- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Excess HSA Contribution when it doesn't appear to be excess?

Excess HSA Contribution when it doesn't appear to be excess?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Why would I get an excess HSA Contribution on line 47 of form 5329 when it doesn't appear there was an excess contribution? Contribution was $3098 for a single. Did I miss something or make an incorrect entry somewhere?

Solved! Go to Solution.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK Thank you both so much for your time.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

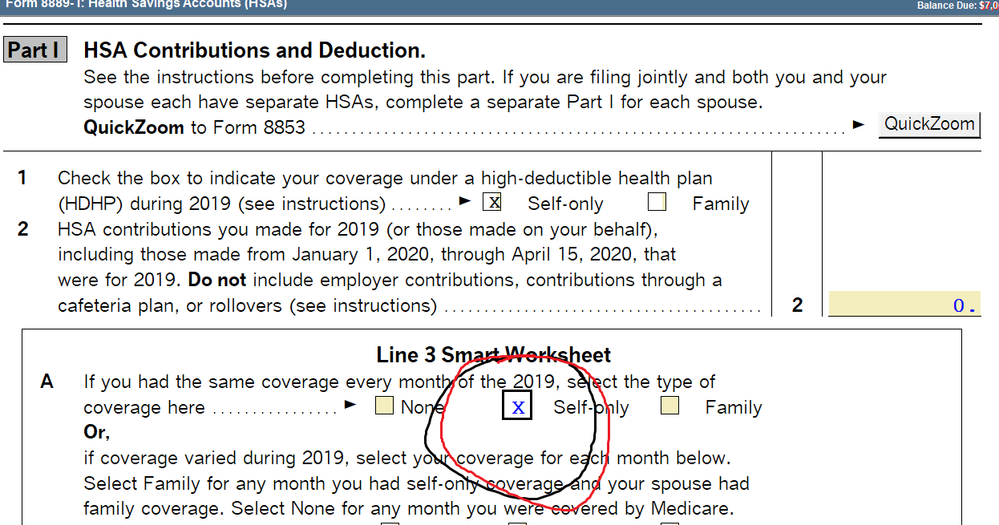

You need to go to the Form 8889 and mark the box for Self or Family in the Smart Worksheet below Line 2 (at least this is what we have to do in Professional)

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks. That is checked. This is driving me crazy.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What did you enter? Did the W2 have a Code W?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes $3098.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Entering the W on the W2, then marking the Self or Family box on the smart worksheet always seems to clear that error for me (just had one yesterday)....you didnt enter the contribution again anywhere, right?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good morning and thanks for your help. Not that I can see. I went over this so many times. Even tried adjusting HSA value at end of year etc. Played with all variables. Can't understand why it is coming up taxable?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You shouldnt enter anything else on that 8889 unless they made contributions outside of payroll.

Since youve fiddled around with it so much, what I would do now, is delete that Code W on the W2 and see if the 8889 disappears, if it doesnt then youve made some kind of entry on it, Delete that 8889. Once its gone, then start over, enter the W on the W2, then go to the 8889 and click the Self or Family box on Line 1 then again in the Smart Worksheet below Line 2 and see if the error clears.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did that. If I remove W $3098 Refund goes from $159 to $758. For some reason it is calculating taxes and a penalty. ???

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Im at a loss then Larry, sorry.

My go-to is enter the Code W on the W2, then pop over to the 8889 and click the boxes on Line 1 and the Smart worksheet below Line 2. That wipes out the 5329 and any excess contribution errors.

If you entered a 1099-SA, be sure youve checked that box that it was all used for medical expenses.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

He didn't get a 1099 because he didn't use any benefits in 2019. That shouldn't matter?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Larry Z wrote:

He didn't get a 1099 because he didn't use any benefits in 2019. That shouldn't matter?

doesnt matter then

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lisa has been spot-on with her advice.

The only other thing I can think of (which sure sounds like it doesn't apply in this case) is maybe a Taxpayer vs. Spouse thing? I think there are two "versions" of the 8889, one for TP and one for SP and you need to make sure the one you're using matches the W-2 with the code W.

Beyond that, just try to line-by-line through the forms to see where things might be going wonky. I'm stumped. Maybe try removing the W-2 entirely (not just the code W), removing the 8889, and starting from scratch with both? Sometimes when ProSeries has an "unexpected behavior" (bug), that's the work-around that helps you get through your day.

Good luck,

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK Thank you both so much for your time.