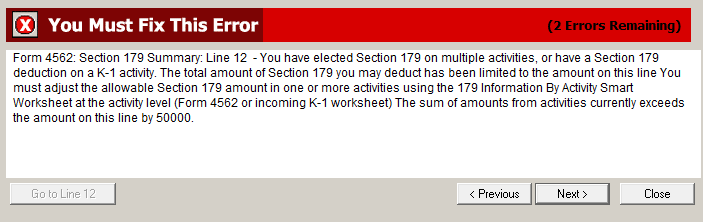

This article will help you resolve the following error in ProSeries Professional in a 1120S S corporation return:

What does this mean?

The amount of 179 deductions that can be deducted in the current year is limited by the business income at the 1120S/1065 level before being passed through to the K-1's. Starting in ProSeries 2019 the ability to track 179 carryovers at the activity level has been added. If the return contains 179 in more then one location or is missing the carryover details, ProSeries needs to know where to limit the 179 deductions to complete the carryover to the next year correctly.

How do I clear the error if I only have a carryover of disallowed deduction from the prior year?

The most common cause of this error in tax year 2019 is missing the activity level carryover information for any 179 carried over from the previous year.

- Make a note of the amount in red on line 10 of Form 4562: Section 179 Summary.

- There are three locations in the return where you may need to review section 179 carryover data:

- Asset Entry Worksheets linked to the 1120S/1065.

- Asset Entry Worksheets linked to the 8825.

- K-1 from another Partnership.

- Using the steps below enter the amount from line 10 on the correct carryover field at the activity level.

For Asset Entry Worksheets linked to the 1120S:

- Press F6 to bring up Open Forms.

- Type 4562 to select the Form 4562.

- Click OK to open the Select Form 4562 window.

- Choose the Form 4562 (Form 4562 Deprecitation Options) and click Finish.

- Enter the amount of the carryover attributed to these assets on line 10. Once all three of the following entries match the amount on the 4562 179 Summary line 10 the error should be cleared.

For Asset Entry Worksheets linked to the 8825:

- Press F6 to bring up Open Forms.

- Type 4562 to highlight the Form 4562.

- Click OK to open the Select Form 4562 window.

- Choose the Form 4562 (Property Address) and click Finish.

- Enter the amount of the carryover attributed to these assets on line 10.

For 179 Carryover reported on a K-1 from a Partnership:

- Open the K-1 Entry Wks-Partnership.

- Scroll down to line 12 to see Section 179 Information by Activity for K-1 Reporting.

- Enter the amount of the carryover attributed to this K-1 on line B.

If this does not clear the error, or if you have no carryover 179 continue with the next section.

How do I clear the level if I have multiple activities claiming 179 deductions?

If you do not have a carryover, or you have already completed the above and the errors remain that means 179 is entered in multiple locations and ProSeries needs to know which amount to limit.

- Make a note of the amount in red on line 12 of Form 4562: Section 179 Summary.

- There are three locations in the return where you may need to review and limit the section 179 allowed per the current tax year:

- Asset Entry Worksheets linked to the 1120S/1065.

- Asset Entry Worksheets linked to the 8825.

- K-1 from another Partnership.

- The steps below will show you where to do the limitation on the three available forms.

- Adjust the following fields until all of the fields equal the amount from the Section 179 Summary line 12 exactly.

For Asset Entry Worksheets linked to the 1120S:

- Press F6 to bring up Open Forms.

- Type 4562 to highlight the Form 4562.

- Click OK to open the Select Form 4562 window.

- Choose the Form 4562 (Form 4562 Deprecitation Options) and click Finish.

- Scroll down to line 11 to Section 179 Informaiton by Activity for K-1 Reporting.

- Adjust the amount on line C as needed.

For Asset Entry Worksheets linked to the 8825:

- Press F6 to bring up Open Forms.

- Type 4562 to highlight the Form 4562.

- Click OK to open the Select Form 4562 window.

- Choose the Form 4562 (Property Address) and click Finish.

- Scroll down to line 11 to Section 179 Informaiton by Activity for K-1 Reporting.

- Adjust the amount on line C as needed.

For 179 reported on a K-1 from a Partnership:

- Open the K-1 Entry Wks-Partnership.

- Scroll down to line 12 to see Section 179 Information by Activity for K-1 Reporting.

- Adjust the amount on line C as needed.