- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

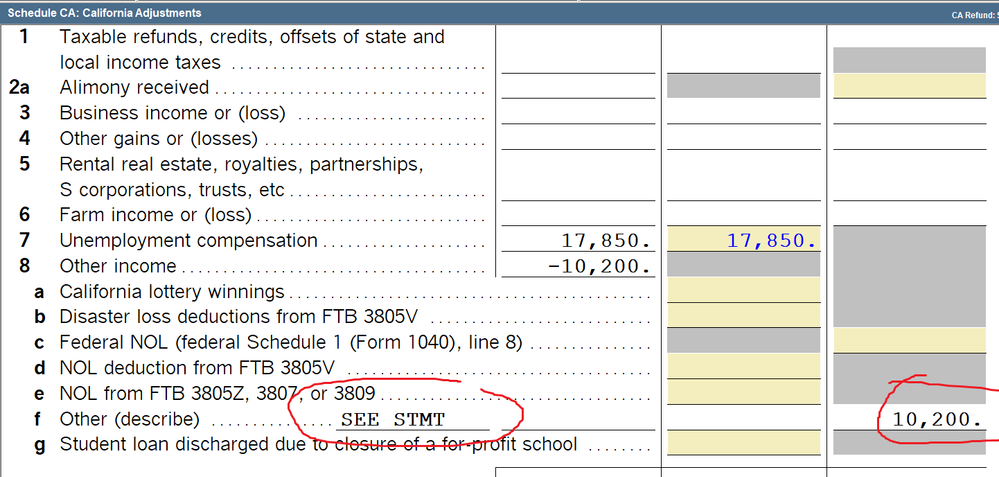

- Don't send California returns with unemployment! The adj for taxable UE since the new update is not correct! It effectively backs out the excluded $10,200 twice for CA.

Don't send California returns with unemployment! The adj for taxable UE since the new update is not correct! It effectively backs out the excluded $10,200 twice for CA.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Dozens of threads on this issue.....check them out.

( Generic Comment )"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think preparers in California are smart enough to do that without being told!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ive just been adding it back on Sch CA.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am doing the same while software is not updated

but not Efiling yet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I haven't been online in a couple days taking a little mini break while they update all this and looks like we still don't have a good update for those of us in CA (or any state for that matter who already excludes UE).

Are the programmers aware of the issue? Anybody have any insider info on when they plan to push through another update for this?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I was doing the same (manually adding $10,200 back to Federal AGI) to make sure that CA calculations are correct.

How will we know when the ProSeries state updates, California in particular, are available?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Unfortunately I already filed a California return with unemployment. And when I filed it, the UCE was not added back in but now it is being added back in as other income. Fortunately (I guess), the return is being held by Intuit so hopefully it will be corrected.