- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Enter PIN Date on 2021 returns

Enter PIN Date on 2021 returns

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Has anyone efiled 2021 returns today they were sitting on? If so, what date did you use?

I sent 3 in with whatever date I completed them in 2022. I originally tried using todays date and then tried updating to no avail.

I am nervously awaiting acks from IRS. I broke my own rule and efiled before 02/01.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You wont get any flack from IRS over it.

I think you cold have just turned off error checking as conversion and used the actual date.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Oh thats good to hear. I probably should've just turned it off as I gave that advice to someone else. Of course I didnt use it in my own situation. Lol.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I use the ProSeries Basic and I have same problem. I tried to file the 2021 (2020 was OK) and in the date PIN entered box I can't write the current date. The system said it must be any from 2022.

Any worksheet connected with it have current date.

So it will be OK if I will write different date?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

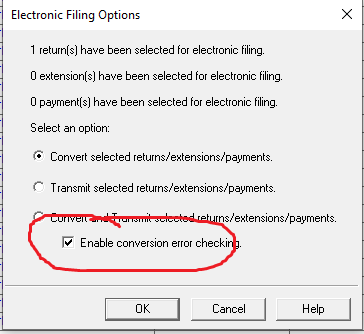

Personally, Id leave the correct date, and just turn off error checking at conversion to bypass the error. This is a Professional screen shot, but Im guessing Basic has something similar.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think I made it.

You right - Basic screen is similar, but to find it was not too easy.

But I did! Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I used 12/31/2022. Using a 2023 date got me an error message. I still haven't received acknowledgements for 2021 returns that I efiled yesterday (1/23).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I did everything like Just-Lisa-Now suggested me and now I got acknowledgement.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@sabkosl13 IRS ack'ed your return already for 2021?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Nice!!!

Im around 24 hours and no acks. But Ill wait it out.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I did also 2020. I got the first ack with information that was sent to the IRS. For accepting I still waiting.

I hope we both will get them soon.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ah, ok, so you are waiting for acceptance. So am I.

Keep in touch here and lets see what happens.

Thanks @sabkosl13

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For 2021 I got acceptance.

I am waiting for 2020 only.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I got you now.

So, I just have to be patient.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello all,

After running "refresh updates", I checked the efile status of the 2021 tax return again.

Received Return Rejected notice that "the year of the 'PrimarySignatureDt' in the Return Header must be equal to the processing year."

Will change my date and re-transmit...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi i got same error 2020 pin no issues with 2023 date but 2021 so just disabling error should be fine, or should we get an update from pro series for this issue,? very consfusing i know 2019 must be paper filed but 2020 thru 2022 efiled , seems like a bug in the program or something , tried calling customer support but wait time 1 hour, i guess will just see if proseries fix the issue and release and update for this

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Update...

After changing the date to the current year on the 2021 tax return, it was acknowledged today.

Easy to do, just as others kindly suggested, I disabled error checking and all was good. Wishing the rest of you similar success.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have Proseries Basic too, can you please let us know the steps necessary to find it.

I thank you in advance.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Go to the EF Clients tab.

- Select the client's federal, and state return if applicable.

- From the E-File menu, select Electronic Filing and then Convert/Transmit Returns/Extensions/Payments.

- On the Electronic Filing Options choose Convert and Transmit selected returns/extensions/payments.

- Uncheck Enable conversion error checking then click OK.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for your information. Since yesterday, I've been struggle the same problem. Now Efile Status shows "received by Intuit." I hope these files will be accepted by Federal and States.

Yesterday, I tried to transmitted and Proseries showed the same message "received by Intuit" or "sent to IRS" however, it was rejected today with the same of other people. Cross my fingers!

By the way, if the same problem happened, when Proseries will solve this software problem?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks everyone for the feedback I disabled the error conversion check when e filing, just sent it hope it gets accepted by the IRS, this must be intuits error I called in yesterday after hour and a half someone finally answered, representative asked me permission to access my pc software guided me thru some steps that i already did before calling like refreshing updates twice then installing them again did not work so she told me to disable that error conversion box , but upon asking her if it was something of the software (proseries professional edition) said no, not really helpful, not release update yet as of today Jan 26 for that issue, it has happened in the past with proseries like with form 8867 in past and other sofware issues agents not really helpful hope the fix this asap

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I avoid CS for PS like the plague. I'd rather call the IRS and thats saying something.