- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- How do I adjust Sch CA NR for out of state HSA contributions?

How do I adjust Sch CA NR for out of state HSA contributions?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Solved! Go to Solution.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

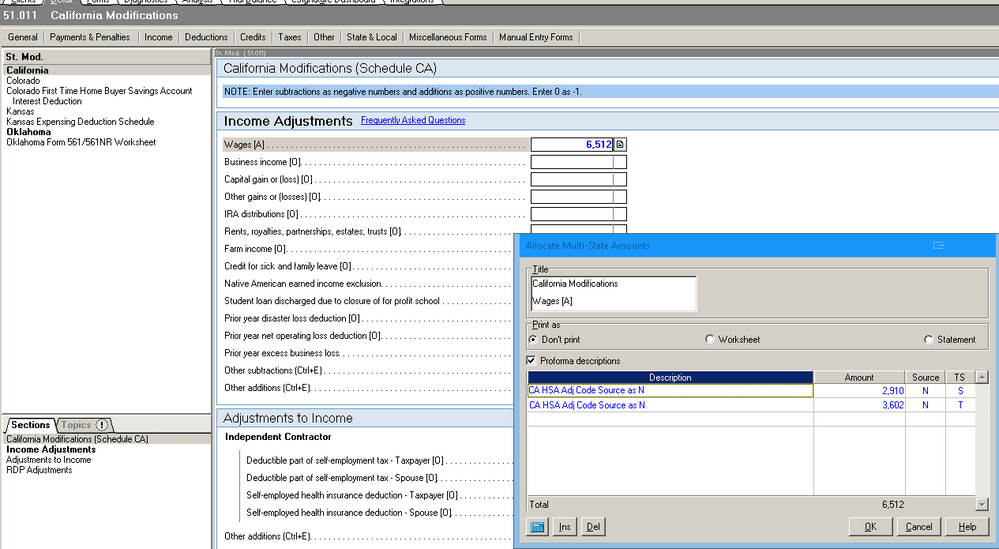

I know how to do this in Lacerte; you'll have to translate into ProConnect.

In Lacerte, the Screen is 51, titled State Modifications. Then you click on California to get to 51.011, California Modifications. In the Income Adjustments section, where it says Wages [A], you want to click on the button to the right to expand that box, and enter the amount of the HSA contribution. In the Source column, enter an N. The taxpayer / spouse flags are optional.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I know how to do this in Lacerte; you'll have to translate into ProConnect.

In Lacerte, the Screen is 51, titled State Modifications. Then you click on California to get to 51.011, California Modifications. In the Income Adjustments section, where it says Wages [A], you want to click on the button to the right to expand that box, and enter the amount of the HSA contribution. In the Source column, enter an N. The taxpayer / spouse flags are optional.