- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Missing W-2's from 2011-2017

Missing W-2's from 2011-2017

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My client hasn't filed a tax return since 2010 and does not have any of his w-2s. How would he get them if the company he worked for does not respond?

Solved! Go to Solution.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have the client request WAGE AND INCOME TRANSCRIPT from IRS.

https://www.irs.gov/individuals/tax-return-transcript-types-and-ways-to-order-them

Here's wishing you many Happy Returns

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have the client request WAGE AND INCOME TRANSCRIPT from IRS.

https://www.irs.gov/individuals/tax-return-transcript-types-and-ways-to-order-them

Here's wishing you many Happy Returns

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is the IRS on his case for those old years? If not, you may not need to go back that far, no refunds can be issued for years older than 2016.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Here's wishing you many Happy Returns

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

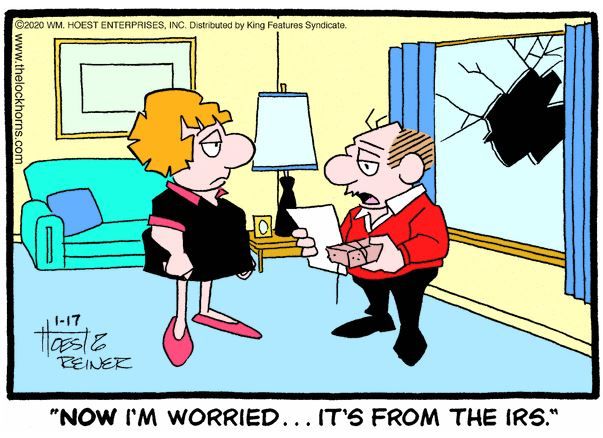

So a guy walks into your office and says he hasn't filed since 2010, but wants you to file the returns so that he is clean with the world. You say ok, let me see your tax documents. He says, I don't have any. Don't you just love this job ![]()

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, I love my job!

Here's wishing you many Happy Returns