- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Repay suspension APTC Efile Hold in ProSeries Professional

Repay suspension APTC Efile Hold in ProSeries Professional

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

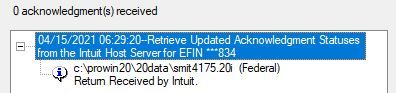

I filed a 2020 1040 tax return via Intuit ProSeries Professional on Sunday 4/11/21. The Efile Status in the HomeBase View still shows "Received by Intuit" as of Thursday 4/15/21. Efile > Electronic filing > Update Acknowledgment Status of Selected Return.

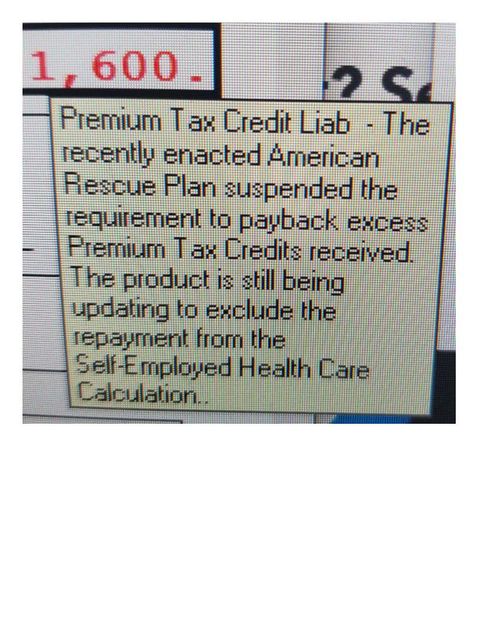

At the time I e-filed the return on 4/11/21, ProSeries' Diagnostic Review showed no efile Errors or Omissions, so the return successfully flowed to Intuit. However, now it is stuck at the "Received by Intuit" stage. I have spoken to two Intuit support professions, who looked up the status of the return in their systems, and both representatives have said that the return is on hold due to the Repay suspension of the APTC provision of the American Rescue Plan Act of 2021.

When I re-open the tax return, it now shows an error in Form 8962. Clearly ProSeries is still being updated.

Are there others who have returns like this stuck at Intuit? Is there any time frame on when the fix will allow ProSeries to send the return to the IRS (or give it back to me)?

Solved! Go to Solution.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

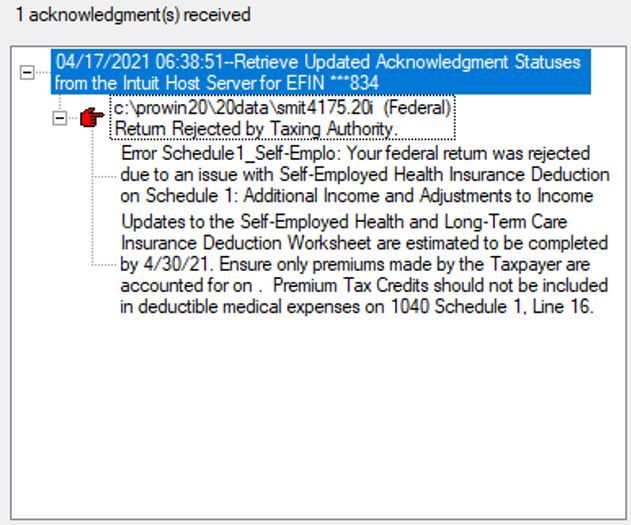

Mine was finally rejected 6 days in. The programming fix is expected by 4/30/21. However, I plan to manually enter the correct amount to the Self-Employed Health Insurance Deduction Worksheet, omitting from that the amount of the Excess APTC repayment (from Form 8962, Part III, line 29).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

it is not being updated--medical expenses(ins) from form 8962 are flowing to sch a in my case and health ins premiums for your self-employed deduction-review and reduce your hlth ins premiums on your self-employment hlth ins worksheet-you may need to enter 8962 exp as a negative on the se wksht-and you should be fine

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am happy to make the manual changes needed to produce the correct result, including executing unsanctioned but "correcting" negative number entries. In my case, I would delete the Form 1095-A, and thus zero out and disappear Form 8962, and then I manually enter the net health insurance premiums paid on the SE Health & Long term Care Insurance Deduction Worksheet in order to secure the SE Health Insurance Adjustment to Schedule 1, Part II, line 16.

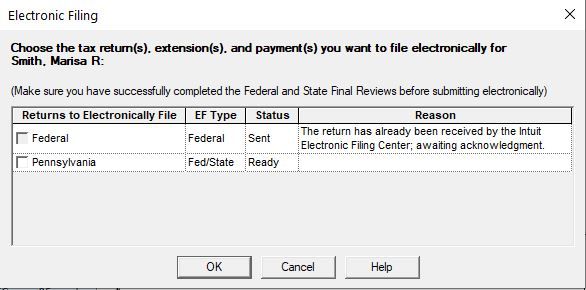

But the problem is that Intuit has the return in a hold position at Intuit... so upon making the changes and then attempting to re-e-file, I am faced with a check box I cannot check, and the message "The return has already been received by the Intuit Electronic Filing Center, awaiting acknowledgement".

How to get Intuit to either give me the return back or tell them to force it to the IRS, so that it can reject and get back to me where I can edit it and re-e-file it?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@JCTaxAdv mine was held for a day then rejected

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Mine was finally rejected 6 days in. The programming fix is expected by 4/30/21. However, I plan to manually enter the correct amount to the Self-Employed Health Insurance Deduction Worksheet, omitting from that the amount of the Excess APTC repayment (from Form 8962, Part III, line 29).