- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax News and Updates

- :

- Re: What's new in ProConnect™ Tax 2020

What's new in ProConnect™ Tax 2020

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What's new in ProConnect™ Tax 2020

With stronger security and more ways to help you be more productive, Intuit® ProConnect™ Tax for tax year 2020 is better than ever – so you can be your best for your clients.

Featured updates: Empowering you to work smarter

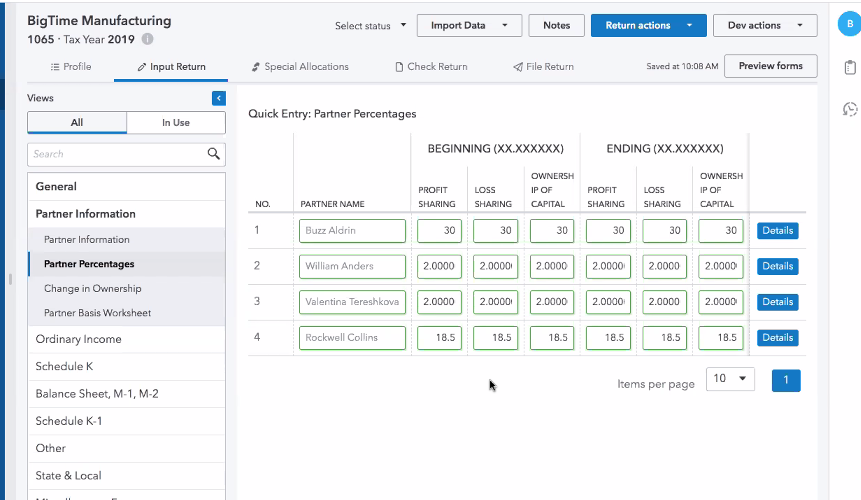

Get more from imports: To help you work more efficiently, CSV or Excel import features extended functionality to include depreciation and pass-through entity members, and Schedule D dispositions.

Take control of e-file permissions: You decide who can e-file returns in your firm with master admin, full-access admin, and basic user permissions.

Manage K-1 forms easily: Now, pass-through business entities have an easy way to produce letters, K-1 forms, K-1 state forms, and more for each partner or shareholder. Just generate PDFs from the File Return screen and send them out.

Masking and watermarking: Now, ProConnect can mask Social Security numbers for you when you print forms or create PDFs. Plus, prevent confusion by adding a watermark that reads “Do not file” to distinguish what’s for review or storage and what’s for filing

E-file amended returns: 1040X efile is now live in ProConnect. We now transfer originally filed ProConnect data to amended returns to help save you time. We also make a copy of the original return for your records.

Enter data more efficiently: Save time entering data by making simple input field calculations. We are updating standardized formats of dates for consistency.

Load returns faster: As larger firms adopt ProConnect, it is critical for our product to enhance our load time performance. This upgrade shows speed improvements for clients with databases of up to 10,000 returns.

Enhanced EFIN verification and security (coming soon): We’re making updates to further enhance e-file security and compliance. A new tool will enable new customers to verify their information and current customers to update their information.

Data automation: Creating the future of taxes: We've been hard at work, investing time and resources to make Link work harder for you.

Data collection:

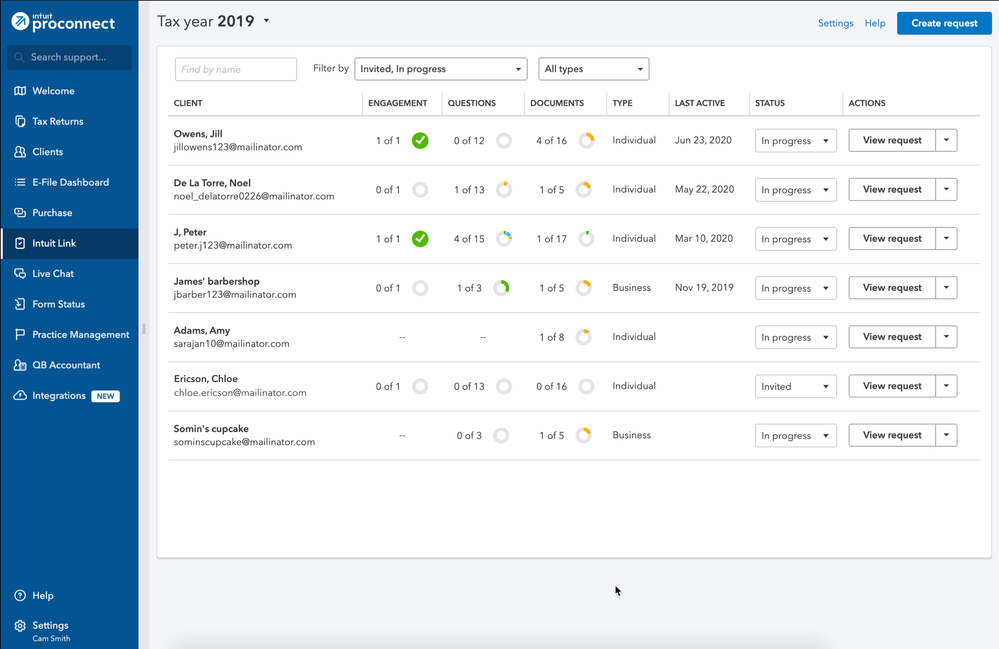

- Batch uploads for customers: We’ve made data collection easier your clients, too. Instead of uploading documents one by one and manually matching them to document checklist items, they can be uploaded in batches and automatically identified by our system.

- Bulk upload for customers (coming soon): Your data collection process will be easier and faster with the ability to send batch requests. Now, you can send request templates to multiple clients at once, rather than going through clients one by one.

Data entry:

- Badge indicating the number of documents ready to be applied: Easily see when a client has documents ready to apply to a return with the new actionable badge. Plus, a new lightning bolt icon indicates the status of each document.

- Manage misclassified documents: You can now move documents between document checklist items without deleting and re-uploading.

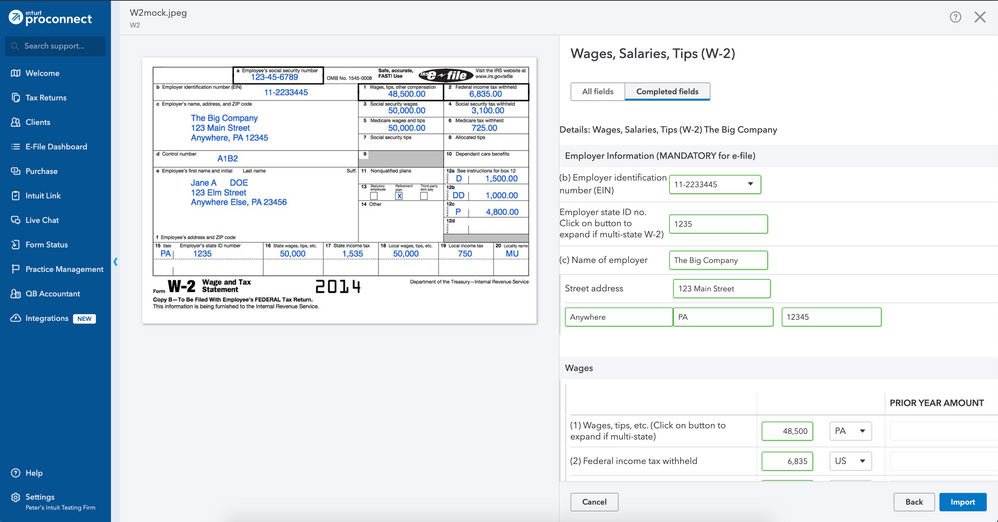

- Document imports: We've improved the accuracy of automated data entry from the following documents uploaded through Intuit Link: W2, 1099-INT, 1099-R, 1098-T, 1098, 1099-DIV, and 1099-MISC. It’s also easier map data to fields, allowing you to select clients to upload to guide successful and accurate data importing. Finally, now when you import a form, you will be automatically taken to the relevant area in the tax return.

- Automatically apply tax data (coming soon): Save prep time and increase data accuracy by applying data at natural points in your workflow. No more going out of your way to look for the needed documents. Forms W-2, 1099-INT, 1099-R, 1098-T, 1098, 1099-DIV and 1099-MISC.

Review

Missing Data – mark and review (coming soon): We will help identify gaps prior to filing by easily marking missing data fields with a red flag. As a result of streamlining this process, missing data will be collected faster and efficiently creating a faster review time.

New e-file capabilities: Boosting your efficiency

New e-file is now available for the following:

- Returns

- Indiana Corporate

- Kentucky Individual, Single Member LLC

- Rhode Island Fiduciary

- Extensions

- Virginia Individual

- Estimates

- Alaska Corporate and S-Corporation

- Arkansas Individual, Corporate, S-Corporation, and Fiduciary

- Colorado Individual

- District of Columbia Individual, Corporate, S-Corporation, Partnership, and Fiduciary

- Kansas Corporate

- Kentucky Individual

- Nebraska Individual, Corporate, S-Corporation, and Partnership

- North Carolina Individual & Corporate

- North Dakota Individual, Corporate, and Fiduciary

- Ohio Individual

- Oklahoma Individual, Corporate, S-Corporation, Partnership, and Fiduciary

- Oregon Individual

- Vermont Individual

- Amended returns

- Indiana Corporate, S-Corporation, and Partnership

- Maryland Individual

- Massachusetts Individual

- New Mexico Corporate

- Ohio Individual

- Pennsylvania Individual

Customer support: Delivering the help you need faster

Intelligent voice assistant: When you call us for help, a new listening tool will be able to route your call to the right agent much more quickly.

Optional workflow tools: Helping you do even more

Intelligent voice assistant: When you call us for help, a new listening tool will be able to route your call to the right agent much more quickly.

Optional workflow tools: Helping you do even more

Intuit Practice Management. Intuit Practice Management powered by Karbon gives you confidence that everyone in your firm is working on the right projects so nothing falls through the cracks. You get real-time visibility to progress across your practice, all from one place.

eSignature: You have new options for capturing in-person electronic signatures. Choose the option that works for you and your clients by opting to use virtually any device for in-person and out-of-office eSignatures through DocuSign. You can also save time with new eSignature forms. No more printing eSignature documents and attaching them to the eSignature widget to send to clients. With auto-mapping, you can select a form and it will be attached automatically.

Pay-by-Refund: To make it easier to get started, enrollment forms for new and returning customers are now pre-filled. Pay-by-Refund status has been added within ProConnect so you can now see Pay-by-Refund returns rejected and solutions on how to solve for them.

Firm-level Audit Assistance. We are partnering with Tax Protection Plus to launch a firm-level option for Audit Assistance, giving you the option to add Audit Assistance and ID Theft Protection to every single 1040 client. Enrolled firms simply pay $10 for every filed 1040 return.

Training: Keeping you up to date

Free live and pre-recorded webinars. Attend live and pre-recorded webinars on topics that matter most to you, at times that work best with your schedule. More than 30,000 pros signed up for webinars last year. New sessions on tax law, ethics, product courses, and more are continually added.

COVID-19 resources. Quickly find the latest information you and your clients need on our newly redesigned COVID-19 resource center.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Click here for more ProConnect Tax News and Updates.