To report partnership Schedule K-1, box 13J expenses for an individual return, follow these steps:

- Go to Screen 20, Passthrough K-1's.

- Select Partnership Information from the top left menu.

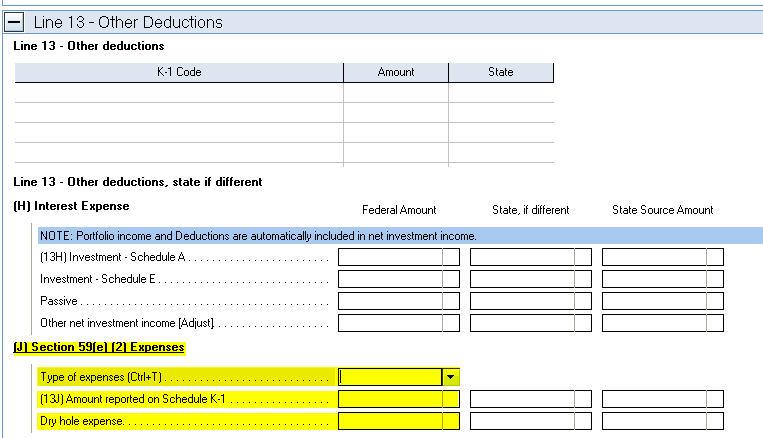

- Select the Line 13 - Other Deductions section from the lower left sections menu.

- Locate the (J) Section 59(e)(2) Expenses subsection.

- Select the Type of expenses (Ctrl+T) from the dropdown menu.

- Enter the (13J) Amount reported on Schedule K-1.

- Enter any Dry hole expense. (if applicable).

The partnership should have included the type and amount of Section 59(e)(2) expense on a statement attached to the K-1. Enter the type of expense indicated on that statement.

If these expenses are deducted in full in the current year, they're treated as an adjustment or tax preference item for the Alternative Minimum Tax. Generally, section 59(e)(2) lets the partner amortize the expense for a number of years to avoid the Alternative Minimum Tax adjustment.

Only enter expenses you want to deduct in full in the K-1 input screen. To amortize the amount, enter the expense on Screen 22, Depreciation and tie the asset to the pass-through entity.

To amortize circulation costs

- Go to Screen 22, Depreciation.

- Select the Add button from the middle left panel.

- Enter the basic information about the circulation costs:

- Description of property

- Select the Form from the dropdown.

- Select the Activity name or number from the dropdown.

- Select 8=Amortization from the Category dropdown.

- Enter the Date placed in service.

- Enter the Cost or Basis.

- Enter 91=Straight Line in Method.

- Scroll down to the Regular Depreciation subsection.

- Enter 3 in Life or class life.

- Select 59 = Sec. 59 - Optional Write-Off of Tax Preferences from the Amortization code section (Ctrl+T) dropdown menu.

To amortize mining exploration or development costs

- Go to Screen 22, Depreciation.

- Select the Add button from the middle left panel.

- Enter the basic information about the circulation costs:

- Description of property

- Select the Form from the dropdown.

- Select the Activity name or number from the dropdown.

- Select 8=Amortization from the Category dropdown.

- Enter the Date placed in service.

- Enter the Cost or Basis.

- Enter 91=Straight Line in Method.

- Scroll down to the Regular Depreciation subsection.

- Enter 10 in Life or class life.

- Select 59 = Sec. 59 - Optional Write-Off of Tax Preferences from the Amortization code section (Ctrl+T) dropdown menu.

To amortize research and experimental expenditures

- Go to Screen 22, Depreciation.

- Select the Add button from the middle left panel.

- Enter the basic information about the circulation costs:

- Description of property

- Select the Form from the dropdown.

- Select the Activity name or number from the dropdown.

- Select 8=Amortization from the Category dropdown.

- Enter the Date placed in service.

- Enter the Cost or Basis.

- Enter 91=Straight Line in Method.

- Scroll down to the Regular Depreciation subsection.

- Enter 10 in Life or class life.

- Select 59 or 174 from the Amortization code section (Ctrl+T) dropdown menu.

To amortize intangible drilling costs

- Go to Screen 22, Depreciation.

- Select the Add button from the middle left panel.

- Enter the basic information about the circulation costs:

- Description of property

- Select the Form from the dropdown.

- Select the Activity name or number from the dropdown.

- Select 8=Amortization from the Category dropdown.

- Enter the Date placed in service.

- Enter the Cost or Basis.

- Enter 97=IDC SL Amort. (60 month default) in Method.