- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Tennessee Franchise & Excise Tax...estimates..

Tennessee Franchise & Excise Tax...estimates..

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So... the Tenn F & E return still defaults to printing estimates for every return..even when it's only the $100 minimum fee... WHEN, taxpayers are not required to make them unless $5,000 or more. I have sent @IntuitAustin countless emails explaining EXACTLY where the problem is... and he doesn't even respond any longer. I think he even has me blocked. So, to the regulars...is there anyone up a level from him, that I can explain this problem to. I do probably 100 Tenn F&E returns a year.. and they messed up this one item this year... and again, i explained to @IntuitAustin countless times, but he doesn't even respond any longer. My package is in excess of $6k a year... and this is ridiculous.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello,

I'll share here what I've shared in our private messages:

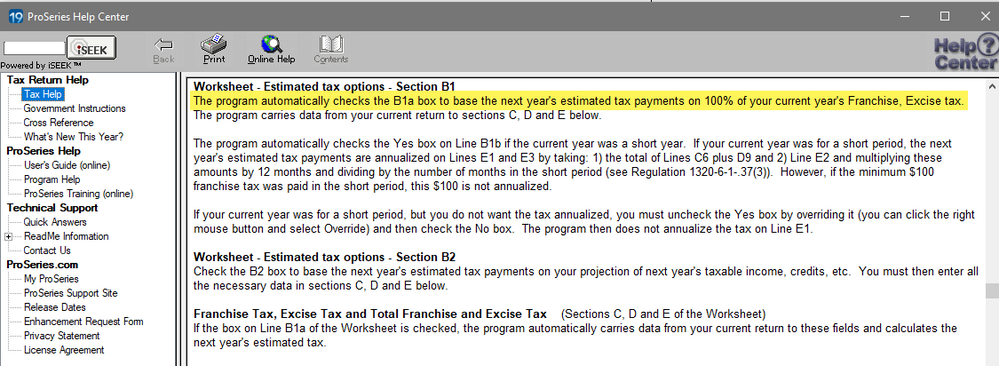

In TY18, ProSeries was producing payment vouchers for TN franchise returns, but this year TN eliminated those vouchers. The program is automatically checking the box B 1a. You can read more about that by right clicking on the field and choosing About prior year tax box. Checking prior year versions of ProSeries, this behavior has been present since at least 2011.

I confirmed with support that the only way to suppress the Estimated Tax Worksheet, is to check the A 1 box suspend estimated tax calculations.

I'll be happy to share your renewed feedback about this program function with our support and product team.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

please do... as I explicitly told you what the problem was in how they had it programmed and the very detail that was incorrect.

We now have to OPT OUT of doing something that is NOT EVEN required by the State of Tennessee. We have to tell it to not generate even the most minimal estimates($100), when the State of Tennessee does not even require them for liabilities less than $5,000. Explain the logic in that. EFT or not. AND, AND, this has never been what we had to do in the over 20 years I have used ProSeries. And I asked you to have the programmers call me, so I could explain to them the simple solution, but for some reason, that has never been an option.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

another one... had to tell it to not make minimum estimates of $100, @IntuitAustin thought you were gonna help on this finally.... Alas..

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi There

For TN, maybe you can help. My client relocated to TN for 2020 as first year return for an S-Corp. I see they need to file the combined TN Franchise and Excise tax return.

Typically, are there other income tax returns for county and city required also? Does Lacerte have these forms too?

Thanks.

Richard A

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is the combined "Business Tax Return" that is due April 15th of each year. This combined return is for the city and county both... and is based on Gross Sales... with some exclusions to get to a taxable amount. You file and pay these on the TNTAP website,....not a proseries application. The tax rates differ for retail and wholesale, and for what type of 'gross sales' you actually have. You register for these on the tenn dept of rev website, just like the F&E return.

Hope this helps. btw, I ignored any discussion regarding sales tax because I assumed that was already ironed out, if applicable.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am not getting the TN Franchise and Excise tax returns in my Pro Series software. Is there an issue?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

First, across the top toolbar>>>Update>>>>Select and download new products>>then for TN check the 1120 box and the 170/LLC box. Then hit NEXT and you can download. When doing a Single-member LLC schedule C, click on the box (about 7 boxes down), to have this automatically fill in parts of your F&E tax return for the LLC. And be sure to select (on the states to E-file on the info wks for individuals) to efile the TN Single member LLC option, not just Tennessee.

If you are doing a corporation return, then you just scroll down on the info wks and click on the TN box.

if you have a 'bundle' package where you get Federal and like 4 other state/city returns, and you opt to have the Tenn F&E as one of your 'bundle', then after you have dowloaded the TN program go to Tools>>>Choose PowerLite Tax Unlimites States and make the TN Franchise/Excise as one of your bundle.

Or they may not have even released them yet, another reason I NEVER import any clients until around the first of february,,, there are so many things they change from the beta version available in Nov/Dec.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am guessing it hasn't been released yet since the support person at ProSeries couldn't find any info on the product