- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: QBI not calculating on Schedule E's

QBI not calculating on Schedule E's

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did my update this morning for ProSeries Pro and the update changed all the Schedule E's to untitled and didn't calculate the QBI deduction. After being on the phone with ProSeries for 2 hours they gave me a work around to do the calculations and told me that an update will be done to correct this problem. Just wanted to give everyone a h

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have the same issue. I also have at least 5 returns that the system is showing changes to the QBI calculation as of todays update that have changed the return since it has been efiled. Amended returns then to correct the calculation?

Is this a ProSeries calculation or an IRS calculation change?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I printed out a return yesterday, they came to sign it today & when I went to e-file I noticed that everything was different! Haven't e-filed it yet. ProSeries said they would correct this with an update? I need to know how long I need to hold this return before attempting to e-file again. Or do we need to do a manual override, print & mail?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I spoke to Proseries late afternoon yesterday. I was told it was my issue not Proseries and that no one else had the issue, disappointed in them this year. The work around is to remove the link and rename them to the Sch E name. That does take the return back to the original amounts. I did ask if this was going to be addressed in another update since I do believe it was caused by their 3/19 update. No simple answers for this year!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's a ProSeries problem. No need to amend returns efiled if they were efiled with the correct QBI calculations. I was promised that it will be fixed with an update. I will be looking for new tax software for 2020. Completely disappointed with Intuit and the incompetent people that try to assist you. The person I spoke with didn't even know what QBI was.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for the heads up @Raymay .

Why are you not alerting all PS19 users to this problem @IntuitAustin ? AND when will this be solved?

The most valuable thing a software program can have is reliability.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hey everyone,

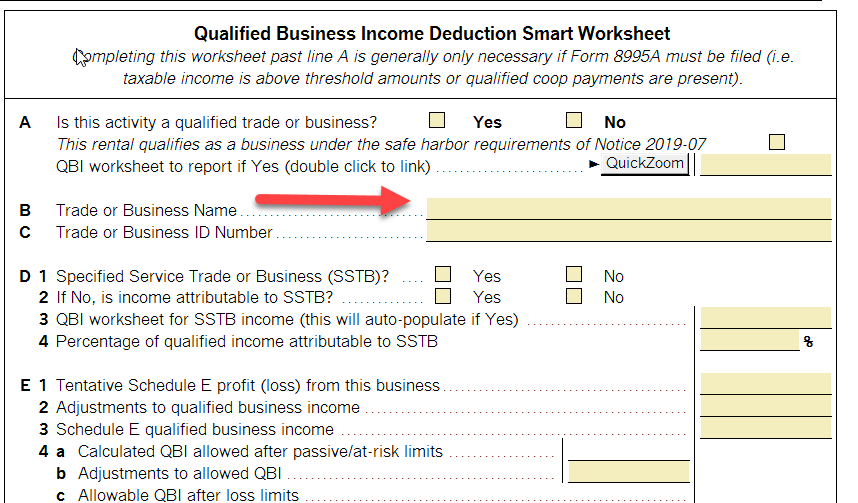

I will share this feedback with the support team. The workaround for this issue is to:

Enter the trade or business name in order to get the QBI Related income to flow to the Component worksheet and the 8995. IRS instructions for 8995/8995A say to use taxpayer name or SMLLC name.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for the reply @IntuitAustin .

The most valuable thing a software program can provide is reliability.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Software should be reliable and ProSeries is not. Every year the cost goes up and the service goes down. The rep I spoke with was trying to tell me to report the Schedule E on a Schedule C so that the calculation would be correct. I guess she didn't realize that a Schedule C has self-employment tax implications. Intuit needs to hire capable and competent tax people not just a voice on the other end of the telephone. I will be purchasing a new tax software program for 2020.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree with you completely @Raymay . Quality control on the updates has become poor. It was not this way in the past. Problems are becoming more and more common.

Intuit's system to report a problem and get Intuit to actually acknowledge the problem exists is terrible. When a PS problem is identified and acknowledged by Intuit they do not automatically inform all PS users of said problem and when the problem will be fixed.

It is extremely unsettling when a PS update comes out and breaks something that was previously working fine. The users bring it to Intuit's attention and Intuit employees [contractors?] give you a work-around. Hey, I don't want a work-around! I want you to fix what you broke within 24 hours! I'm really busy this time of year. I can't afford to wait weeks or months for Intuit to fix what Intuit broke.

The most valuable thing a software program can provide is reliability.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The work around is not working for me. Any tips? I'm using taxpayer name on the component worksheet and at bottom of schedule E. Is that all I am supposed to input to get the data to flow?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You have to delete the Untitled in the component worksheet and then link the new one to the Schedule E.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think that we should all ask for a refund. This problem with the QBI is still not fixed!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The workaround still does not work. Any other idea.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do you delete the untiled?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, it is my issue. Very disappointed too. As was stated earlier, we rely on this software and pay a lot of money. At least let us know that you are trying to fix it. I so appreciate all your responses. It was very helpful.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IntuitAustin is there a PS19 fix date for this issue yet?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you. I was able to fix it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Chris is this the issue you posted about?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It does seem to be the same thing. I wanted to make sure that the message its self could be searched and did not see this one.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@acdmbacpa @Just-Lisa-Now- Is this your problem too?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This last update was terrible. I lost seven hours of tax preparation because a patch was not working correctly onco Pro Series end, so it was not recognizing my license. I am on the east coast, at my desk at 4am, and I can not even get support until 9am, since they work off Pacific time. When I finally get support after 5 hours wasted, I get someone in Virginia, on the east coast, and she was clueless, after two hours with her, I called my computer guy and he helped me work around it.

So frustrating, I do not have time to waste especially when my work load has doubled trying to finish tax season since we are still on the April 15th deadline because NYS did not extend the deadline, and I am trying to help as many people file for unemployment or the small business loan.

What started out as a really good tax season has crashed and burned.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did this fix work for anyone?, or is there another work around?. I entered the taxpayer's name in "B" and ON THE "A" Quickzoom but am still NOT getting a flow through to page one for the QBI. nor a 8995

What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't have time to fix all of these Sch E and Form 8995 problems. Such a waste of time since it was working and an update from ProSeries broke it. VERY upset with ProSeries this year. One problem after another. PLEASE get an update to fix this problem asap. I figured out how to correct it, but it's time consuming and I don't know how to check every client.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

HBSJMKS would you mind sharing how you are fixing it?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I learned the fix by reading an earlier post - I removed all QBI Component worksheets (which were no longer named but called untitled). Then I went to the Sch E worksheet for each rental. Go to the lower section "QBI Deduction Smart Wksht" and in part A type the name of the property as it appears in the top section of the E Wksht under property description. Hit the QuickZoom and a new QBI Component wksht will be available to re-link. I did this for each rental property. The Form 8995 came back with correct figures. Good luck! This worked for me but it was time consuming which is frustrating!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IntuitAustin Wonder if the user's of TurboTax are having this issue with the QBI not calculating for the Schedule E's or is it just ProSeries?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Maybe a class action lawsuit would get Intuit's attention and fix all the problems that they created!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is the fix for this going to be in this weeks update @IntuitAustin ?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good morning!

This issue was resolved on the the last update of ProSeries, 2019.240

Schedule E Worksheet, Rentals and Royalties - QBI income was not flowing to a QBI Component Worksheet nor to Form 8995 unless the Trade or Business Name was entered in line B of the QBI Deduction Smart Worksheet

http://prodldfp.proseries.com/pro/2019/readme/pro_1040.htm

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hip-hip-horrah!! I like that it got fixed. Thanks @IntuitAustin

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Austin,

I have installed my updates and even refreshed the updates. Was on the telephone for 45 min with support and they can not re-establish the broken link between Sch E worksheet and QBI worksheet. HELP!!! @IntuitAustin