This article will help you:

- Enter basis limitations for S-Corp K-1s.

- Generate Form 7203, S-Corporation Shareholder Stock and Debt Basis Limitations.

- Verify the form is attached for e-filing when required.

To enter basis limitation info in the individual return:

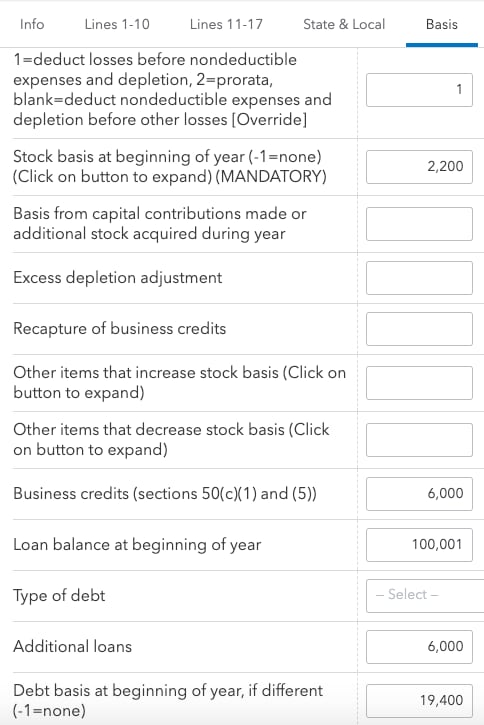

- From Income, under Passthrough K-1's, go to S-Corp Info (1120S K-1).

- From along the top of the workspace, select Basis.

- In the Basis Limitation (7203) section, enter your client’s Stock basis at beginning of year to print on line 1.

- This entry is mandatory to generate the form.

- The program will automatically calculate many of the increases and decreases based on your K-1 entries. You may need to enter the following items in this section, which aren’t automatically calculated:

- Basis from capital contributions made or additional stock acquired during year for line 2.

- Excess depletion adjustment for line 3j.

- Recapture of business credits for line 3l.

- Other items that increase stock basis for line 3m.

- Business credits (sections 50(c)(1) and (5)) for line 8c.

- Other items that decrease stock basis for line 13.

![]() The program will only produce Form 7203 for K-1s where your client is claiming a loss, received a distribution, disposed of stock, or received a loan repayment. Other activities will still generate a Basis Limitation Worksheet to keep for your records.

The program will only produce Form 7203 for K-1s where your client is claiming a loss, received a distribution, disposed of stock, or received a loan repayment. Other activities will still generate a Basis Limitation Worksheet to keep for your records.

To enter shareholder debt basis:

If your client only has one loan to the S-Corporation:

- Enter the Loan balance at beginning of year, if any.

- Select the Type of debt.

- Enter any Additional loans made during the year that increased the outstanding balance of this loan.

- Enter the Debt basis at beginning of year, if different from the loan balance at the beginning of the year.

- If applicable, enter the amount of Adjustments to debt basis.

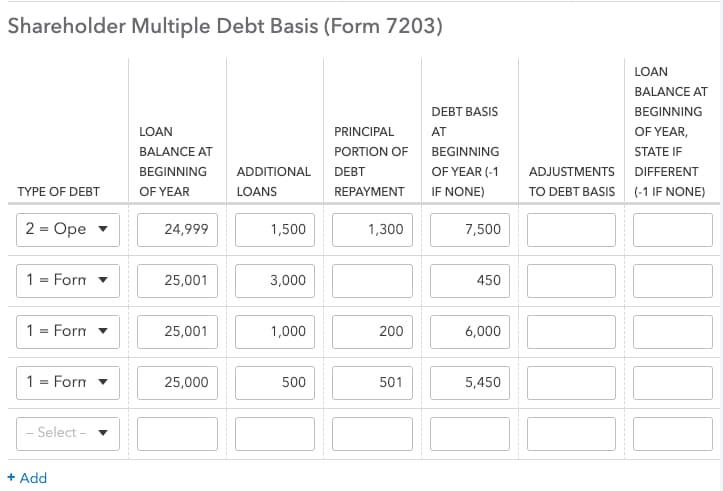

If your client has multiple loans to the S-Corporation:

- Enter the total beginning balance for all loans in Loan balance at beginning of year.

- Leave the Type of debt blank.

- Enter the total of all Additional loans made during the year.

- Enter the total Debt basis at beginning of year, if different from the total loan balance at the beginning of the year.

- If applicable, enter the total Adjustments to debt basis for all loans.

- Use the Shareholder Multiple Debt Basis grid to enter the details of each loan:

- Select the Type of debt.

- Enter the Loan balance at beginning of year.

- If applicable, enter Additional loans made during the year.

- If applicable, enter the Principal portion of debt repayment.

- Enter the shareholder’s Debt basis at beginning of year, if different from the loan balance at the beginning of the year entered on this line.

- Verify that your grid totals equal the amounts you entered in steps 1-5.

Multiple debt basis example

If your client had more than three debts, additional form(s) 7203 will generate to show the loan details.

Attaching Form 7203 to the tax return:

ProConnect Tax will generate a critical diagnostic (Ref #56844) reminding you to attach this form as a PDF for e-filing. To generate the form as a PDF:

- Go to the File Return tab.

- Select Partial Print on the left side of the screen.

- Check the box for 7203.

- Click the Create PDF button.

- Press Download PDF. The form will open in a new tab, where you can save it to your computer.

Once the form is saved to your computer, go to the Check Return tab and click on the critical diagnostic beginning "Form 7203" to upload and attach your PDF. See here for help attaching a PDF to the return.