- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Montana Schedule K-1

Montana Schedule K-1

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On the Montana Schedule K-1 in PTO where do I enter line 13, Other expense deductions apportionable and/or allowable to Montana?

Tax payer is a Montana non resident.

Thanks.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

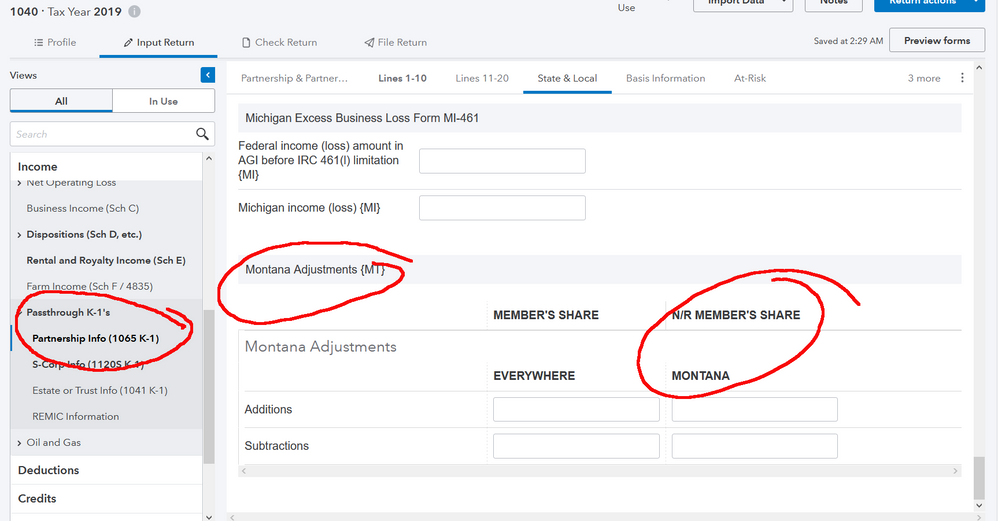

Check out the following input screen:

- On the left panel, click on Income > Passthrough K-1's > Partnership Info (1065 K-1) or S-Corp Info (1120S K-1);

- Go to the State & Local tab;

- Scroll down to Montana Adjustments {MT}; and

- Enter the amount(s) under the MONTANA column.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It doesn't list MT in that area. I checked to make sure that state is marked and it is.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You may want to take a second look...

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I contacted support since I couldn't find it and after an hour they realized that it wasn't supported in 2018 and that's why I couldn't find it, so I either have to do it using another method for preparing the tax return or just not use that deduction.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You should have stated 2018 in original post.

The logical assumption we volunteers make is that you are working on a current year return unless otherwise specified.

Ex-AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, I realized that after the fact. I apologize for that.

This return has 12 states and has been a total time killer, to the detriment of my other clients, especially since I don't deal with most of these states. I'm used to calling customer support, but this year they are asking me where on the tax return the item should go. I previously used Lacerte, but customer support may be this way across the board.

Once again, I'm sorry, but at least I'll know how to do this for the 2019 return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No problem. I know you're learning.

Ex-AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As Susan says, that's not a problem. We're glad our input helped you save a couple minutes. That's where this forum comes into play - sharing our collective experience to help one another. Cheers!

Still an AllStar