On January 18, 2022, the IRS revised the instructions for Schedule K-2 and K-3, which broadened the scope of who must file these forms.

This article will help you:

- Understand when Schedules K-2 and K-3 are required,

- Automatically fill out the K-2 and K-3 when there’s no foreign activity on the return,

- Complete the required schedules, and

- Specially allocate amounts in Part II and Part III of the K-2

Table of contents:

Who must file Schedules K-2 and K-3?

Generally, any partnership or S corporation must file if they:

- Have international income, assets, credits, or activity;

- Have an international owner (partner or shareholder); or

- Have owners who claim a credit for foreign taxes paid on their return (Form 1116 or 1118).

Domestic filing exception

New for tax year 2022, certain domestic partnerships and S corporations don't need to file Schedules K-2 and K-3 if they meet all of these criteria:

- No or limited foreign activity;

- All direct partners are U.S. Citizens or resident aliens;

- Notify all partners or shareholders that they won't receive a K-3 from this business no later than when the K-1 is furnished;

- No partner or shareholder requests a K-3 within by the "1-month date", meaning one month before the date the partnership or S corporation files their tax return.

For more information about this exception and examples, review the Schedule K-2 and K-3 instructions.

To claim the domestic filing exception:

- Go to the Schedule K-2 screen (Screen 78 for partnerships or Screen 86 for S corporations).

- Check the box labeled Qualified for exception to filing Schedule K-2.

- The program will attach a statement to Schedule K, line 16 with exception text. This statement is automatically e-filed with the return.

- If desired, check the box for Include partner notification on Schedule K-1.

- When checked, the program will print a partner or shareholder notification on the pages that follow each K-1.

To complete the K-2 and K-3 when there's no foreign activity on the return:

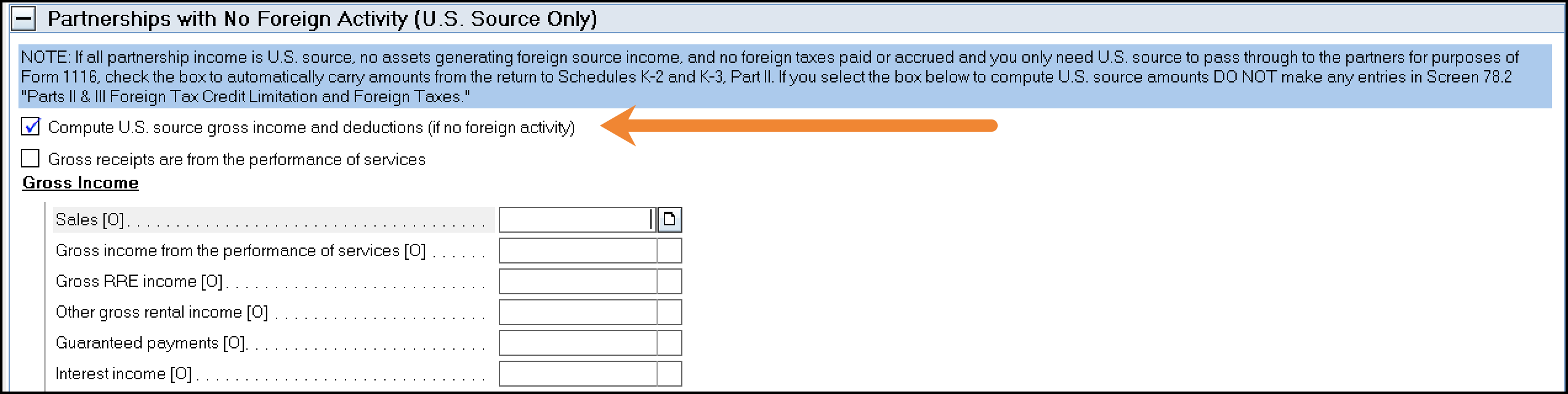

If the partnership or S corporation only has U.S. source amounts, and you only need to furnish the Schedules K-2 and K-3 because partners or shareholders may need the information to claim a foreign tax credit on their own return (from other income sources), the program can automatically complete Part II of these forms.

- Go to the Schedule K-2 screen (Screen 78 for partnerships or Screen 86 for S corporations).

- Check the box to Compute U.S. source gross income and deductions (if no foreign activity).

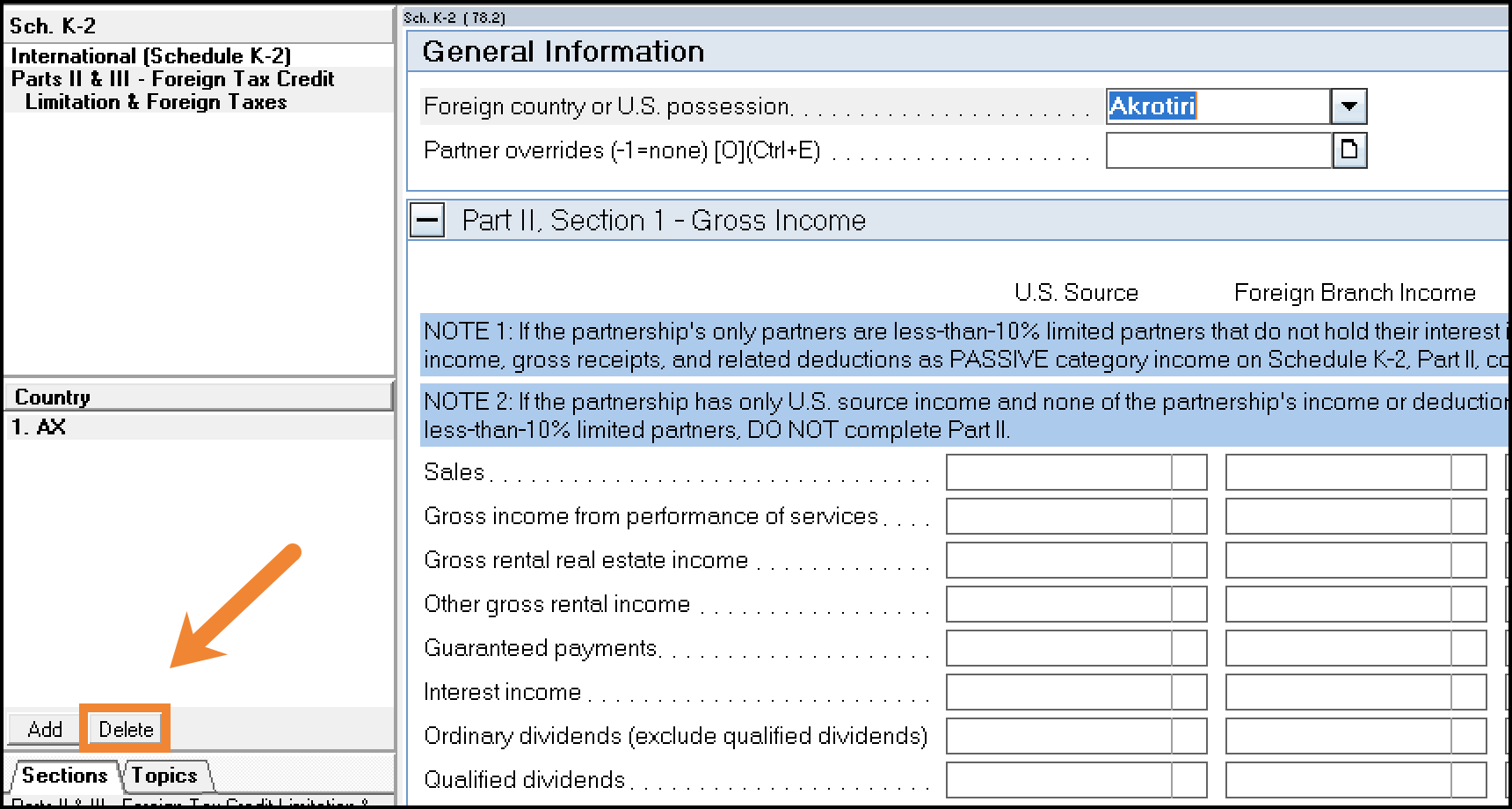

- On the left-side menu, select Parts II & III - Foreign Tax Credit Limitation & Foreign Taxes.

- If any countries are listed, press the Delete button to erase them.

- Any entries on this screen will prevent the automatic calculation.

The program will automatically carry amounts from the return to Schedules K-2 and K-3, Part II.

These automatically calculated gross income items, or their overrides entered on Screen 78.1, can be specially allocated on Screen 29.

To complete the K-2 and K-3 when the return contains foreign activity:

The majority of these Schedules K-2 and K-3 aren’t automatically calculated at this time. Exceptions, such as certain total columns in Part X, are noted with an [O]. Review the form instructions to determine which sections and attachments you’re required to complete.

- Go to Screen 78 (partnership returns), or Screen 86 (S corporate returns).

- Scroll down to Part I - Partnership’s Other Current Year International Information section.

- Complete the required entries.

- All items entered on this screen can be allocated using the Schedule K-3 Overrides screen (partnership Screen 79, S corporate Screen 87).

- On the left-side menu, select Parts II & III - Foreign Tax Credit Limitation & Foreign Taxes.

- Enter the name of the Foreign country or U.S. possession this applies to.

- Complete all applicable entries for this country.

- Click Add on the left-side menu to add another country, if necessary.

How do I specially allocate part II and part III amounts?

Since a single return can have multiple instances of the Parts II & III screen for different countries, those entries can’t be allocated to partners or shareholders using the single Schedule K-3 Overrides screen.

Instead, you can set different Partner/Shareholder overrides for each country you add to this screen.

To enter partner or shareholder overrides:

- Select the Country/Instance you need to allocate on the left.

- At the top of the screen, open the Partner/Shareholder overrides (-1=none)[O] field.

- Select or enter each partner, and the percentage of this country's amounts they should receive.

- As with other special allocations, enter a -1 for any partner or shareholder who should receive none. Your total won’t equal 100%, but this is correct.

- If only one item for the country needs to be specially allocated, Add a new Instance on the left, for the same country. Only enter the specially allocated item on this Instance.

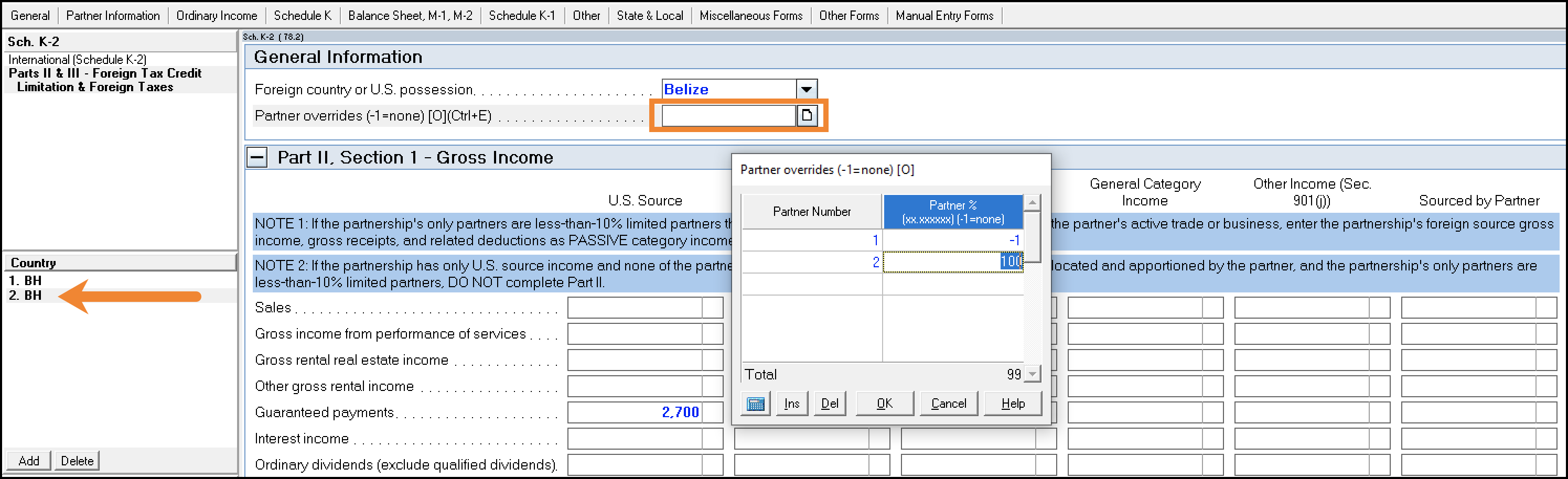

Example: Allocating only guaranteed payments

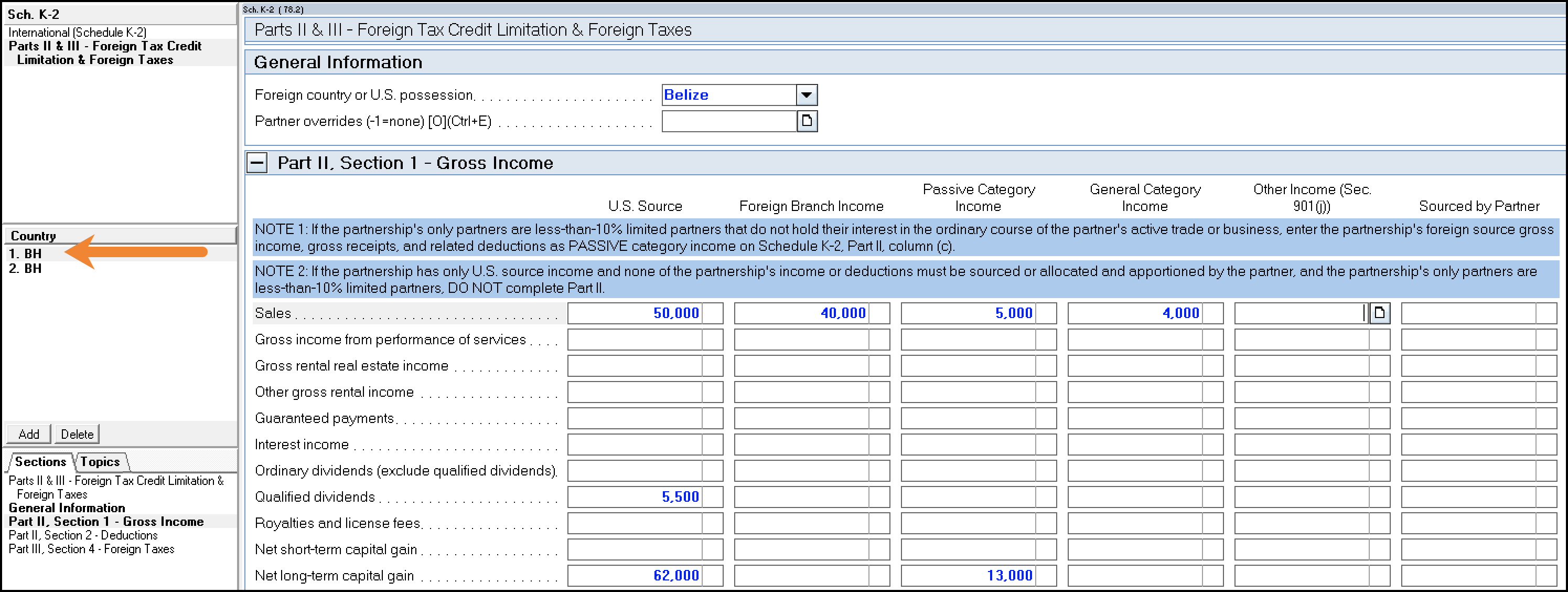

In this example, the partnership is reporting foreign income from Belize. While the sales, dividends, and capital gains should be allocated according to partners’ percentages, all of the guaranteed payments were attributable to only one partner.

- Enter the items that should be allocated by ownership percentage on one country/instance. Leave the Partner overrides blank.

- Press Add to create a new country/instance.

- Select the same Foreign country or U.S. possession.

- Enter only the Guaranteed payments.

- Use the Partner overrides to allocate 100% of the guaranteed payments to partner 2.

Country/instance 1 - Belize items sourced by ownership percentage:

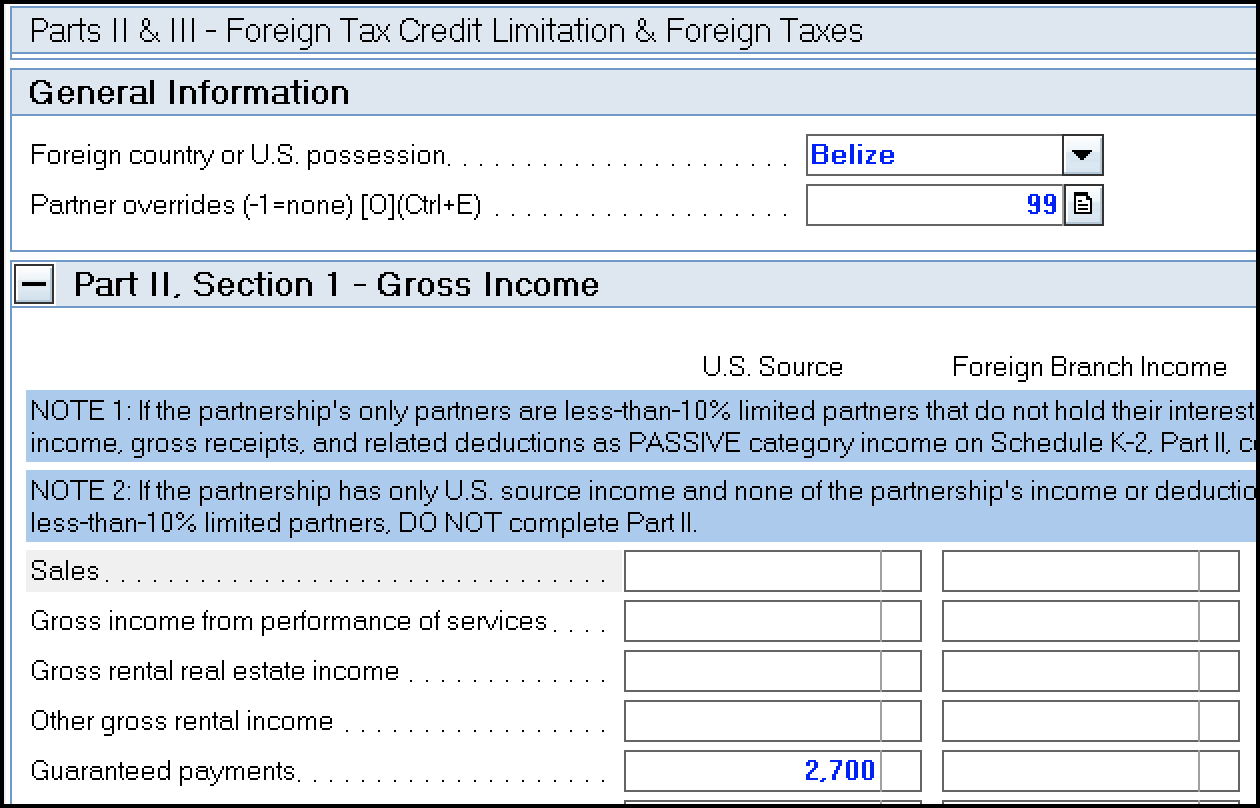

Country/instance 2 - Belize guaranteed payments allocated 0% to partner 1, and 100% to partner 2:

When you allocate an amount using the partner overrides, and any partner receives 0%, your total on the input screen will appear to be less than 100% due to the -1 entries. The Schedule K-3 will print correctly.