- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Schedule L Balance Sheet

Schedule L Balance Sheet

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

New to proseries and I am unable to get the ending balance of my assets to automatically populate. I have entered the beginning balances and checked to enter on the balance sheet. The prior year ending accumulated depreciation comes over in the current year (10b) and the current year depreciation is not included, but is listed on page 1 of the 1120S....odd. 10a is also blank. I know I am missing something, thank you in advance

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

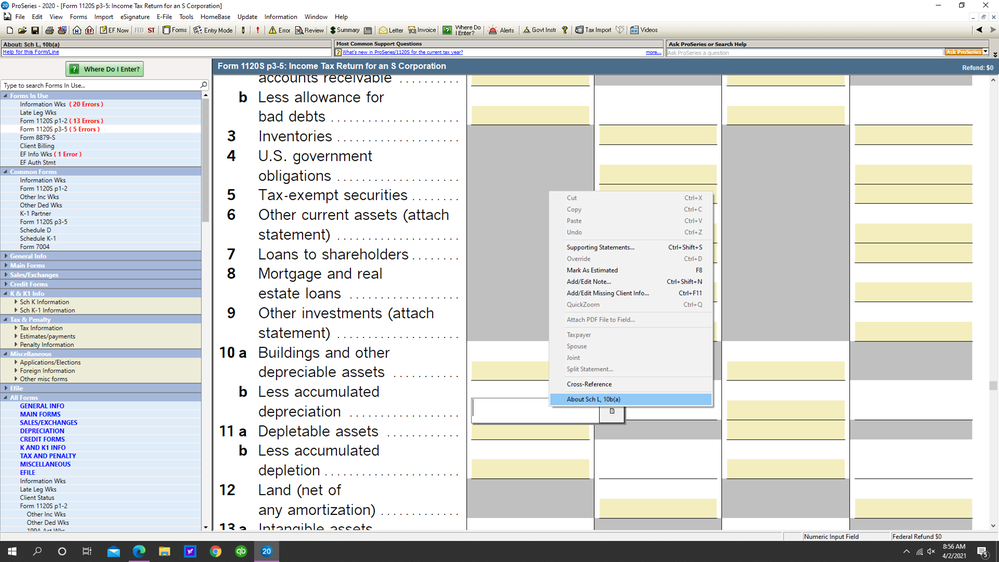

Good morning @jake1 , go to the Schedule L , line 10a or 10b then right click for options. Select the last one "About Sch L, 10b(a)" . You will get instructions which will tell you how to auto populate these items.

I had to do the select and click twice before the instructions popped up.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

To be honest, I've never used the feature. I always have a balance sheet or trial balance ready prior to preparing the return so I just plink in the numbers as I go.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you both. I was able to find the box in "entry mode" it was under additional information

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am still looking for the "box" to transfer asset/accumulated depreciation information to BS, is there a screenshot you could share? I know it is there but cannot find it LOL

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Go to Schedule L line 10a or 10b - then right click which will open a box - select last line About Schl L 10(a)(b). It will open window with instructions on how to populate automatically.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks! it worked !!!