- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- 1099-G/ Payers Federal TIN

1099-G/ Payers Federal TIN

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

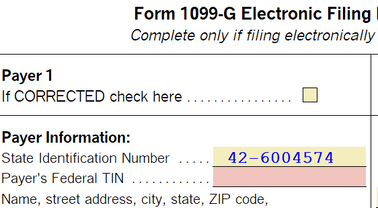

95% of my clients didn’t not-itemized last year. This is my 2nd year using Intuit/Proseries All my with state refunds transferred from las year got a 1099-G worksheet with the amount of last year’s state refund. The program is asking me for a state Identification number and Payer Federal Tin, Im not sure what to enter for the Payers Federal TIN and if I don’t enter anything it keep giving me and error. May be is something so simple and my brain just froze. Can someone please help? Thank you

Solved! Go to Solution.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

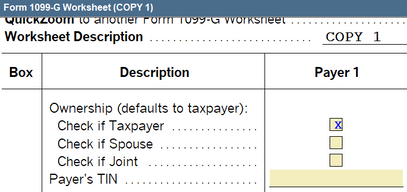

You also have to enter IA EIN right below the 3 little check boxes. I see you entered it on line 10b of the worksheet. 2 entries for Iowa.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I see this happen when more than one state is involved, try this website see if you can find your missing state EINs.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You also have to enter IA EIN right below the 3 little check boxes. I see you entered it on line 10b of the worksheet. 2 entries for Iowa.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Make sure you enter the payers id in the unemployment worksheet and it will eliminate the problem, it happened to me many times until I figured it out. Hope it helps.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do I have to complete 1099-G's even when the Taxpayer didn't itemized? for his refund

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do I have to complete the 1099-G worksheet showing for the state refund even when the taxpayer didn't itemized?