should now have the calculations required to enter the Schedule K-1.

Step 2 - Complete the Schedule K-1 Worksheet in the individual return:

- Go back to the Schedule K-1 worksheet for the Shareholder.

- Scroll down to Part III - Shareholders Share of Current Year Income, Deductions, Credits, Other Items.

- Using the amounts from the 7203 Part III columns C and D enter the allowable losses on the Schedule K-1 worksheet for the shareholder.

- Amounts on the 7203 Part III column E will transfer to next years return.

- Enter any additional items from the Schedule K-1 received that we're not limited by the 7203.