- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: How to fix Estimate Tax Worksheet number?

How to fix Estimate Tax Worksheet number?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

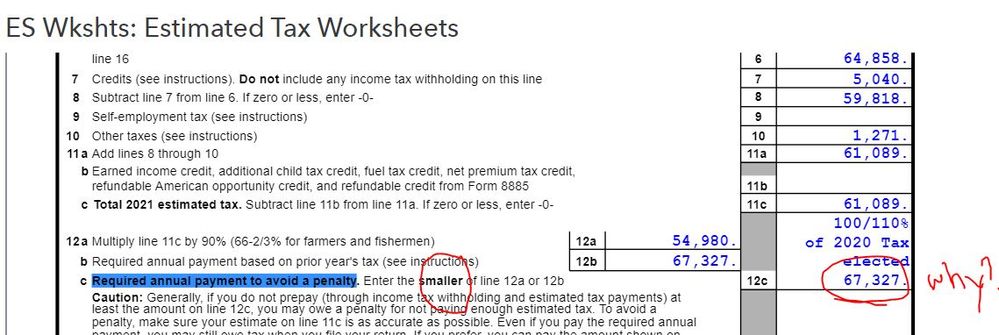

12c number should be the smaller of line 12a or 12b.

But the bigger number(12b) was auto selected, resulting in Estimate

How can I fix it?

Solved! Go to Solution.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That's because you've overridden the option for Payments & Penalties > 2021 Estimated Tax (1040-ES) > Estimate options [O] with option 3=Greater of 90% of 2021 or 100/110% of 2020 tax. The one you should select is 2=Lesser of 90% of 2021 or 100/110% of 2020 tax. I'm assuming you are pretty certain your client will have a lower liability this year.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That's because you've overridden the option for Payments & Penalties > 2021 Estimated Tax (1040-ES) > Estimate options [O] with option 3=Greater of 90% of 2021 or 100/110% of 2020 tax. The one you should select is 2=Lesser of 90% of 2021 or 100/110% of 2020 tax. I'm assuming you are pretty certain your client will have a lower liability this year.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Given the uncertainties around tax law changes, adjustments for future installments may be necessary if you really don't want to use the ol' trusted prior year exception.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for your advice.

I fixed the federal option to 2=Lesser of 90% of 2021 or 100/110% of 2020 tax and if fixed!!!

Yes, I'm quite certain my client would not need estimated tax payment because he set much higher withholding amount from his W2 this year.

May I ask what is the right option for CA?

And what is "the ol' trusted prior year exception"?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Prior year exception is 100/110% of 2020 tax.

CA works the same way as federal but you can't use prior year exception if your client wasn't a FY CA resident.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a state return I am doing, and this was great information!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you! I appreciate your help!!!